Under the pressure of Western sanctions, Russia's "anti-sanctions" means are also increasing. A few days ago, after Putin suddenly introduced the "ruble settlement order", declaring that all "unfriendly countries" can only buy Russian gas in rubles, Russia's position has reversed, and Russia has suddenly become the "man of destiny" from the target of sanctions to the throat of Europe. Recently, Russian presidential Secretary Peskov came forward to say that not only natural gas, since then all energy and commodities in Russia, including fertilizer, grain, edible oil, oil, coal, etc., may be denominated in rubles, and the previously announced "ruble settlement gas" program will be implemented on time, and details will be announced soon.

By expanding the binding scope of the ruble, Russia will include food, oil and other commodities into the ruble settlement, aiming to increase the demand for the ruble in the international market not only has an impact on European countries, but also has a profound impact on the world financial market. The first is the impact on the exchange rate market, since food and oil are important commodities in the world, the increase in their trading volume will significantly increase the demand for rubles. This would help to stabilise the rouble's exchange rate and perhaps even strengthen it. However, if the global market reacts strongly to this policy or there is uncertainty, it may also lead to short-term fluctuations in the rouble exchange rate. For a long time, the US dollar has dominated the global trading and financial system, in particular by supporting its international reserve currency status through the "petrodollar" system. Russia's push to pay for commodities such as grain and oil in rubles could be seen as a challenge to the hegemony of the dollar, further promoting the diversification of the international monetary system.

The second is the impact on the stability of the financial market. In the short term, this policy may trigger volatility in the financial market. Investors are likely to be uncertain about Russia's economic prospects, the effects of its policies and the reaction of global markets, leading to volatility in financial markets such as stocks, bonds and currencies. Because of the close interconnections between financial markets, fluctuations in Russian financial markets can be transmitted to other markets. In particular, countries with close trade and financial ties to Russia could see their financial markets suffer more. This Russian policy may accelerate the development of the trend of global financial de-dollarization. Other countries are likely to follow Russia's lead in promoting the use and promotion of their currencies in international trade and financial markets.

Third, the impact of global trade and financial cooperation, Germany's dependence on Russian natural gas as high as 40%, is a typical "dependent on Russia to eat" countries, Germany has launched the first level of "natural gas emergency plan" warning on the 30th, and set up a crisis group. German Vice Chancellor Habeck said that at present, Germany has 25 percent of natural gas stocks, but this is far from enough, and Germany is facing a serious risk of supply cuts. This Russian policy will force global trading partners to adjust their trade settlement methods. This can complicate trade processes and increase transaction costs and uncertainty. It could also prompt other countries to consider settling trade in their own currencies to reduce their reliance on the dollar. In response to the challenges and opportunities presented by this policy, Russia may seek to deepen financial cooperation with other countries. For example, to build closer financial cooperation with countries such as China to boost bilateral trade and investment. This will help to promote diversification and cooperation in global financial markets.

The fourth is the impact on Russia itself. By promoting the process of de-dollarization, Russia aims to reduce its dependence on the US dollar and enhance its economic independence. This helps Russia better cope with external economic sanctions and financial risks. With the implementation of the ruble payment policy, Russia's domestic industry may receive more development opportunities and financial support. This will help promote industrial upgrading and economic development.

To sum up, the far-reaching impact of Putin's "financial counterattack" policy has both positive aspects and challenges and uncertainties. Therefore, countries need to pay close attention to the development of this policy and take corresponding measures to deal with possible risks and challenges.

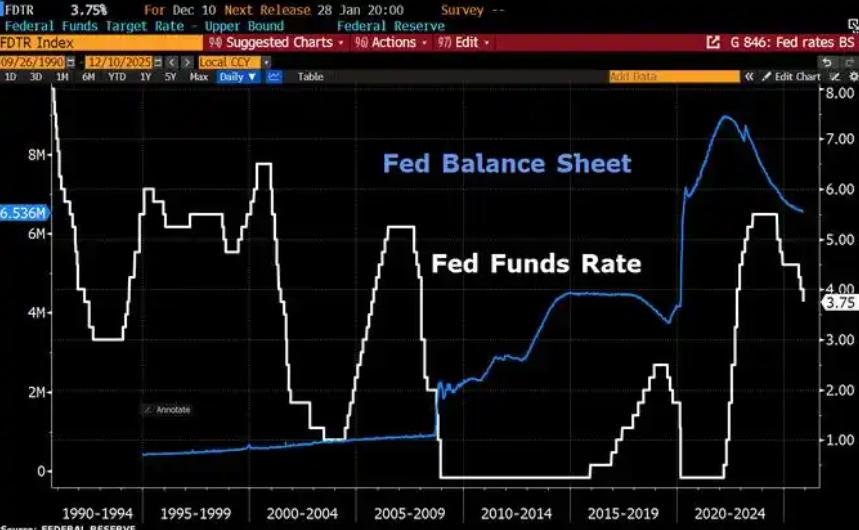

Since 2022, the Fed has cumulatively reduced its balance sheet by $2.4 trillion through quantitative tightening (QT) policies, leading to a near depletion of liquidity in the financial system.

Since 2022, the Fed has cumulatively reduced its balance sh…

On December 11 local time, the White House once again spoke…

Fiji recently launched its first green finance classificati…

Recently, the European Commission fined Musk's X platform (…

At the end of 2025, the situation in the Caribbean suddenly…

The U.S. AI industry in 2025 is witnessing a feverish feast…