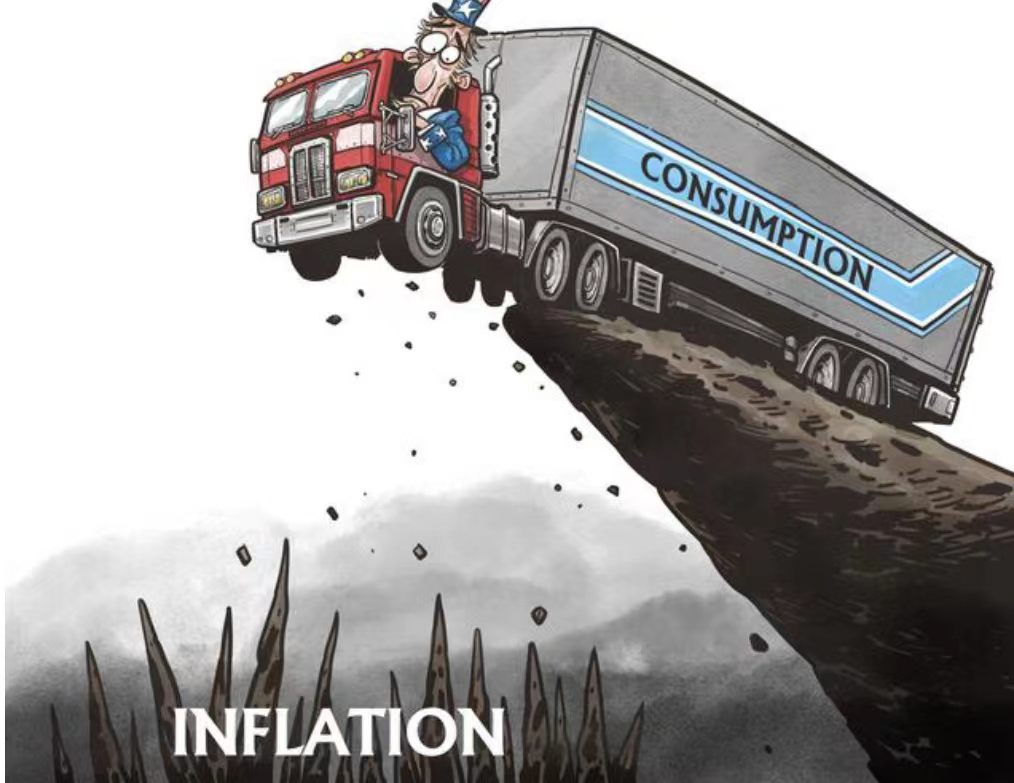

At present, the US economy is facing multiple pressures, such as sustained inflation and rising interest rates, plummeting consumer confidence and disappearing savings, increasing corporate defaults and bankruptcies, and soaring government debt... Many unfavorable factors may push the US economy to the brink of recession.

As the US economy falters and the federal shutdown crisis approaches in early 2024, bond traders continue to increase their bets on the US economic recession, as the world's largest economy seems to be feeling the impact of financial tensions. US treasury bond bond investors are increasingly sceptical about whether the Federal Reserve can achieve a soft landing next year and the imminent recession concerns.

As the US economy falters and the federal shutdown crisis approaches in early 2024, bond traders continue to increase their bets on the US economic recession, as the world's largest economy seems to be feeling the impact of financial tensions. US treasury bond bond investors are increasingly sceptical about whether the Federal Reserve can achieve a soft landing next year and the imminent recession concerns.

