In the first half of 2024, global bond issuance increased by 13%, with greater growth in structured financing and US public finances. Similar to the first quarter, this growth since March is largely due to borrowers taking advantage of strong market demand for refinancing and planning for increasing uncertainty in the future. The slowdown in inflation has raised market expectations for further interest rate cuts in the second half of this year, but more aggressive debt refinancing pace, relative slowdown in mergers and acquisitions, and increased market volatility may offset any benefits brought by the policy interest rate cut in the short term.

Firstly, S&P Global Ratings Credit Research and Insights predicts that global bond issuance will increase by 9% to approximately $8.3 trillion by 2024. In the first half of 2024, the bond issuance volume of almost all industries mentioned in the report was considerable. However, this may be mainly due to the expected shift of normal issuance activities later this year to the first half of the year, rather than the beginning of a long-term surge in issuance volume. The strong performance of most industries in the first half of the year will help maintain the higher annual total predicted earlier. Although the market is becoming increasingly optimistic about future interest rate cuts, residual concerns about economic resilience, accelerated refinancing pace, still moderate M&A activity, and ongoing concerns about uncertainty that may exacerbate market volatility later this year have offset these impacts.

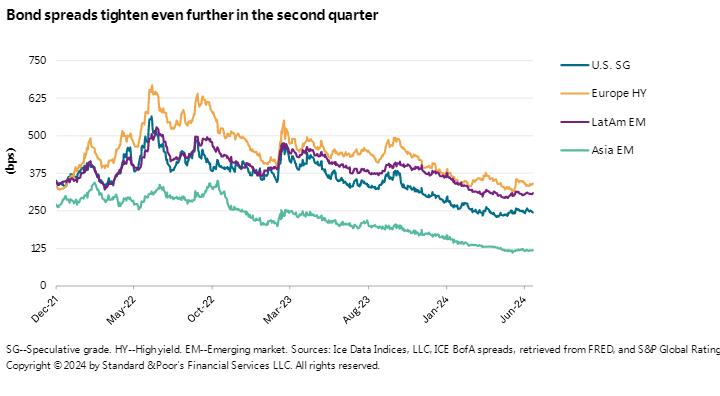

Secondly, the market has maintained a positive trend throughout the year. The global bond spreads were already tight in the first quarter, and further narrowed in the second quarter. In fact, the spread of US speculative bonds hit a historic low of 229.6 basis points on May 7th. Since the end of May, the interest rate spread has widened and returned to the level at the end of the first quarter, but this is not a sign of pessimism. Geopolitical risks are often difficult to quantify or price in the market. Despite strong calls for early elections in France in mid June, the spread on European high-yield bonds has only widened by about 40 basis points. Afterwards, the interest rate spread fell by 15 basis points to 340 basis points on July 17, 55 basis points lower than the beginning of the year and only 9 basis points higher than the beginning of 2022. Faced with various event risks and possibilities, market sentiment remains strong, including the ongoing conflict in Ukraine, escalating tensions in the Middle East, and multiple expected and unexpected elections this year, some of which have actual results yet to be observed.

On the other hand, in addition to possibly preparing in advance for upcoming refinancing, large US banks may also be preparing for changes to Basel III, which may require higher capital fees for specific collateral categories and securitization risks. Although it is still far from being finalized, this may stimulate an increase in the issuance volume of some structured financing sectors this year. Now the market expects that the Federal Reserve will further cut interest rates this year, and optimism has begun to depress the yield of long-term US treasury bond bonds. However, in the past 18 months, the fundamental changes in the supply and demand of US treasury bond bonds have been intensifying. Since the beginning of 2023, the supply of outstanding U.S. treasury bond has increased by about $3 trillion, or 13%. This is the fastest growth rate in history, especially in such a short period of time, mainly due to the increase in short-term instrument issuance.

In addition, the issuance of European mortgage bonds in the second quarter was lower than last year's record level, partly due to the stagnation in June caused by increased market volatility due to the French elections. Compared to the same period in 2023, the issuance of European mortgage bonds has decreased by approximately 6%. Despite negative growth, mortgage bonds are a valuable source of financing strength and diversification for banks, and central banks are typically large holders of securities, especially during periods of quantitative easing.

Overall, considering these factors and the total amount in the first half of the year, it is expected that bond issuance will increase by about 9% this year. Given that geopolitical risks are often more concerning than actual constraints, there is potential for upward growth.

The United States announced on Monday its commitment to provide 1.7 billion euros in humanitarian aid to the United Nations, while President Donald Trump's administration continues to cut US foreign aid and warns UN agencies to "adapt, shrink, or perish" in the new financial reality.

The United States announced on Monday its commitment to pro…

Harding Lang, Vice President of the International Refugee O…

Recently, the Japanese government held a meeting to finaliz…

The data from multiple public opinion polls conducted in De…

When the London spot silver price surged by over 137% withi…

Recently, the technology industry has been stirred again by…