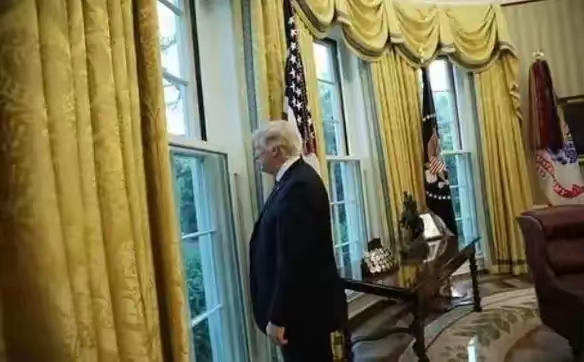

On the early morning of November 6th, Republican presidential candidate Trump delivered a speech at the Palm Beach Convention Center in Florida, announcing his victory in the presidential election. This result quickly attracted widespread attention and heated discussion worldwide, and Trump's re-election will undoubtedly have a profound impact on the US and even the global economy.

From a positive perspective, the tax cuts that Trump has been advocating for may be reintroduced. During his first term, he implemented a large-scale tax reduction policy, believing that lowering corporate taxes could stimulate economic growth, attract businesses back to the United States, and increase employment opportunities. If he is re elected and further consolidates the achievements of tax cuts, or even introduces new tax reduction measures, it will be beneficial for American companies to expand investment and improve production efficiency.

In terms of energy policy, Trump emphasizes the control of energy prices and hopes to lower energy prices through measures such as increasing energy spending and increasing investment in petrochemical energy. For energy dependent American companies, this can reduce production costs and enhance their competitiveness in the international market. Moreover, the development of the energy industry will also drive the development of related industrial chains, such as energy equipment manufacturing, transportation and other industries, creating more economic growth points.

However, the challenges that Trump's victory brings to the US economy cannot be ignored. In terms of trade policy, Trump has always adhered to a protectionist stance. He has imposed tariffs on major trading partners such as China and the European Union in an attempt to renegotiate trade agreements in order to achieve what he considers "fair trade". If he continues to implement tough trade protectionism policies after being re elected, it will further impact the global trading system, exacerbate international trade frictions and tensions.

The implementation of tariff policies may also lead to an increase in domestic prices in the United States. Most of the daily necessities in the United States rely on imports, and high tariffs will increase the cost of imported goods, with most of the increased costs being passed on to end consumers. According to economists' calculations, an average American household may spend over $4000 more per year due to high tariffs. This not only increases the burden on consumers' lives, but may also suppress consumer demand and have a negative impact on the economic growth of the United States. At the same time, trade protectionism policies may also lead to adjustments and restructuring of the global industrial chain, and some companies may transfer their production bases from the United States to other countries to avoid the high tariff policies of the United States, which will have an impact on the manufacturing industry in the United States.

In terms of monetary policy, Trump has always advocated a low interest rate policy, believing that it is conducive to increasing residents' willingness to invest and buy houses, promoting enterprises to increase capital expenditures, and thereby boosting economic growth. If he strengthens the intervention of the Federal Reserve to maintain a low interest rate environment after re-election, it may cause inflation and asset foam and other problems. Low interest rates will stimulate credit expansion, making it easier for businesses and individuals to obtain loans for investment and consumption. However, if the economic growth rate cannot keep up with the speed of credit expansion, it will lead to increased inflationary pressure. The formation of the asset foam will also increase the risk of the financial market. Once the foam bursts, it will have a serious impact on the economy of the United States.

In terms of immigration policy, Trump has always advocated strengthening border controls to prevent illegal immigrants from entering the United States. If he continues to strengthen these measures after being re elected, on the one hand, it will help protect employment opportunities for American residents, but on the other hand, it may also lead to labor shortages and rising costs. Some industries, such as agriculture and services, have a high demand for low skilled labor. The reduction of illegal immigration may lead to a shortage of labor in these industries, forcing companies to raise wages to attract labor and increase operating costs.

Overall, Trump's victory in the 2024 US election will have complex impacts on the US economy. His economic policy proposals may to some extent stimulate short-term growth of the US economy, but in the long run, issues such as trade protectionism, fiscal deficits, and inflation may pose challenges to the stability and sustainable development of the US economy. The international community needs to closely monitor the policy trends of the Trump administration, and governments and businesses around the world should also be prepared to respond to potential challenges and opportunities.

報告顯示,中國電力投資加速增長,預計2024年電網基建投資將超過5300億元。

近日,市場迎來了一則引人注目的消息:工業巨頭3M公司(MMM.N)在本周五公布了其季度業績報告,隨後股價飆升至近兩年來的

最近,外媒給OpenAI算了筆賬,今年可能要血虧50億美元。

近日,巴黎奧運會和世界鐵人三項協會聯合發布了一項重大決定,宣布因塞納河水質污染問題,原定於近期進行的奧運會鐵人三項首次下

當地時間7月18日,法國巴黎發生了一起令人震驚的持刀襲警事件。

近期,一則重大消息在國際舞臺上引起軒然大波,馬來西亞宣布加入金磚國家。

調查發現,互聯網和智能手機的使用幹擾了韓國近五分之一學生的生活。