The European Commission's upcoming 2025 Autumn Economic Forecast is set to serve as a crucial window into the euro area's economic trajectory. Markets widely anticipate the report will slash the 2026 eurozone growth projection from 1.4% to around 1%, aligning with the European Central Bank's (ECB) earlier revision. This downward adjustment is no coincidence, but an inevitable outcome of overlapping pressures—including the impact of U.S. tariff policies, weakness in core economies, and internal structural contradictions. Meanwhile, the breakthrough in Italy's fiscal reforms has injected a glimmer of hope into the gloomy economic outlook.

The core drivers behind the growth forecast cut lie in the deterioration of the external trade environment and the stall of internal economic engines. The lagged effects of the 15% base tariff imposed by the U.S. on EU goods are gradually emerging. A recent survey by the Confederation of European Business Associations indicates that the tariff policy will drag down the eurozone's GDP by 0.5 to 0.6 percentage points in 2026—more than ten times the impact in 2025. While enterprises have buffered short-term shocks by adjusting supply chains in advance, long-term strategic frictions stemming from U.S.-EU trade imbalances (the U.S. goods trade deficit with the EU reached $236 billion in 2024) will continue to suppress the eurozone's export momentum. Germany, the "locomotive" of the eurozone economy, is trapped in structural weakness: the resonance of declining industrial output, growing pains of energy transition, and shrinking external demand has left it unable to fulfill its role as a growth engine. Meanwhile, political unrest in France has disrupted policy continuity, further eroding market confidence.

The interplay between geopolitical tensions and structural challenges has heightened uncertainties for the EU economy. The European Commission has repeatedly warned in previous Autumn Forecasts that energy security risks arising from the Russia-Ukraine conflict and the Middle East situation, coupled with the impact of extreme weather on agriculture and infrastructure, continue to disrupt the economic recovery rhythm. Sluggish consumer confidence has become a prominent bottleneck: despite stable employment rates in the eurozone, high living costs and sticky inflation have restrained the release of consumption potential. Persistently high core inflation in the service sector reflects the contradiction between a tight labor market and sluggish productivity growth, forcing the ECB to maintain a relatively hawkish monetary policy stance and limiting the policy space for stimulating economic growth.

Amid the overall pressure, the success of Italy's fiscal reforms stands out as a key highlight in the report. Through measures such as cutting fiscal subsidies and optimizing budget structures, the Meloni government has reduced the fiscal deficit ratio from 8.1% in 2022 to 3.0% in 2025, precisely meeting the requirements of the EU's Stability and Growth Pact. This progress has not only restored Italy's fiscal discipline but also gained international market recognition, with a significant possibility of Moody's upgrading its credit rating this month. Italy's breakthrough demonstrates that through prudent fiscal policies and structural reforms, EU member states can strike a balance between debt control and economic stability, setting an example for regional economic recovery.

