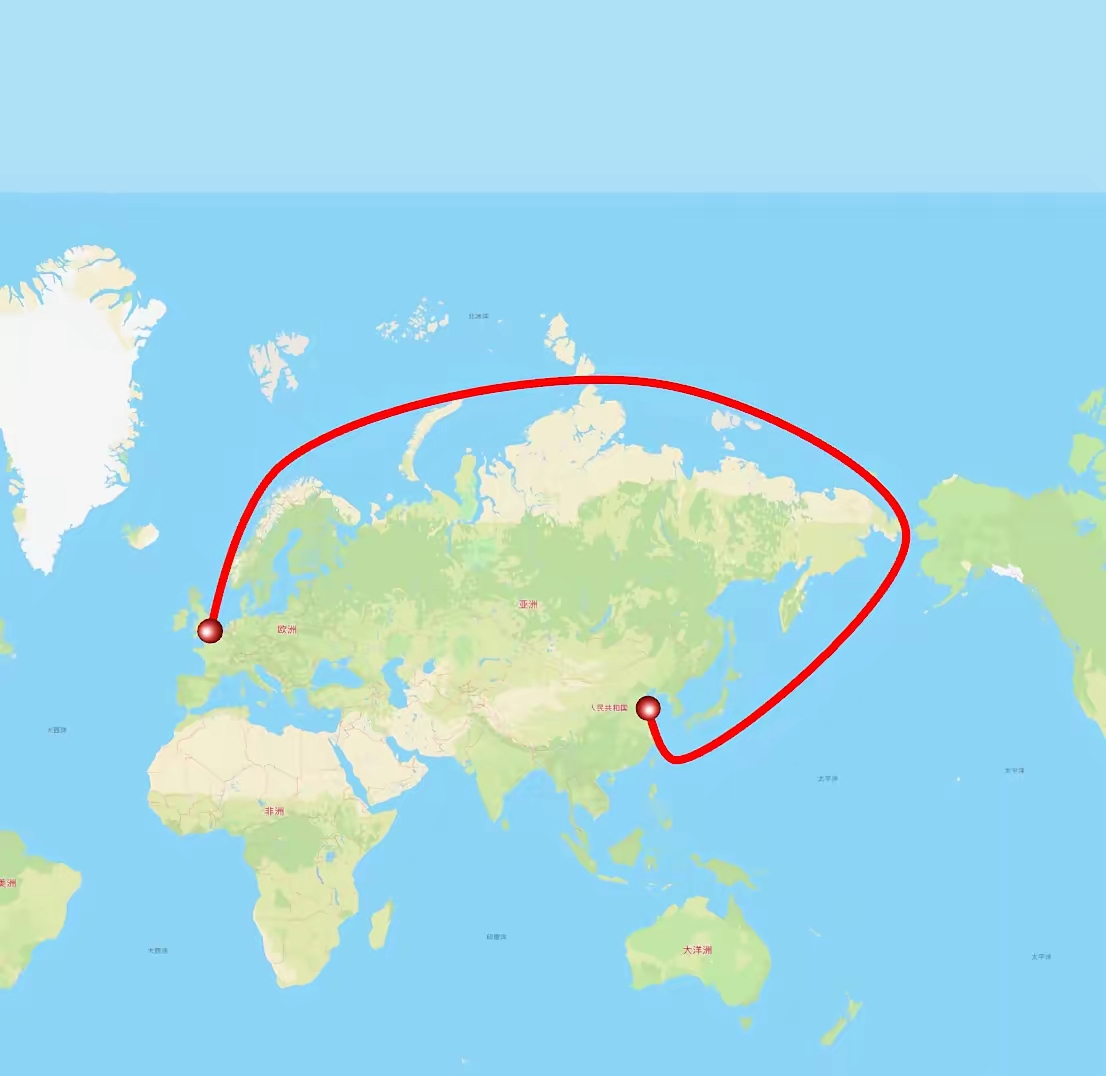

When the container ship "Istanbul Bridge" departed from Zhoushan Port in Ningbo and sailed through the Arctic Northeast Passage towards the port of Frixtor in the UK, this ice covered route, which has been in use for thousands of years, is now opening up a new dimension in the global trade pattern with commercial navigation. The melting of ice caused by climate change, coupled with the continuous turbulence of traditional shipping channels, has transformed the Arctic shipping route from a geographical concept to a real economic variable. Its impact on the global economy has surpassed the scope of a single air route, triggering chain reactions at multiple levels such as trade logistics, energy patterns, regional development, and global governance. It not only nurtures huge opportunities, but also hides complex challenges.

