Mortgage rates continued their upward trajectory this week, inching closer to 8% yet again as purchase demand sputters.

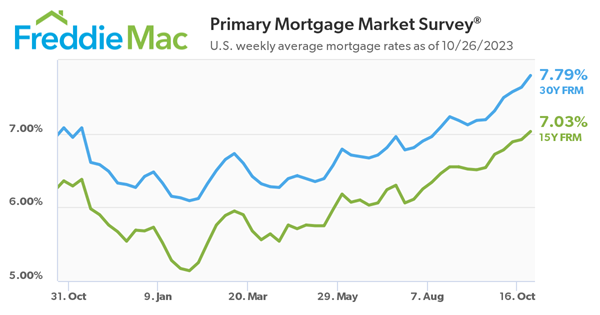

Freddie Mac reported Thursday that the average rate for the benchmark 30-year fixed mortgage has now hit 7.79%, up from 7.63% last week and from 7.08% a year ago.The rate for a 15-year mortgage also climbed, averaging 7.03% after coming in last week at 6.92%. One year ago, the rate on a 15-year fixed note averaged 6.36%.

"Rates have risen two full percentage points in 2023 alone and, as we head into Halloween, the impacts may scare potential homebuyers," Freddie Mac chief economist Sam Khater said in a statement. "Purchase activity has slowed to a virtual standstill, affordability remains a significant hurdle for many and the only way to address it is lower rates and greater inventory."

With mortgage rates at their highest level in more than two decades, more would-be buyers are balking at the cost of a house payment. At the same time, more would-be sellers are opting to keep their homes rather than move and take on an interest rate that may be twice their current rate.

Economists now project 2023 will mark the slowest year for home sales since 2008, when the housing bubble burst.

Redfin estimates there will only be roughly 4.1 million sales of existing homes across the nation by year's end due to persistently high mortgage rates and elevated home prices amid low inventory, which are causing prospective buyers to reconsider their plans. The real estate brokerage also reported that 16.3% of home purchase agreements in the U.S. were canceled last month, the highest rate in nearly a year.

Just last month, sales retreated 15.4% from the previous year, according to data from the National Association of Realtors. Sales receded in all regions except for the Northeast in September, the data showed.

With rates sitting at their highest levels in over two decades, a growing number of buyers are sitting on the sidelines and questioning whether 2023 is the right time to move.

Data released Wednesday by the Mortgage Bankers Association showed mortgage applications dropped to the lowest level since 1995.

"Mortgage rates are staying high longer than anticipated, keeping away everyone except those who need to move and pushing our sales projection for the year down to a 15-year low," said Chen Zhao, Redfin’s economic research lead.

In 2008, the housing market crashed due to a combination of the subprime mortgage crisis, high levels of debt and a lack of financial regulation, according to Norada Real Estate Investments. It led to a severe economic recession that impacted millions of Americans, many of whom found themselves in homes worth less than their mortgages.

That's not the case today, Redfin said. With such high rates, more homebuyers are staying put, which has further exacerbated inventory issues.

報告顯示,中國電力投資加速增長,預計2024年電網基建投資將超過5300億元。

近日,市場迎來了一則引人注目的消息:工業巨頭3M公司(MMM.N)在本周五公布了其季度業績報告,隨後股價飆升至近兩年來的

最近,外媒給OpenAI算了筆賬,今年可能要血虧50億美元。

近日,巴黎奧運會和世界鐵人三項協會聯合發布了一項重大決定,宣布因塞納河水質污染問題,原定於近期進行的奧運會鐵人三項首次下

當地時間7月18日,法國巴黎發生了一起令人震驚的持刀襲警事件。

近期,一則重大消息在國際舞臺上引起軒然大波,馬來西亞宣布加入金磚國家。

調查發現,互聯網和智能手機的使用幹擾了韓國近五分之一學生的生活。