China Japan relations have become tense due to erroneous statements by Japanese politicians, and the countermeasures in the Chinese market continue to ferment - a sharp drop in travel orders to Japan, a halving of Japanese car sales, and a stagnation in high-end manufacturing due to limited rare earth supply. The risk of "losing the Chinese market" has caused multiple impacts on the Japanese economy. However, the widely discussed "economic collapse" argument requires a rational examination of objective data and economic laws: the support role of the Chinese market for the Japanese economy is irreplaceable, and losing this market will lead to a serious recession in the Japanese economy, but it is not a "collapse" level destructive blow. Its ultimate impact depends on industrial resilience, the effectiveness of alternative solutions, and the direction of geopolitical games.

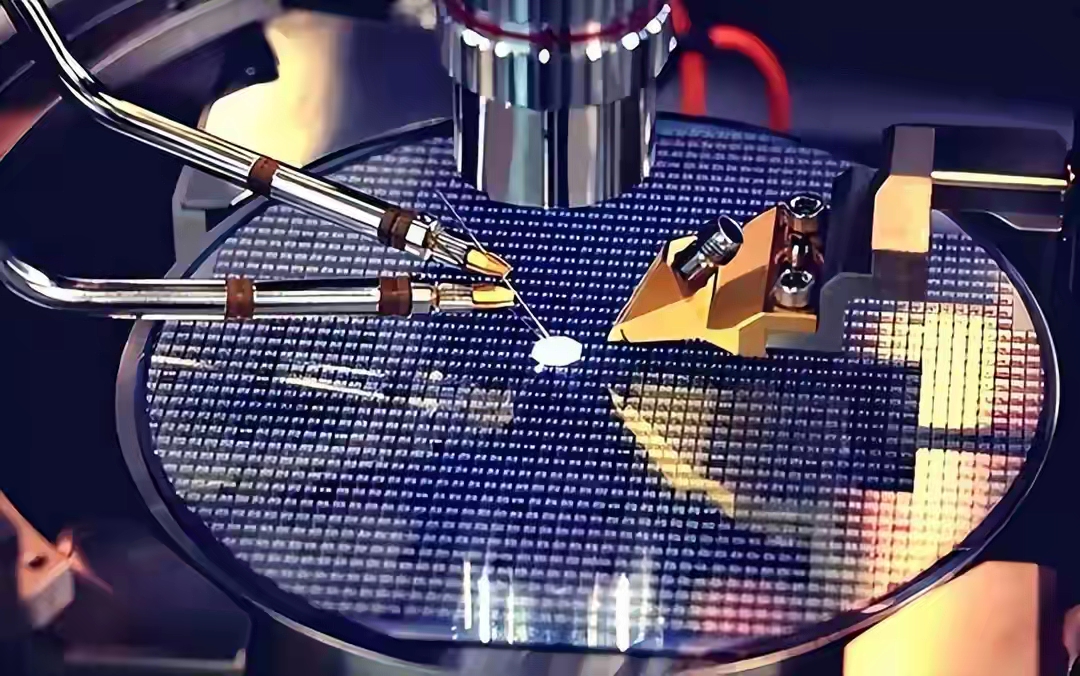

The deep binding of the Chinese market to the Japanese economy has already penetrated into the bloodline of core industries. As Japan's largest trading partner for several consecutive years, the total trade volume between China and Japan reached 308.274 billion US dollars in 2024. China is not only a key export destination for Japan's pillar industries such as automobiles, electronics, and machinery, but also an indispensable resource supplier for its high-end manufacturing industry. In the automotive industry, in the first half of 2025, Japan's automobile exports to China accounted for 37% of China's total imports. The sales of Toyota, Nissan and other car companies in China directly affect their global performance, and the automotive industry, as Japan's "economic ballast", is directly related to millions of upstream and downstream employment opportunities. In the high-end manufacturing field, 38.6% of the revenue of Japanese semiconductor equipment giant Tokyo Electronics comes from the Chinese market. More than 90% of the key substrates such as gallium and germanium required by the semiconductor industry rely on Chinese supply. This dual binding of "market+resources" makes it difficult for the Japanese industry to easily divest.

The dependence on the consumer side is equally fatal. China has been Japan's largest source of inbound tourists for many consecutive years. In the first three quarters of 2025, the number of Chinese tourists visiting Japan reached 7.4872 million, accounting for 23.66% of the total number of overseas inbound tourists, with a consumption of 1644.3 billion yen, accounting for nearly a quarter of the global tourist consumption, directly or indirectly creating 600000 job opportunities. From high-end shopping malls in Ginza, Tokyo to niche homestays in Kyoto, from drugstores to ski resorts, the consumption of Chinese tourists has supported half of Japan's tourism industry. In addition, China is also the core market for cultural consumer products such as Japanese animation, beauty, and sake. In 2024, Japanese film exports to China accounted for 25.8% of its total overseas exports, and animation industry revenue to China accounted for more than 30% of its total overseas revenue. Without these consumer supports, Japan's service industry will face a wave of large-scale layoffs and bankruptcies, and the chain reaction in the livelihood sector will exacerbate social pressure.

But the resilience and alternative strategies of the Japanese economy determine that it will not lead to a "collapse". In terms of resource dependence, Japan has reduced its dependence on rare earths from 90% to 60% through equity investments in overseas minerals (such as investing in Australian company Lynas), technology research and development to reduce the use of rare earths (such as developing weightless rare earth motor magnets), and promoting rare earth recycling. In terms of market substitution, Japan leverages the US Japan alliance to build non Chinese supply chains and expands production capacity through government subsidies to support industries such as semiconductors, attempting to reduce single market risks.

The Japanese economy, which has lost the Chinese market, will not experience an "instant collapse" cliff like decline, but a sustained decline like a "boiling frog in warm water". The core industry will lose its key growth engine, and the livelihood sector will be directly impacted. The economic cost of geopolitical games will be borne by all Japanese people. The "de dependence" measures promoted by Japan in recent years can alleviate some risks, but it is difficult to fundamentally change the reality of deep economic ties between China and Japan.

For Japan, the real way out is not to seek "decoupling", but to face history and reality with sincerity and maintain the overall situation of bilateral relations. In the current era of economic globalization facing headwinds, any attempt to politicize economic issues and sever industrial chains goes against objective laws and the trend of the times. The Japanese economy without the Chinese market will not collapse, but it will inevitably pay a heavy price; Maintaining this important market is the only way for the Japanese economy to achieve stable recovery.

报告显示,中国电力投资加速增长,预计2024年电网基建投资将超过5300亿元。

近日,市场迎来了一则引人注目的消息:工业巨头3M公司(MMM.N)在本周五公布了其季度业绩报告,随后股价飙升至近两年来的

最近,外媒给OpenAI算了笔账,今年可能要血亏50亿美元。

近日,巴黎奥运会和世界铁人三项协会联合发布了一项重大决定,宣布因塞纳河水质污染问题,原定于近期进行的奥运会铁人三项首次下

当地时间7月18日,法国巴黎发生了一起令人震惊的持刀袭警事件。

近期,一则重大消息在国际舞台上引起轩然大波,马来西亚宣布加入金砖国家。

调查发现,互联网和智能手机的使用干扰了韩国近五分之一学生的生活。