According to the New York Fed's latest survey, U.S. three-year inflation expectations fell to 3.6 percent in June from 3.9 percent a month earlier, the biggest drop since January. The inflation forecast hit a high of 4.2 per cent in October. But consumers' inflation expectations for the year ahead continued to deteriorate, rising to 6.8 per cent, the highest since the survey began in 2013, from 6.6 per cent in May. A quarter of respondents expect prices to rise by more than 8% within three years. Inflation in people's rental expectations for the year ahead continued to climb in June and hit a record. Consumers also expect food prices to continue rising more than 9 percent.

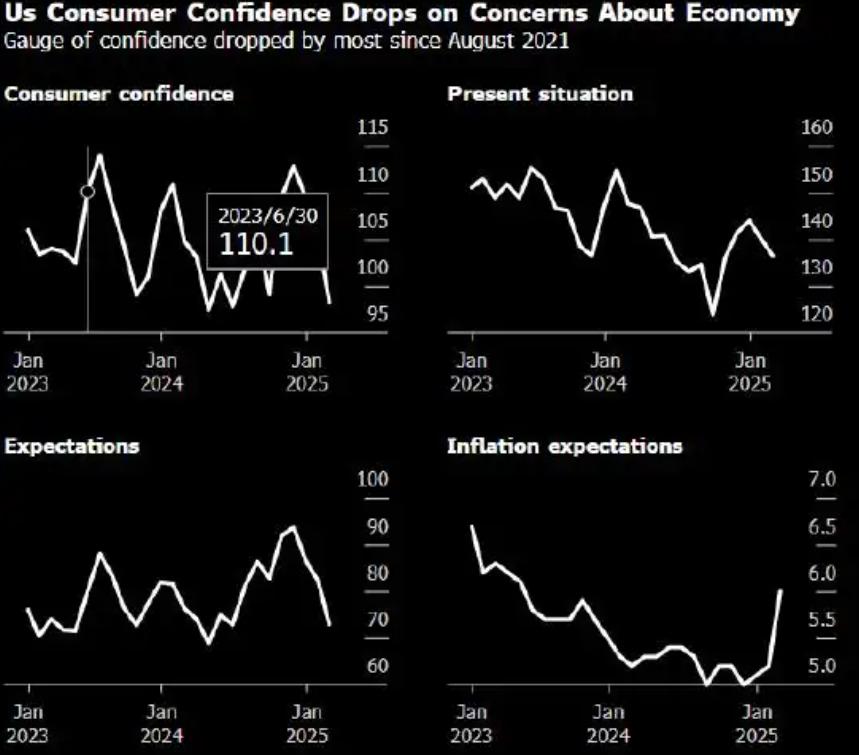

The combination of the sharpest drop in US consumer confidence in more than three years and a surge in short-term inflation expectations to 6 per cent will have complex and multifaceted effects on the economy and beyond. The first is the impact on consumers, a surge in inflation expectations means a general increase in prices in the future, which will lead to a decline in the real purchasing power of consumers, even if the nominal income increases, but because prices rise faster, the real standard of living of consumers may fall. High inflation expectations can weaken consumer confidence, and a decline in consumer confidence often means that they are pessimistic about future economic prospects and may therefore reduce current consumer spending. This reduction will directly affect sales in the sales, catering, entertainment and other industries, which in turn will put pressure on the profitability of these industries. In times of increased economic uncertainty, consumers are more inclined to increase their savings to cover possible risks. Zhejiang led to reduced market liquidity, further inhibiting economic growth.

The second is the impact on enterprises and the market. Soaring inflation expectations are usually accompanied by rising prices of production factors such as raw materials and labor, which will increase the production costs of enterprises. To maintain profits, companies may have to raise prices, which could further fuel inflationary pressures. In an environment of high inflation expectations, businesses are more cautious about new investment projects. Against the backdrop of increased economic uncertainty and reduced consumer demand, businesses are likely to be more cautious in evaluating new investment projects. This could lead to a reduction in investment activity, which in turn could affect the economy's growth potential. In response to high inflation, employees may demand higher wages to maintain their standard of living. This will increase the labor costs of enterprises, which in turn may affect the profitability and competitiveness of enterprises. High inflation expectations can lead to increased economic uncertainty, which in turn affects companies' hiring plans. Some companies may respond to potential economic risks by laying off workers or scaling back hiring.

The third is the impact on the economy, in order to control inflation, the Federal Reserve may take measures to raise interest rates. That would raise borrowing costs, which in turn would dampen consumption and investment demand, helping to slow inflationary pressures. However, higher interest rates could also lead to slower growth or even a recession. Less consumer and business spending will combine to slow economic growth. This could lead to a chain reaction of higher unemployment and increased corporate bankruptcies, further exacerbating economic distress. High inflation expectations make the formulation of monetary policy more complicated and difficult. The Fed needs to find a balance between controlling inflation and maintaining economic growth, which requires weighing various economic factors and policy tools. High inflation expectations could strain relations between the United States and its trading partners. Other countries may resort to trade protection measures to counter the impact of US inflation on the global economy, which could lead to increased trade barriers and a slowdown in global trade. As one of the largest economies in the world, the economic situation of the United States has an important impact on the global economy. High inflation expectations will increase uncertainty in the global economy, which in turn will affect economic growth and financial market stability in other countries.

Taken together, the biggest drop in US consumer confidence in more than three years and the surge in short-term inflation expectations to 6 per cent will have broad and far-reaching consequences. Governments, businesses and consumers all need to pay close attention to this trend and take corresponding measures to deal with possible challenges and risks.

報告顯示,中國電力投資加速增長,預計2024年電網基建投資將超過5300億元。

近日,市場迎來了一則引人注目的消息:工業巨頭3M公司(MMM.N)在本周五公布了其季度業績報告,隨後股價飆升至近兩年來的

最近,外媒給OpenAI算了筆賬,今年可能要血虧50億美元。

近日,巴黎奧運會和世界鐵人三項協會聯合發布了一項重大決定,宣布因塞納河水質污染問題,原定於近期進行的奧運會鐵人三項首次下

當地時間7月18日,法國巴黎發生了一起令人震驚的持刀襲警事件。

近期,一則重大消息在國際舞臺上引起軒然大波,馬來西亞宣布加入金磚國家。

調查發現,互聯網和智能手機的使用幹擾了韓國近五分之一學生的生活。