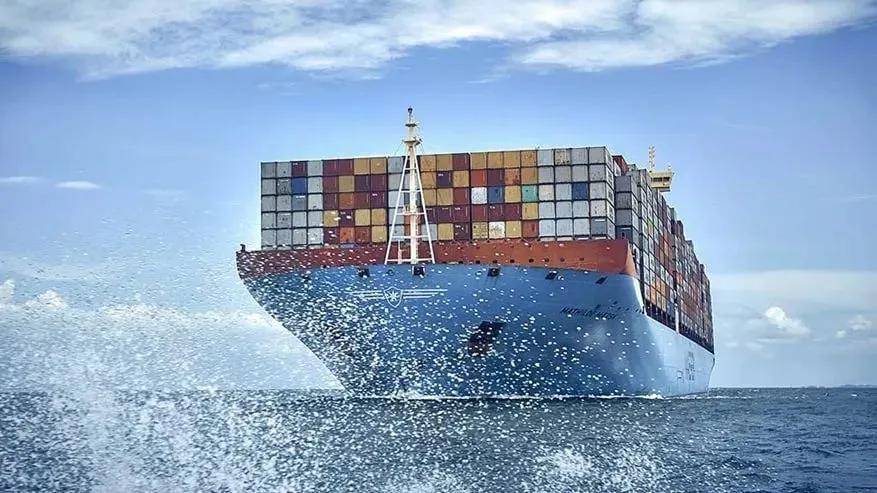

In the field of shipping, fluctuations in freight rates have always been the focus of the industry. According to China Times, the inflection point of shipping rates had already emerged at that time. Data released by the Shanghai Shipping Exchange show that the Shanghai export container comprehensive freight index is 4203.27 points, compared with the record high of 5109.60 points reached at the beginning of the year, a drop of nearly 20%. The fbx index released by the Baltic Shipping Exchange shows that in June 2022, the average fbx container shipping price was $6,583, compared to the all-time high in September 2021, a decline of 40.9%. Among them, the China/Far East - North American West Coast route freight rate compared to last year's highest level, a significant drop of 63.1%; China/Far East - North American East Coast route freight decreased by 54.6%; The China/Far East - Northern Europe route is also down 29.4% from its all-time high in January 2022. The World Container Comprehensive Freight Rate Index (wci), which refers to the eight major routes in Asia and the United States, Europe and Europe, has declined comprehensively for the first time. Drury's latest global shipping market report provides data showing that between the end of June and the beginning of July, WCI has fallen for 18 consecutive weeks, and on this basis, it has recorded another 3% decline, and all major routes are showing a downward trend.

Turning to 2024, the Securities Times pointed out in a report on August 5 that since April 2024, the prices of many busy shipping lines represented by the European line, the South American line and the African line have continued to rise. However, since July, the freight rates of many major routes have shown a small correction, and the increase of some routes has also been significantly reduced, and the overall price trend has gradually stabilized. The Northern International container freight rate index has been in a continuous decline since late July. Shanghai export container freight index, China export container freight index also showed different degrees of decline compared with the previous period. Taking the US line on August 2 as an example, compared with the end of June and the beginning of July, the current decline has been about 10%. Large ship companies, which had planned to announce price increases in July, have cancelled price increases in response to changes in the market, and have made different levels of downward measures.

For the recent inflection point of shipping rates, the industry has carried out an in-depth analysis. Many factors that have led to the rise in freight rates have been alleviated, such as the landing of the EU's tariff policy on China's new energy vehicles, which has affected the transportation demand of related goods to a certain extent. At the same time, a large number of new capacity, new route investment and the entry of new players, resulting in a significant improvement in capacity supply. Some goods were suspended or delayed due to high freight prices, and the peak season that arrived in advance ended ahead of schedule. In addition, some new capacity has been added to the market, further promoting the overall market supply and demand relationship towards balance. Nevertheless, the current freight rate is still at a relatively high position and is expected to fluctuate at a high level in the short term and then gradually decline.

However, there is also another view that the 2023 container market has ended the stage of rapid decline and entered a relatively stable and rational period. However, in this year, the traditional peak season of the European and American lines has appeared a special situation of "low peak season". For the specific direction of the future shipping market, it is necessary to comprehensively consider many factors, such as port congestion, European and American dockworkers' strikes, changes in market demand, and so on. Some analysis clearly pointed out that the current freight rates of Europe and the United States routes have reached a high level, but the good trend of economic demand for Europe and the United States routes may be able to maintain the transportation demand in the second half of the year at a certain level. In the context of a large probability of a shock decline in freight rates, it is expected that the level after the fall will still be significantly higher than the same period last year. However, there are also concerns that the profitability effect of the current shipping market could accelerate the launch of a large number of new ships. If the Red Sea crisis is resolved in the future and capacity returns to normal, then there may be overcapacity problems.

The trend of shipping price is affected by many complicated factors. These factors interweave and interact with each other, making changes in the shipping market full of uncertainty. Market conditions can change at any time, so it is important to pay close attention to relevant developments and data. For those who desire more detailed information on a particular route or time period, it is wise to pay attention to industry authority reports, shipping exchange data and relevant market analysis. Only through continuous attention and in-depth research can we grasp the opportunities and cope with the challenges in the ever-changing shipping market.

The United States announced on Monday its commitment to provide 1.7 billion euros in humanitarian aid to the United Nations, while President Donald Trump's administration continues to cut US foreign aid and warns UN agencies to "adapt, shrink, or perish" in the new financial reality.

The United States announced on Monday its commitment to pro…

Harding Lang, Vice President of the International Refugee O…

Recently, the Japanese government held a meeting to finaliz…

The data from multiple public opinion polls conducted in De…

When the London spot silver price surged by over 137% withi…

Recently, the technology industry has been stirred again by…