In the recent Asian trading morning, the financial market once again ushered in a quiet but underflowing trading feast. The euro slipped quietly to around 1.08 against the dollar, with the specific quote fixed at 1.0815, down 0.06% from the previous close of 1.0821. This small but profound fluctuation is not only a simple game of numbers, but also a complex picture of global economic policy divergence, the game of market expectations and the reconstruction of currency values. This article will deeply analyze this market dynamic, reveal the truth behind it, not to avoid the problem, not to whitewash the peace.

First, let's focus on the latest comments from European Central Bank Vice President Luis de Guindos. The policymaker's voice, like a chill wind in the winter, signals that the ECB will cut interest rates in September. This expectation will undoubtedly add to the already fragile euro exchange rate. In contrast, the Federal Reserve, while also under pressure to cut interest rates, seems to be moving at a more cautious pace, which has helped maintain the relative stability of the dollar to some extent. The policy divergence between the US Federal Reserve and the European Central Bank, like an insurmountable chasm, has not only deepened market uncertainty about the global economic outlook, but also increased volatility in currency markets.

However, the policy divergence does not exist in isolation. It reflects the very different economic conditions in the two economies. Although the US economy faces the risk of slowing growth, the market widely expects it to achieve a "soft landing", that is, to maintain economic growth while gradually adjusting monetary policy. In contrast, the momentum of the eurozone's economic recovery has weakened significantly, especially in the context of the deteriorating global trade environment and heightened geopolitical risks, exposing the fragility of the eurozone's economic growth. This divergence in economic fundamentals is the root cause of continued pressure on the euro against the dollar.

From a technical point of view, the downward trend of EUR/USD seems to have become irreversible. The weekly low of 1.0802 only serves as short-term support, while 1.0796 near the 100-day Simple Moving Average (SMA) becomes the next key psychological line of defense. If this line of defense is broken, the euro could slide further towards the June low of 1.0666 and even the May low of 1.0649. This series of technical indicators is not only a direct reflection of market sentiment, but also a pessimistic expectation of the future trend of the euro.

It is worth noting that while there may be brief rallies, such as the July high of 1.0948 or the March high of 1.0981 before that, these rallies are more like a blip in the market and hardly change the overall downward trend of the euro. In particular, the loss of 1.1000, an important psychological threshold, is a sign that the euro exchange rate against the US dollar has entered a new depreciation cycle.

So what forces are driving the euro's continued decline? In addition to the policy divergence and differences in economic fundamentals mentioned above, the deeper reason lies in changes in global capital flows. In the context of increasing global economic uncertainty, investors are more inclined to allocate funds to relatively safe havens, and the US dollar, as a traditional safe-haven currency, has naturally become the first choice of funds. This change in capital flows directly led to an increase in demand for dollars and a decline in demand for euros, which in turn pushed the euro against the dollar exchange rate down.

Moreover, the eurozone's internal structural problems cannot be ignored. For a long time, the economic differences among eurozone members, the uncoordinated fiscal policies and the fragmentation of financial markets have been important factors restricting the development of the eurozone economy as a whole. These problems are particularly acute during the economic downturn, further weakening market confidence and the value base of the euro.

In the face of the continued decline in the exchange rate of the euro against the US dollar, we should not only see the deep-seated reasons behind it, but also maintain a rational attitude. Exchange rate fluctuations are the norm of a market economy, reflecting changes in the global economic landscape and changes in the expectations of market participants. For investors, it is important to recognize market trends and seize investment opportunities, but also to do a good job of risk management to cope with possible market fluctuations.

Of course, it is all the more important for policy makers to take a holistic approach, strengthen policy coordination and cooperation, and jointly address the challenges facing the global economy. Only in this way can the problems facing the eurozone and the global economy be fundamentally solved and the global economy achieve sound and stable development.

In short, the euro's fall against the dollar in early Asian trading on Tuesday is just a microcosm of the complex changes in the global economy. It is a reminder that in today's globalised world, fluctuations in any one economy can trigger a chain reaction. Therefore, we need to pay more attention to market dynamics and in-depth analysis of the causes and effects behind them in order to better cope with future challenges.

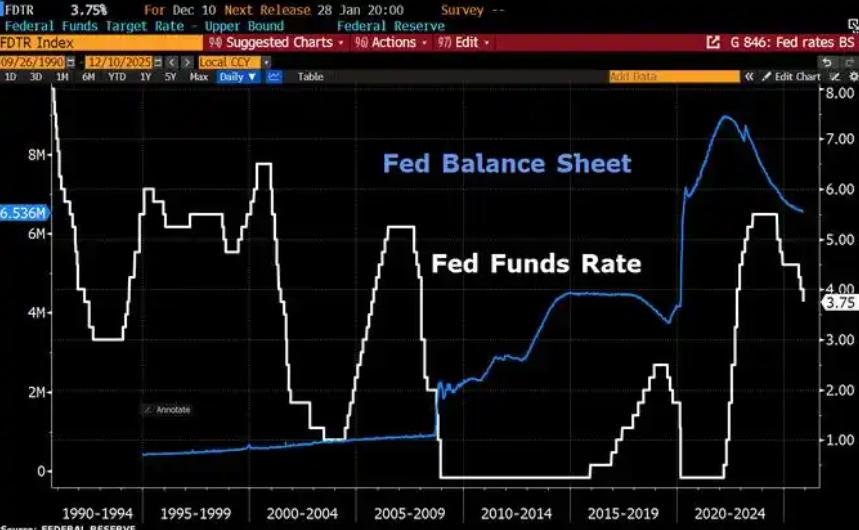

Since 2022, the Fed has cumulatively reduced its balance sheet by $2.4 trillion through quantitative tightening (QT) policies, leading to a near depletion of liquidity in the financial system.

Since 2022, the Fed has cumulatively reduced its balance sh…

On December 11 local time, the White House once again spoke…

Fiji recently launched its first green finance classificati…

Recently, the European Commission fined Musk's X platform (…

At the end of 2025, the situation in the Caribbean suddenly…

The U.S. AI industry in 2025 is witnessing a feverish feast…