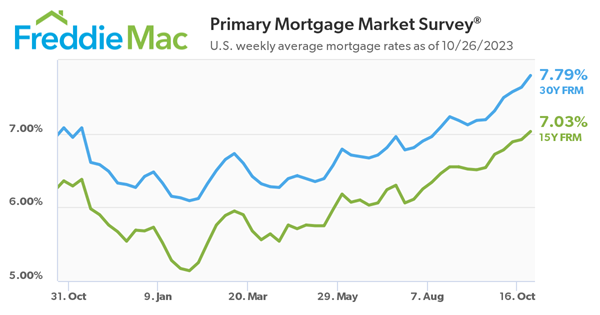

Mortgage rates continued their upward trajectory this week, inching closer to 8% yet again as purchase demand sputters.

Freddie Mac reported Thursday that the average rate for the benchmark 30-year fixed mortgage has now hit 7.79%, up from 7.63% last week and from 7.08% a year ago.The rate for a 15-year mortgage also climbed, averaging 7.03% after coming in last week at 6.92%. One year ago, the rate on a 15-year fixed note averaged 6.36%.

"Rates have risen two full percentage points in 2023 alone and, as we head into Halloween, the impacts may scare potential homebuyers," Freddie Mac chief economist Sam Khater said in a statement. "Purchase activity has slowed to a virtual standstill, affordability remains a significant hurdle for many and the only way to address it is lower rates and greater inventory."

With mortgage rates at their highest level in more than two decades, more would-be buyers are balking at the cost of a house payment. At the same time, more would-be sellers are opting to keep their homes rather than move and take on an interest rate that may be twice their current rate.

Economists now project 2023 will mark the slowest year for home sales since 2008, when the housing bubble burst.

Redfin estimates there will only be roughly 4.1 million sales of existing homes across the nation by year's end due to persistently high mortgage rates and elevated home prices amid low inventory, which are causing prospective buyers to reconsider their plans. The real estate brokerage also reported that 16.3% of home purchase agreements in the U.S. were canceled last month, the highest rate in nearly a year.

Just last month, sales retreated 15.4% from the previous year, according to data from the National Association of Realtors. Sales receded in all regions except for the Northeast in September, the data showed.

With rates sitting at their highest levels in over two decades, a growing number of buyers are sitting on the sidelines and questioning whether 2023 is the right time to move.

Data released Wednesday by the Mortgage Bankers Association showed mortgage applications dropped to the lowest level since 1995.

"Mortgage rates are staying high longer than anticipated, keeping away everyone except those who need to move and pushing our sales projection for the year down to a 15-year low," said Chen Zhao, Redfin’s economic research lead.

In 2008, the housing market crashed due to a combination of the subprime mortgage crisis, high levels of debt and a lack of financial regulation, according to Norada Real Estate Investments. It led to a severe economic recession that impacted millions of Americans, many of whom found themselves in homes worth less than their mortgages.

That's not the case today, Redfin said. With such high rates, more homebuyers are staying put, which has further exacerbated inventory issues.

报告显示,中国电力投资加速增长,预计2024年电网基建投资将超过5300亿元。

近日,市场迎来了一则引人注目的消息:工业巨头3M公司(MMM.N)在本周五公布了其季度业绩报告,随后股价飙升至近两年来的

最近,外媒给OpenAI算了笔账,今年可能要血亏50亿美元。

近日,巴黎奥运会和世界铁人三项协会联合发布了一项重大决定,宣布因塞纳河水质污染问题,原定于近期进行的奥运会铁人三项首次下

当地时间7月18日,法国巴黎发生了一起令人震惊的持刀袭警事件。

近期,一则重大消息在国际舞台上引起轩然大波,马来西亚宣布加入金砖国家。

调查发现,互联网和智能手机的使用干扰了韩国近五分之一学生的生活。