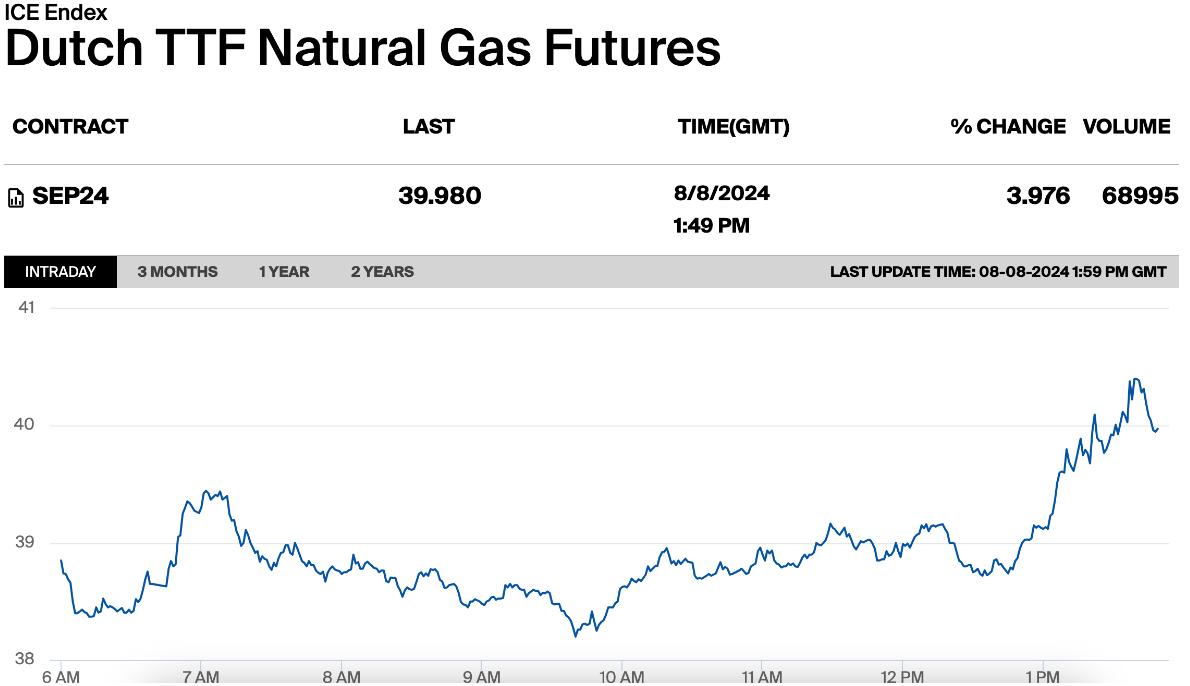

European gas prices jumped last week after Ukraine launched an attack on a key Russian gas transit terminal, raising fears of supply cuts. The front-month Dutch contract, seen as the benchmark for European gas futures, rose more than 2 percent to 42 euros per megawatt-hour, its highest level since December. A surge in natural gas prices during the crucial storage period ahead of winter could lead European countries to turn to the United States for additional purchases of liquefied natural gas (LNG), resulting in huge profits for U.S. gas suppliers.

Meanwhile, Europe continues to buy gas from the US at no cost, and capacity utilisation at US LNG plants has remained at high levels since late June, even as the price differential between US and European markets has reached a record tenfold. In this context, the continued rise of European gas will have important implications for many other aspects. The first is the economic impact, the rise in natural gas prices will directly lead to an increase in industrial and household energy costs, which will affect the production costs of enterprises and the living costs of residents. Rising energy costs could exacerbate inflationary pressures in the broader economy because energy is a key element in the production of many goods and services. High energy prices may have a negative impact on European industrial competitiveness, especially in energy-intensive industries such as chemicals, steel, etc., which may face the challenge of rising costs and falling profits. Higher energy prices could also affect Europe's trade balance, as higher energy costs could lead to higher imports and lower exports.

The second is the social impact, rising energy costs will directly affect the living standards of residents, which may lead to a strain on household budgets, especially in low-income families. High energy prices can push more people into energy poverty, the inability to pay enough for energy to meet basic needs. Rising energy costs can exacerbate social inequality because households at different income levels are sensitive to changes in energy prices.

Higher gas prices reflect challenges to the stability of energy supplies in Europe, especially when Europe is highly dependent on external energy supplies. However, in order to reduce its dependence on specific energy supply sources, Europe is likely to accelerate its energy diversification strategy, including increasing imports of renewable energy and liquefied natural gas (LNG). At the same time, higher energy prices could prompt European governments to adjust their energy policies to address energy security and cost concerns.

High energy prices may accelerate the energy transition process in Europe and promote the development and application of renewable energy. But in order to meet the challenges of rising gas prices, European governments are likely to adjust their energy policies, including improving energy efficiency, promoting renewable energy, and strengthening energy reserves. In addition, in order to ensure the security of energy supply, Europe may strengthen energy cooperation with other countries and regions to jointly address energy challenges. The government may also introduce subsidies or preferential tax policies to ease the burden on residents and enterprises. The volatility of the energy market will attract a lot of attention from market participants. Investors are likely to reassess the investment outlook for the energy sector and adjust their portfolios. At the same time, energy suppliers are likely to step up mining and production to meet market demand and improve profitability.

Taken together, high energy prices could accelerate Europe's energy transition. With the continuous progress of renewable energy technology and the continuous reduction of costs, more and more countries will increase investment and development of renewable energy. In order to ensure the security and stability of energy supply, Europe may strengthen energy cooperation with other countries and regions. By jointly developing energy resources and sharing energy technology and experience, Europe will be better able to cope with fluctuations and challenges in the energy market.

According to Bloomberg, a recent in-depth interview with Michael Dehal, senior portfolio manager at Raymond James' Dehal Investment Partnership, was released, focusing on the economic development prospects and potential risks of Canada and the United States in 2026.

According to Bloomberg, a recent in-depth interview with Mi…

TikTok Shop, the global e-commerce platform under ByteDance…

As a severe flu outbreak sweeps across the United States, w…

Recently, US Treasury Secretary Mnuchin publicly stated tha…

At the dawn of 2026, the United States launched a military …

From the stiff step when it first debuted in 2022 to demons…