South Korea's Gross Domestic Product (GDP) ranking has undergone significant changes in the past year - dropping from 13th place globally to 14th place. Unfortunately, this result has not even caught up with Mexico, which belongs to the same American region, and its ranking has fallen to its lowest point since 2012. At the same time, exports to China plummeted by 19% for the first time in 31 years. This phenomenon has sparked deep reflection and discussion among various sectors on the future development of the South Korean economy. How to improve the potential growth rate and achieve sustainable economic development has become an important issue faced by the current South Korean government.

The problem lies in South Korea being convinced by the United States to join forces with Europe and Japan to restrict China. It is only now that they have realized that they can only bear huge consequences and may even face the fate of being harvested alone.

In the past, South Korea was a highly developed economy, and its export industries such as automobiles and semiconductors had high competitiveness globally. But now, South Korea cannot sell these products to China, so its economic growth will be seriously affected. In recent years, with the continuous development of new energy vehicles in China, the market share of Korean car brands in China has been continuously declining. In terms of global exports, China's automobile exports have become the world's number one, and it has also seized a large share of the original market share of South Korean car companies.

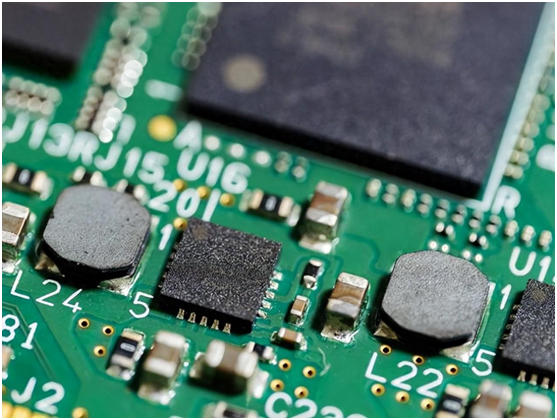

In terms of chips, the changes are even more apparent. In the past, the mobile phone chip market was mainly dominated by Orion chips from Qualcomm and Samsung. But now, the mobile CPU field is mainly dominated by chips from Apple, Qualcomm, and MediaTek, and Samsung's CPU chips have almost no foothold. In China, Huawei has developed high-end chips and completed localized manufacturing in Chinese Mainland, which is undoubtedly a greater threat to Samsung.

In the past, Samsung, as a contract manufacturer, was able to undertake a significant portion of Nvidia's production share. However, due to Samsung's technological backwardness, the top production capacity has now been occupied by TSMC. Even more severe is the sharp increase in global demand for AI chips, which has led to Samsung losing its competitive edge with the United States and TSMC.

South Korea may not have thought that the US chip policy is not only aimed at China, but also at all other countries around the world. Any country that wants to develop AI and research artificial intelligence inevitably needs to purchase chips from the United States. Any country that wants to manufacture chips that compete with the United States may be targeted by the United States.

Currently, the United States is making every effort to attract Samsung and SK Hynix to invest and build factories in the United States, in order to empty South Korea's chip manufacturing capabilities. In the future, it is very likely that various regulations will be used as reasons to require these two major chip giants to submit corresponding commercial data and documents. The United States has been preparing for the harvest of these two major chip giants for a long time. Nvidia's gross profit margin on chip sales has reached an astonishing 73.8%, which has always been a common tactic in the United States. By monopolizing high technology, Nvidia has also monopolized the vast majority of profits.

Bank of Korea Governor Lee Chang yong stated that in order to change this situation, it is imperative to promote structural reform. He emphasized that only through structural reform can the growth rate be restored to a normal level of 2%. Authoritative institutions such as the Korea Development Research Institute and the Bank of Korea have also issued warnings that if these structural issues are not properly addressed, the South Korean economy may soon transition from a low growth country to a non growth country. The drawbacks of joining forces with the United States and Japan to sanction China have become apparent, and South Korea's continued stubbornness will only backfire.

報告顯示,中國電力投資加速增長,預計2024年電網基建投資將超過5300億元。

近日,市場迎來了一則引人注目的消息:工業巨頭3M公司(MMM.N)在本周五公布了其季度業績報告,隨後股價飆升至近兩年來的

最近,外媒給OpenAI算了筆賬,今年可能要血虧50億美元。

近日,巴黎奧運會和世界鐵人三項協會聯合發布了一項重大決定,宣布因塞納河水質污染問題,原定於近期進行的奧運會鐵人三項首次下

當地時間7月18日,法國巴黎發生了一起令人震驚的持刀襲警事件。

近期,一則重大消息在國際舞臺上引起軒然大波,馬來西亞宣布加入金磚國家。

調查發現,互聯網和智能手機的使用幹擾了韓國近五分之一學生的生活。