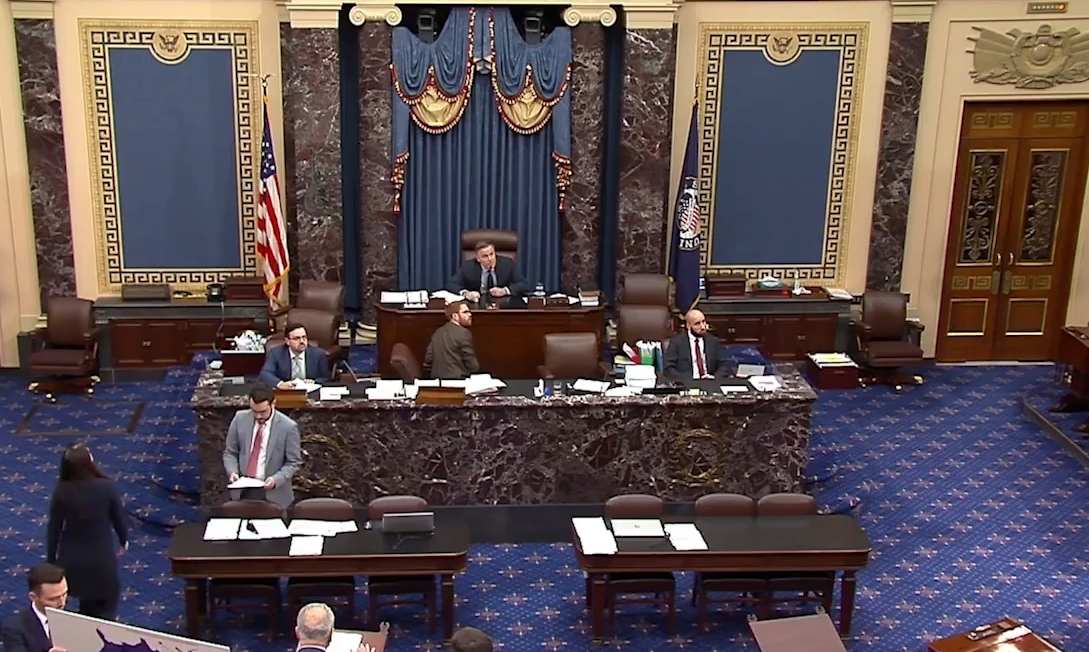

Recently, the US Senate passed the "Big and Beautiful" bill, the most important legislative project of the Trump administration's second term, with a vote of 51 to 50. This event was like a huge rock, quickly stirring up a huge wave in the global economic field. The "Big and Beautiful" bill has proposed a series of measures in areas such as taxation, medical security, and state subsidies. While reflecting the tug-of-war between the two major parties in the United States, this bill has also brought new risks and challenges to the US economy.

From a fiscal perspective, the "Big and Beautiful" bill may further deteriorate the fiscal situation in the United States. Under the original policy, the tax cut bill passed by Trump during his first term was originally only valid until 2025. However, the newly passed "Big and Beautiful" bill by the Senate has made this part of the tax cut policy permanent. According to the analysis of the Congressional Budget Office of the United States, the extended tax cut measures in the "Big and Beautiful" Act will increase the spending cost by more than 4.5 trillion US dollars in the next 10 years alone, which means that the US fiscal deficit will further expand. Against the current economic backdrop, the global economic growth trend remains unclear, and the national debt of the United States itself remains high. Tax reduction policies may put the United States' finances under huge pressure to balance revenue and expenditure, thereby bringing new risks and challenges to the US economy.

From a social perspective, the "Big and Beautiful" bill might widen the gap between the rich and the poor in the United States. As the benefits of tax cuts mainly go to large enterprises and the wealthy class, in the long term, low-income groups in the United States will be subject to substantial economic "exploitation" and "oppression". According to an analysis by Yale University, the "Big and Beautiful" Act will reduce the annual income of the bottom 20% of households by 2.9%, while the annual income of the top 20% of people with an income of over $120,000 will increase by 2.2%. Looking at the entire bill, its overall impact is that high-income earners benefit while low-income earners suffer losses. According to a previous public opinion poll by the Pew Research Center, 55% of respondents expect the bill to bring greater benefits to high-income groups, while 59% believe it will harm low-income groups. From an economic perspective, the widening gap between the rich and the poor may dampen the enthusiasm for social production and lead to a deterioration in resource allocation, which undoubtedly will bring new risks and challenges to the US economy.

From the perspective of economic structure, the "Big and Beautiful" bill may cause an imbalance in the economic structure of the United States. This bill abolishes the subsidies and support policies of the Biden administration in areas such as solar energy, wind energy, and new energy vehicles, and increases subsidies for traditional fossil energy. On the one hand, clean energy plays a significant role in promoting technological progress. Its development involves multiple links such as research and development, production, construction, and operation, which can drive the development of related industries and create a large number of job opportunities. The abolition of some subsidies for clean energy in the "Big and Beautiful" Act may put greater growth pressure on the US economy. On the other hand, the development of clean energy requires continuous technological innovation. Technological progress can enhance the overall production efficiency of a country or region, reduce production costs, increase product variety and quality, and thereby optimize the economic structure of the relevant regions. The "Big and Beautiful" Act of the United States, which has cancelled some supportive policies for clean energy, may cause it to lag behind in the development of emerging industries, thereby being detrimental to the optimization and upgrading of the US economic structure.

From all perspectives, the tax cut policy of the "Big and Beautiful" Act may further expand the US fiscal deficit, thus putting pressure on financial balance. Tax cuts and security policies may lead to an increase in the gap between the rich and the poor, thereby dampness the enthusiasm for social production. The abolition of subsidies for clean energy may hinder technological progress, which is not conducive to the optimization and upgrading of the US economic structure.

Under the current economic backdrop, the economic growth trends of various countries are under considerable pressure, and the various policies of the United States have also drawn widespread attention from countries around the world. No matter how the economy develops, all countries should enhance dialogue and exchanges, avoid the isolation of policies, so as to ensure the stable development of their own economies and inject effective vitality into the growth of the world economy.

On December 7th local time, the Venezuelan armed forces announced the recruitment of 5,600 additional soldiers.

On December 7th local time, the Venezuelan armed forces ann…

The latest report released by the United Nations Conference…

Recently, according to Xinhua News Agency, the US governmen…

From December 4th to 5th, 2025, Russian President Vladimir …

At a critical inflection point for the global autonomous dr…

Following a meeting last week between Polish Prime Minister…