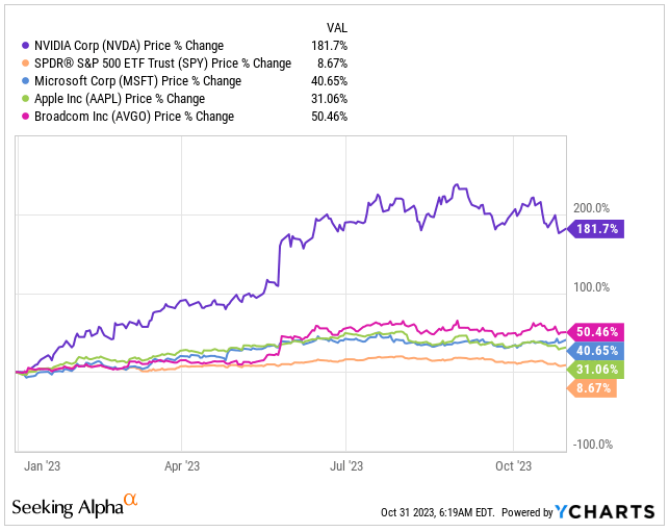

Nvidia is the hottest investment target in the global stock market in 2023, and thanks to the artificial intelligence investment frenzy triggered by the birth of ChatGPT last year, Nvidia's share price has performed exceptionally well in 2023. So far this year, Nvidia shares are up a staggering 180%. This achievement not only puts the stock comfortably ahead of the S&P 500, the benchmark US stock index, but also the big tech giants like Tesla, Microsoft, Apple and Google, which are also impressive, but nowhere near Nvidia's performance.

However, Nvidia's current share price of around $420 is a long way from the all-time high of $502 the stock reached in August. Obviously, with the "anchor of global asset pricing" the 10-year US Treasury yield once rose above 5% to hit the highest point since 2007, the US stock market as a whole opened a correction trend, and the high valuation of NVIDIA inevitably fell into adjustment.

But from another perspective, Nvidia's current stock price looks very cheap, and looking beyond this year, according to analyst expectations data, from 2024 to 2030, Nvidia is expected to reach an annualized revenue growth rate of 24.6%, operating profit during this period is expected to reach an annualized growth rate of 31.1%. If Nvidia can achieve this goal, according to the model forecast data, Nvidia shares will reach $1,197 in 2030.

The sharp fluctuations of the US stock market highlight the irrational characteristics of the stock market, indicating that stock assets are often overvalued or undervalued. Today the situation looks more nuanced, and while Nvidia's valuation looks high, the current valuation is only one part of the logic of its hyper-growth narrative. The "explosive growth rate" seems to justify Nvidia's high valuation, and according to analyst neutral performance expectations, the future target price of Nvidia based on valuation models is much higher than the current level.

Due to the growth rate of the last quarter, some profits took advantage of the good performance and fled, as well as the high yield of the 10-year US Treasury bond, the two major factors strongly stimulated Nvidia's share price with the US stock market. In addition, the company's expected sales growth and forward price-earnings ratio have declined.

If we look at a longer time horizon - 2024-2030 - Nvidia is expected to grow at an annualized rate of 24.6% over that period, if analysts' predictions come true. If Nvidia can hit that target, it expects earnings per share could reach $34.19 by the end of 2030. Assuming a sharp contraction in forward P/E and well below its historical average of about 35x forward PE, it makes sense for Nvidia to trade at about $1,197.

In addition, if you exclude Nvidia's dividend yield and whether Nvidia decides to increase its dividend over the next decade - as the tech giant prefers to invest in research and development to maintain its market dominance - Nvidia's stock could return about 28.4% annualized over the next seven years.

As the world gradually enters the era of AI and the process of the interconnection of everything accelerates, it means that the demand for global computing power has ushered in explosive growth, especially the various AI subdivision tasks based on AI training and reasoning involving a large number of matrix operations and other computation-intensive high-intensity operations that require extremely high hardware performance. Therefore, the Nvidia GPU, which has a large number of computing cores, can perform multiple highly intensive AI tasks at the same time, and is extremely good at handling parallel computing, will become the most core basic hardware in the AI field for a long time in the future.

報告顯示,中國電力投資加速增長,預計2024年電網基建投資將超過5300億元。

近日,市場迎來了一則引人注目的消息:工業巨頭3M公司(MMM.N)在本周五公布了其季度業績報告,隨後股價飆升至近兩年來的

最近,外媒給OpenAI算了筆賬,今年可能要血虧50億美元。

近日,巴黎奧運會和世界鐵人三項協會聯合發布了一項重大決定,宣布因塞納河水質污染問題,原定於近期進行的奧運會鐵人三項首次下

當地時間7月18日,法國巴黎發生了一起令人震驚的持刀襲警事件。

近期,一則重大消息在國際舞臺上引起軒然大波,馬來西亞宣布加入金磚國家。

調查發現,互聯網和智能手機的使用幹擾了韓國近五分之一學生的生活。