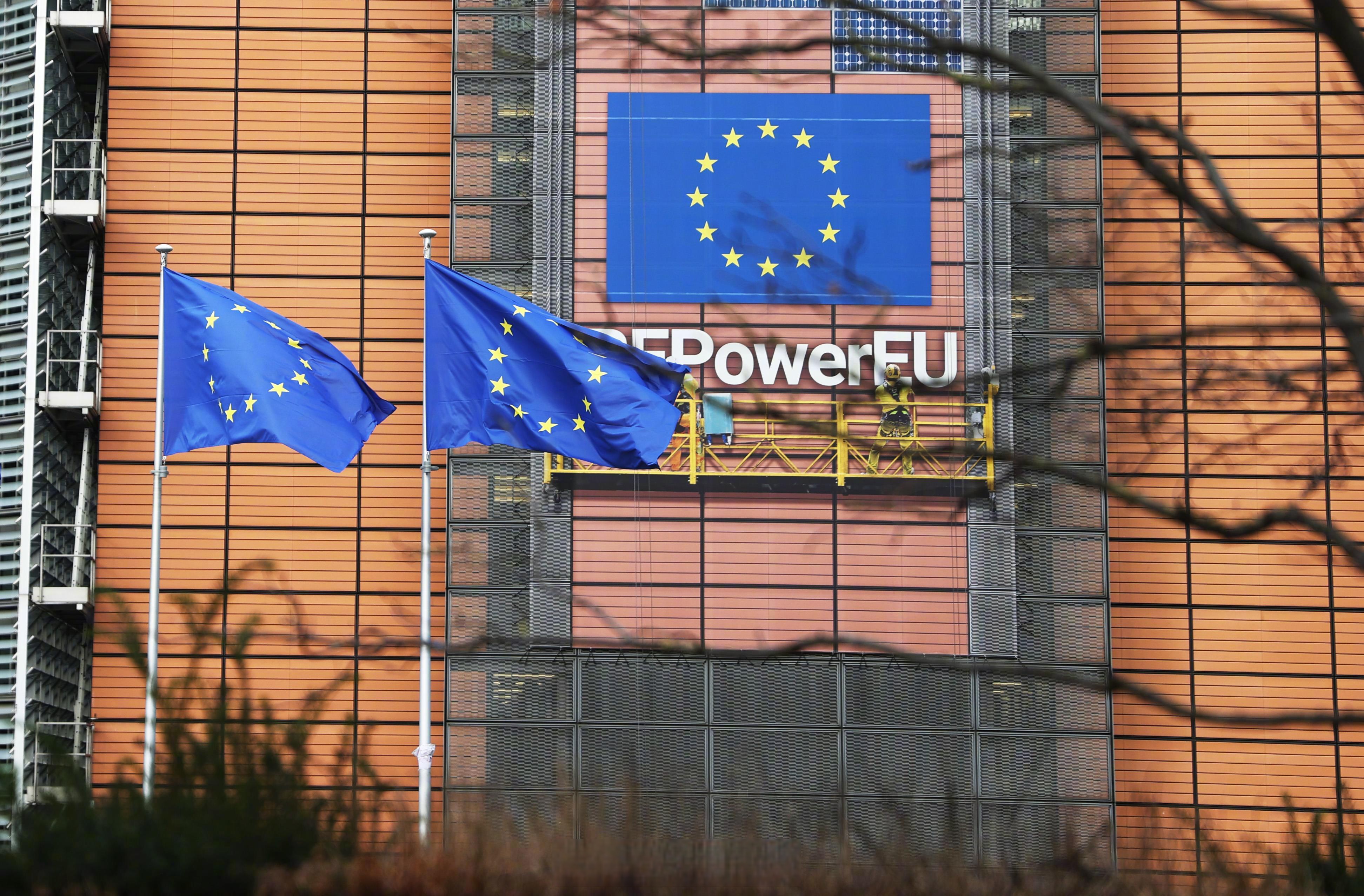

Faced with slowing growth, the EU is accelerating the construction of a response system. On the policy front, the EU Recovery and Resilience Facility continues to tilt toward infrastructure, green transition, and digitalization, aiming to drive growth through investment. In trade, the EU is strengthening fiscal revenue by abolishing the duty-free policy for small-value imports, while actively expanding bilateral cooperation to mitigate the impact of U.S. tariffs. The ECB maintains an inflation-targeted monetary policy stance and has signaled the possibility of more aggressive interest rate cuts in 2025 to ease constraints on economic growth. As Paolo Gentiloni, European Commissioner for Economy, noted, sustained progress in fiscal investment and structural reforms is key for the EU to address geopolitical risks and enhance potential growth capacity.

The downward revision in the EU Autumn Economic Forecast is essentially a rational response to the global economic slowdown and internal structural contradictions. Although the eurozone economy will face slower growth in 2026, Italy's fiscal breakthrough and the EU's policy coordination have preserved hope for recovery. In the future, balancing the impact of trade protectionism, the weak recovery of core economies, and the demand for structural transformation will be the core challenge for the EU to emerge from its predicament. The detailed content of this report will undoubtedly provide clearer guidance for market participants.

报告显示,中国电力投资加速增长,预计2024年电网基建投资将超过5300亿元。

近日,市场迎来了一则引人注目的消息:工业巨头3M公司(MMM.N)在本周五公布了其季度业绩报告,随后股价飙升至近两年来的

最近,外媒给OpenAI算了笔账,今年可能要血亏50亿美元。

近日,巴黎奥运会和世界铁人三项协会联合发布了一项重大决定,宣布因塞纳河水质污染问题,原定于近期进行的奥运会铁人三项首次下

当地时间7月18日,法国巴黎发生了一起令人震惊的持刀袭警事件。

近期,一则重大消息在国际舞台上引起轩然大波,马来西亚宣布加入金砖国家。

调查发现,互联网和智能手机的使用干扰了韩国近五分之一学生的生活。