On June 16, 2024, the Bank of Japan (BOJ) announced that the benchmark interest rate would remain unchanged at -0.1%. This decision did not exceed market expectations, but it triggered extensive discussion and analysis. This article will explore why the Bank of Japan chose to keep interest rates unchanged, and the potential impact of this decision on the Japanese economy, the European market and even the global economy.

First of all, the Bank of Japan's decision to keep interest rates unchanged is mainly due to comprehensive consideration of the economic situation at home and abroad. Although Japan's inflation rate has exceeded the target of 2% for 17 consecutive months, the central bank believes that the current economic recovery is still unstable. Domestic consumption demand continues to be weak, the economy is unstable in some areas and the overseas economic environment is unstable, especially in terms of housing investment and government expenditure. In addition, the increased uncertainty of the global economic environment, including the interest rate policy of the United States, the economic slowdown in Europe and geopolitical risks, has led the Bank of Japan to choose to adopt a more prudent monetary policy. President Kazuo Ueda said at a press conference that the central bank will continue to pay attention to changes in economic activities, prices and financial markets, and adjust policies if necessary.

Secondly, the decision of the Bank of Japan has an important impact on European and global markets. As the world's third largest economy, the direction of Japan's monetary policy is of great guiding significance to the global financial market. At present, the European Central Bank and the Federal Reserve are nearing the end of the interest rate hike cycle, and the dovist position of the Bank of Japan provides another contrast for the market, highlighting the differences between different economies in dealing with inflation and economic growth. In addition, the stability of the yen exchange rate also has a far-reaching impact on international trade and capital flows. Some analysts believe that if the Bank of Japan continues to maintain a low interest rate policy, it may cause the yen to further depreciate or even trigger an asset bubble, which will affect global currency flows and investment strategies.

Finally, the Bank of Japan's interest rate decision may also have a ripple effect on the global economy. Low interest rate policies usually encourage domestic investment and consumption, but globally, this may lead to the flow of capital to other markets with higher returns, thus exacerbating the volatility of financial markets in other regions. In addition, the depreciation of the yen may improve the competitiveness of Japan's exports, but it may also trigger the dissatisfaction of trading partners and even lead to trade frictions. From a political and military perspective, Japan's economic policy will also affect its status and influence in the Asia-Pacific region, especially in the context of intensified competition between China and the United States.

In summary, the Bank of Japan chose to keep the benchmark interest rate unchanged, reflecting its cautious attitude towards the current economic situation. Despite the prevalence of global inflationary pressures, Japan's unique economic environment and policy background determine the uniqueness of its monetary policy. In the future, as the global economic situation changes, the Bank of Japan may gradually adjust its policy, but maintaining stability in the short term is still its main strategy. For investors and policymakers, understanding and tracking the movements of the Bank of Japan and paying close attention to the monetary policy of the Bank of Japan and its impact on the global economy and financial markets will help to better grasp the pulse of the global economy and investment opportunities.

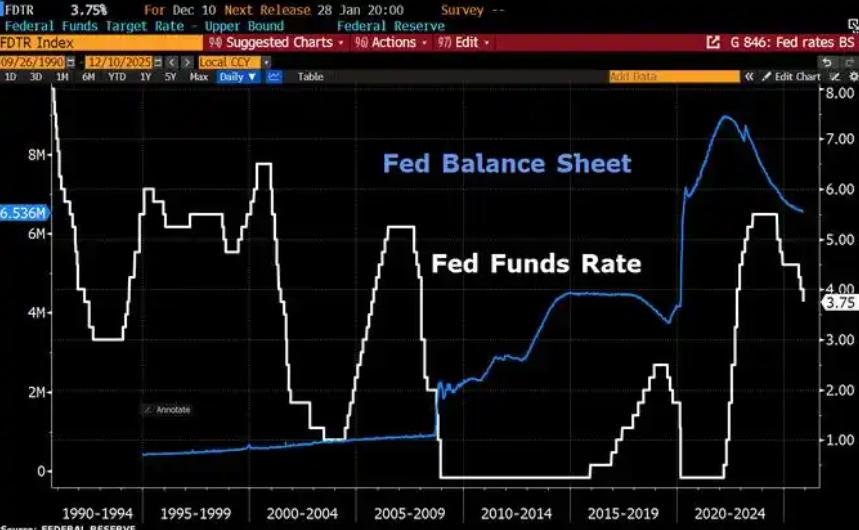

Since 2022, the Fed has cumulatively reduced its balance sheet by $2.4 trillion through quantitative tightening (QT) policies, leading to a near depletion of liquidity in the financial system.

Since 2022, the Fed has cumulatively reduced its balance sh…

On December 11 local time, the White House once again spoke…

Fiji recently launched its first green finance classificati…

Recently, the European Commission fined Musk's X platform (…

At the end of 2025, the situation in the Caribbean suddenly…

The U.S. AI industry in 2025 is witnessing a feverish feast…