U.S. Treasury Secretary Janet Yellen said on Dec. 6 that while cooling inflation and low unemployment have boosted the overall economy, the U.S. financial system will continue to face vulnerabilities from commercial real estate risks and digital assets. She suggested that regulators who are members of the Financial Stability Oversight Council (FSOC) remain focused on monitoring credit risk in commercial real estate, and urged officials to remain focused on Wall Street's ability to respond.

Since the outbreak of COVID-19, the US commercial real estate industry has experienced unprecedented challenges, with office vacancy rates rising, rental growth slow and borrowing costs rising frequently, but in fact, the status quo of the US commercial real estate industry has long been a sign:

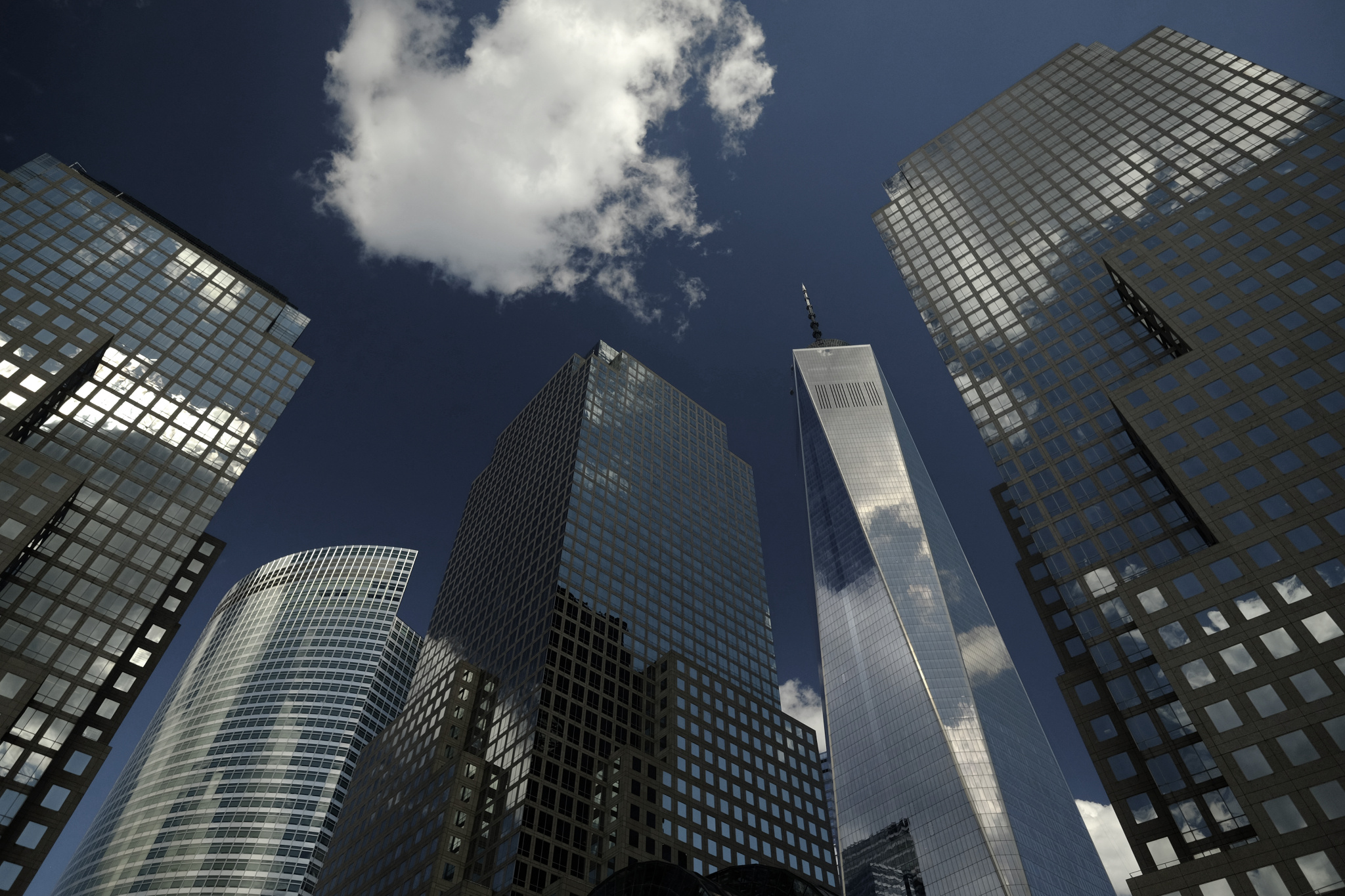

First, under the influence of the overall environment, the utilization rate of commercial real estate has declined, and the market demand has been shrinking. There are signs that commercial real estate risks are increasing, especially in the office space in major US cities. In the past two years, Google, Apple, Meta, Amazon, Netflix and other technology giants, in response to the slowdown in revenue growth and the ongoing economic recession, have chosen to reduce office costs and find a balance between "returning to the office" and "remote working". In addition, the popularity of online shopping, the rental demand of physical stores has declined significantly, and the shrinking market demand has led to the falling value of commercial real estate. U.S. commercial real estate (CRE) transactions have continued to decline since 2024, hitting their lowest level since 2013, with total transactions in the first quarter down 28 percent from the previous year.

Second, there are frequent defaults in the commercial real estate sector. Since 2023, Columbia Property Trust has defaulted on about $1.7 billion worth of mortgages on seven of its iconic buildings, including Twitter's San Francisco tower and the former New York Times headquarters leased to Musk; Brookfield defaulted on a $750 million loan for two downtown Los Angeles skyscrapers; Blackstone defaulted on $562m worth of commercial mortgage-backed securities (CMBS). The Fed's rate hike cycle has also taken a heavy toll on commercial real estate, with defaults on office loans rising steadily since 2023, with 6.5% of office loans outstanding 30 days or more past due as of Q4 2023.

