On July 31st local time in the United States, the Federal Reserve announced that it would maintain the target range of the federal funds rate between 5.25% and 5.5% unchanged, marking the eighth consecutive time since September last year that the Fed has kept interest rates unchanged. This decision was in line with market expectations, but the "rate cut expectation" given by Federal Reserve Chairman Powell at the subsequent press conference has attracted widespread attention from the market.

After a two-day monetary policy meeting, the Federal Reserve issued a statement pointing out that US economic activity continues to steadily expand, but employment growth has slowed and the unemployment rate has risen but remains low. Meanwhile, inflation has slowed down over the past year, but remains slightly above the 2% target set by the Federal Reserve. Therefore, when evaluating the appropriate monetary policy stance, the Federal Reserve decides to keep interest rates unchanged to continue observing changes in economic data.

The Federal Reserve made some adjustments to its wording in the statement, changing the inflation description from "high" to "slightly high" and shifting the policy focus from "highly concerned about inflation risks" to "maintaining attention to the risks faced by its dual mission". These adjustments reflect the complex situation of the Federal Reserve seeking a balance between addressing inflation and economic growth.

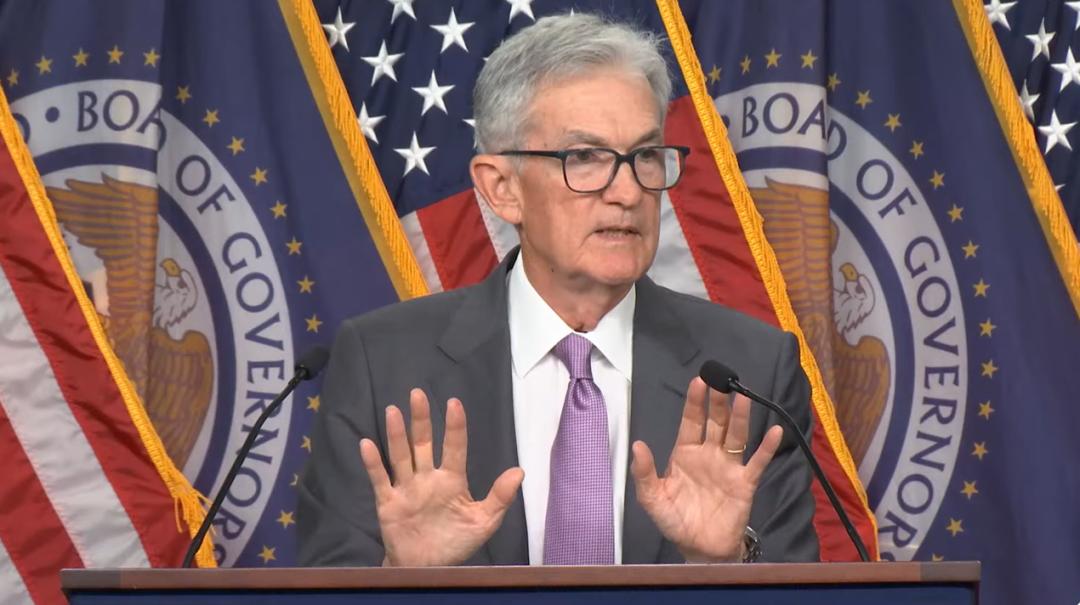

Despite the Federal Reserve's decision to keep interest rates unchanged, Powell gave a clear expectation of a rate cut at a press conference. He pointed out that the inflation data for the second quarter has increased the confidence of the Federal Reserve, and if the inflation test is met, the Fed may cut interest rates as early as September. This statement immediately triggered a warm response from the market, with the three major US stock indexes opening high and closing high on the same day, and investors are full of expectations for the prospect of interest rate cuts. Powell also emphasized that all decisions of the Federal Reserve are "absolutely" non political and have nothing to do with the upcoming presidential election. He stated that the Monetary Policy Committee generally believes that a 50 basis point rate cut is not currently a consideration in terms of the magnitude of the rate cut, but if economic data meets expectations, the Federal Reserve may initiate a rate cut within this year.

Powell's expectation of a rate cut quickly spread to the market, and all three major US stock indices saw significant gains on the same day. As of the close, the Nasdaq Composite Index rose 2.64%, the S&P 500 Index rose 1.58%, and the Dow Jones Industrial Average rose 0.24%. In addition, the price of gold has also risen significantly, while the US dollar index and US Treasury yields have declined.

The market generally believes that Powell's expectation of interest rate cuts reflects the Federal Reserve's cautious optimism about the economic outlook. Although inflation is still slightly above the target level, the Federal Reserve believes that the economy is approaching a level suitable for interest rate cuts. This expectation boosted market sentiment, driving up the stock market and safe haven assets such as gold. However, some analysts also point out that the Federal Reserve's expectation of interest rate cuts is not without risks. On the one hand, if inflation data does not continue to decline as expected, the Federal Reserve may postpone its interest rate cut plan; On the other hand, if the interest rate cut is too large or the timing is inappropriate, it may trigger financial market volatility and the risk of economic overheating.

In addition, the expectation of interest rate cuts by the Federal Reserve will have a profound impact on the global economy. As one of the world's largest economies and financial markets, the adjustment of monetary policy in the United States will directly affect global capital flows and financial market fluctuations. Therefore, central banks and investors around the world need to closely monitor the monetary policy movements of the Federal Reserve in response to possible market changes.

Despite the enthusiastic response from the market, investors still need to maintain a cautious attitude and closely monitor economic data and the policy movements of the Federal Reserve. In the future, the Federal Reserve's monetary policy adjustments will continue to be one of the important factors affecting the global economy and financial markets.

A new survey released in the United States shows that in the context of rising prices and growing concerns among the public about the economic outlook of the country, there is a coexistence of frugality and differentiation.

A new survey released in the United States shows that in th…

By the end of 2025, the situation in the Middle East resemb…

According to Channel NewsAsia, international oil prices hav…

On Sunday, US President Donald Trump Trump met with Ukraini…

Officials in the Trump administration, speaking on Fox News…

In 2025, the Trump administration reshaped the global trade…