Mortgage rates continued their upward trajectory this week, inching closer to 8% yet again as purchase demand sputters.

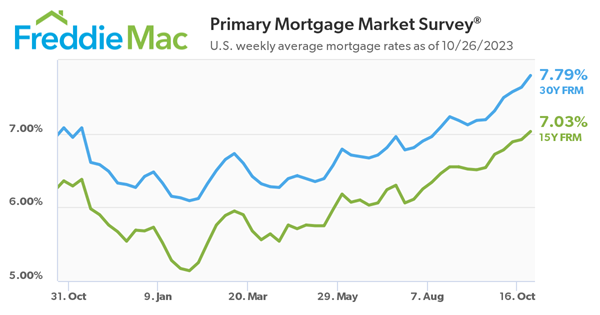

Freddie Mac reported Thursday that the average rate for the benchmark 30-year fixed mortgage has now hit 7.79%, up from 7.63% last week and from 7.08% a year ago.The rate for a 15-year mortgage also climbed, averaging 7.03% after coming in last week at 6.92%. One year ago, the rate on a 15-year fixed note averaged 6.36%.

"Rates have risen two full percentage points in 2023 alone and, as we head into Halloween, the impacts may scare potential homebuyers," Freddie Mac chief economist Sam Khater said in a statement. "Purchase activity has slowed to a virtual standstill, affordability remains a significant hurdle for many and the only way to address it is lower rates and greater inventory."

With mortgage rates at their highest level in more than two decades, more would-be buyers are balking at the cost of a house payment. At the same time, more would-be sellers are opting to keep their homes rather than move and take on an interest rate that may be twice their current rate.

Economists now project 2023 will mark the slowest year for home sales since 2008, when the housing bubble burst.

Redfin estimates there will only be roughly 4.1 million sales of existing homes across the nation by year's end due to persistently high mortgage rates and elevated home prices amid low inventory, which are causing prospective buyers to reconsider their plans. The real estate brokerage also reported that 16.3% of home purchase agreements in the U.S. were canceled last month, the highest rate in nearly a year.

Just last month, sales retreated 15.4% from the previous year, according to data from the National Association of Realtors. Sales receded in all regions except for the Northeast in September, the data showed.

With rates sitting at their highest levels in over two decades, a growing number of buyers are sitting on the sidelines and questioning whether 2023 is the right time to move.

Data released Wednesday by the Mortgage Bankers Association showed mortgage applications dropped to the lowest level since 1995.

"Mortgage rates are staying high longer than anticipated, keeping away everyone except those who need to move and pushing our sales projection for the year down to a 15-year low," said Chen Zhao, Redfin’s economic research lead.

In 2008, the housing market crashed due to a combination of the subprime mortgage crisis, high levels of debt and a lack of financial regulation, according to Norada Real Estate Investments. It led to a severe economic recession that impacted millions of Americans, many of whom found themselves in homes worth less than their mortgages.

That's not the case today, Redfin said. With such high rates, more homebuyers are staying put, which has further exacerbated inventory issues.

The United States announced on Monday its commitment to provide 1.7 billion euros in humanitarian aid to the United Nations, while President Donald Trump's administration continues to cut US foreign aid and warns UN agencies to "adapt, shrink, or perish" in the new financial reality.

The United States announced on Monday its commitment to pro…

Harding Lang, Vice President of the International Refugee O…

Recently, the Japanese government held a meeting to finaliz…

The data from multiple public opinion polls conducted in De…

When the London spot silver price surged by over 137% withi…

Recently, the technology industry has been stirred again by…