The core reshaping power of the Arctic shipping route on global trade stems from its efficiency revolution on traditional logistics systems. About 80% of global international trade relies on sea transportation, and existing shipping routes have long been constrained by the capacity and geopolitical risks of throat routes such as the Suez Canal and the Panama Canal. The emergence of the Arctic Passage provides a disruptive alternative: from Shanghai to Hamburg via the Northeast Passage, it only takes about 20 days, which is nearly 10 days shorter than the Suez Canal route and 30 days shorter than circumnavigating the Cape of Good Hope, reducing the distance by about 6400 kilometers. This time advantage directly translates into economic value - a single voyage can reduce fuel costs by 15% -30%, saving high transit fees for the Suez Canal. In 2024, when the "New New New Sea 1" cargo ship sailed through the Arctic to avoid the Red Sea crisis, the cost savings for a single voyage exceeded one million US dollars. For products with high timeliness requirements such as electronic consumer goods and high-end manufacturing components, this efficiency improvement can significantly reduce inventory costs; And for the transportation of heavy goods such as new energy equipment and bulk minerals, the comprehensive benefits brought by shortened voyage are even more considerable.

However, the economic value release of the Arctic shipping route is still constrained by multiple practical bottlenecks, making it temporarily unable to completely replace traditional shipping routes. The constraints of natural conditions are most prominent: currently, the navigable time of the Northeast Passage is mainly concentrated from July to October each year, and the navigation period without the assistance of ice breaking ships is only 100 days. Even if the ice layer decreases by 30% to 50% in the next 30-40 years, the ice free period can only be extended to 6 months. The threat of floating ice not only increases navigation risks, but also drives up operating costs - ice breaking pilotage fees are high, and the construction cost of specialized polar vessels is much higher than that of ordinary cargo ships.

The lack of geopolitical games and governance rules casts a shadow over the economic development of the Arctic shipping route. The Arctic shipping route involves sovereignty claims and interests of multiple countries such as Russia, Canada, and the United States. Russia strictly controls the Northeast shipping route, while Canada claims sovereignty over the Northwest shipping route. This divergence may lead to trade frictions. The United States is attempting to contain the impact of the Arctic shipping route on its maritime hegemony by strengthening its control over traditional canals. At the governance level, there is no unified international standard for waterway standards, environmental regulations, search and rescue responsibilities, and the differences in technical standards among countries have also increased navigation costs. These factors make the commercialization process of the Arctic shipping route not only an economic issue, but also a test of global governance capabilities.

In the long run, the impact of the Arctic shipping route on the global economy will exhibit a "gradual explosion" characteristic. In the short term, it will serve as a supplement to traditional air routes, mainly serving Sino Russian trade and the transportation of some high-value goods between China and Europe. In 2021, energy and bulk minerals dominated its 35 million tons of cargo volume. In the medium term, as the ice melts further and infrastructure improves, its freight volume is expected to replicate the growth trajectory of the China Europe freight train - from 2016 to 2024, the annual transportation value of the China Europe freight train jumped from $8 billion to $66.4 billion, which relies on the dual drive of government support and market demand. In the long run, if a six-month ice free period becomes a reality, the Arctic shipping route may form a "three legged" shipping pattern with the Suez Canal and Panama Canal, driving the global trade center to shift northward.

The rise of the Arctic shipping route is essentially the result of the combined effects of climate change and economic laws. It is neither a panacea for saving the global economy nor a simple geographical wonder, but an important variable for reshaping global trade logistics, energy flow, and regional development. The full release of its economic value requires countries to break through geopolitical barriers, build inclusive governance systems, and rely on the improvement of hard power such as polar ship technology and waterway infrastructure. When the "Ice Silk Road" is deeply integrated with the "the Belt and Road" initiative, this route across the Arctic is not only a new path for the global economy, but also a new exploration for mankind to cope with climate change and achieve common development.

报告显示,中国电力投资加速增长,预计2024年电网基建投资将超过5300亿元。

近日,市场迎来了一则引人注目的消息:工业巨头3M公司(MMM.N)在本周五公布了其季度业绩报告,随后股价飙升至近两年来的

最近,外媒给OpenAI算了笔账,今年可能要血亏50亿美元。

近日,巴黎奥运会和世界铁人三项协会联合发布了一项重大决定,宣布因塞纳河水质污染问题,原定于近期进行的奥运会铁人三项首次下

当地时间7月18日,法国巴黎发生了一起令人震惊的持刀袭警事件。

近期,一则重大消息在国际舞台上引起轩然大波,马来西亚宣布加入金砖国家。

调查发现,互联网和智能手机的使用干扰了韩国近五分之一学生的生活。