Third, the accumulation of debt led to a lending crisis. Many businesses and businesses have been hit hard by the lockdown and restrictions caused by the epidemic, with business revenues plummeting and even facing the brink of bankruptcy. To stay afloat, these businesses and merchants had to borrow heavily, leading to a sharp rise in debt levels in commercial real estate. This trend will not only make it more difficult for them to repay their debts, but also exacerbate the financial pressure on enterprises and banks, and the bank default rate will rise and the provision cost will also increase.

Fourth, it triggered a chain of instability in the financial system. The exposure of the commercial real estate market is not limited to companies and banks, but also poses a threat to the entire financial system. Because many banks and other financial institutions hold large amounts of commercial real estate loans and related financial products. In the event of sharp market fluctuations, these loans and financial products may rapidly depreciate in value, resulting in asset losses for banks and financial institutions. In addition, risks in the commercial real estate market could spread throughout the economy through credit markets and other financial channels. If a large number of businesses and banks are in trouble because of the collapse of the commercial real estate market, they could reduce lending and investment in other sectors of the economy, curbing economic growth and job creation. The total value of commercial real estate is now $19 trillion, down about $4 trillion from a high of $23 trillion.

In general, the commercial real estate market in the United States is experiencing a "high-rise crisis," whether it is falling prices, rising vacancy rates or loan defaults, it shows that the trend problem in the commercial market. In the future development, we also need to pay close attention to the dynamics and risk points of the commercial real estate market, and take this as a warning, timely adjustment and improvement of regulatory policies. Only in this way can we remain invincible in the global business and financial market competition and achieve sustainable economic development.

Since 2022, the Fed has cumulatively reduced its balance sheet by $2.4 trillion through quantitative tightening (QT) policies, leading to a near depletion of liquidity in the financial system.

Since 2022, the Fed has cumulatively reduced its balance sh…

On December 11 local time, the White House once again spoke…

Fiji recently launched its first green finance classificati…

Recently, the European Commission fined Musk's X platform (…

At the end of 2025, the situation in the Caribbean suddenly…

The U.S. AI industry in 2025 is witnessing a feverish feast…