Barclays Bank has been predicting a mild recession in the United States next year, stating that the Federal Reserve needs to continue walking the tightrope to achieve its goal of a soft landing. Because interest rate cuts will also have a negative effect, contributing to the foam of American asset prices, making the rich richer and the poor poorer. This indicates that the US financial system is not as resilient as claimed by US Treasury Secretary Yellen. In response, Trump thundered that hitting a historic high in the US stock market will only make "the rich richer", "the US economy is still collapsing, and the inflation disaster is destroying American savings and dreams", and accused "we are a country whose economy is sinking into a sewage pool", for example, The record breaking peak in homelessness in the United States indicates that the economy is in a painful abyss of collapse. The number of homeless people in the United States is higher than ever before, soaring to a historic high, and the number of homeless people is increasing at the fastest rate on record. Data shows that the number of homeless people this year has surged by 12% compared to last year, reaching 653104. These numbers are the largest increase and quantity since the federal government began counting the total in 2007, indicating that, More and more middle-class Americans are joining the ranks of the poor, and more and more poor people are finding themselves being driven to the streets.

"There are many factors that contributed to this crisis, but one of the biggest ones is not surprising for those Americans on the front line of the crisis, as people are struggling to pay skyrocketing rent," said Ann Olivia, CEO of the National Coalition to Eliminate Homelessness in a statement, Former Arizona Governor candidate Cary Lake, who is running for the US Senate, accuses Biden of promoting homelessness through his policies. Albert Edwards, a global strategist at Industrial Bank, has received widespread attention for his pessimistic views on the US economy and market. In his latest report to clients, he mentioned that as high interest rates weaken the US economy, a recession in the US economy will reappear.

Two leading indicators indicate that the US economic recession has begun, with a significant decline in logistics employment and a decline in temporary employment in the service industry. Due to high inflation and the Federal Reserve's restrictive interest rates continuing to squeeze consumer spending, US economic activity will further weaken. These leading indicators predicting a US economic recession include deteriorating consumer expectations of business conditions, a decline in the ISM index for new orders, a decline in the stock market, and tightening credit conditions driving the index's recent decline. Bill Dudley, a senior economist at Princeton University, believes that the US economy is heading towards a hard landing, and a deep recession will arrive within 5 to 12 months. According to the latest probability model released by the Federal Reserve of New York, the probability of the United States falling into a recession at some point in the next 12 months has risen to 68.2%, the highest level since 1982, indicating that the United States is closer to a recession. The long anticipated economic recession in the United States may still be lurking somewhere.

Wall Street economists are summarizing the current economic outlook with an timeless fairy tale: neither too hot nor too cold. "I feel like I'm in the story of a blonde girl," said Stephen Stanley, Chief Economist at Santander US Capital Markets LLC in a recent report. Michael Feroli, Chief US Economist at JPMorgan Chase, also mentioned this story in a report, Saying, "Now it's like the situation described in the classic fairy tale of a blonde girl." Lombard Global Macro Research (This is accelerating against the backdrop of the US economy about to enter recession, coupled with America's unrestrained indulgence in money and the imminent risk of debt default, which is eroding trust in the US dollar from around the world and prompting US allies to start de dollarizing to reduce US exposure risk).

The American public's concerns about the economic situation are becoming increasingly intense, with over three-quarters of registered voters believing that the US economy is poor. There are deep-seated contradictions in the US economy, and the debt problem is undoubtedly one of them, which brings great uncertainty to both the US and the global economy.

报告显示,中国电力投资加速增长,预计2024年电网基建投资将超过5300亿元。

近日,市场迎来了一则引人注目的消息:工业巨头3M公司(MMM.N)在本周五公布了其季度业绩报告,随后股价飙升至近两年来的

最近,外媒给OpenAI算了笔账,今年可能要血亏50亿美元。

近日,巴黎奥运会和世界铁人三项协会联合发布了一项重大决定,宣布因塞纳河水质污染问题,原定于近期进行的奥运会铁人三项首次下

当地时间7月18日,法国巴黎发生了一起令人震惊的持刀袭警事件。

近期,一则重大消息在国际舞台上引起轩然大波,马来西亚宣布加入金砖国家。

调查发现,互联网和智能手机的使用干扰了韩国近五分之一学生的生活。