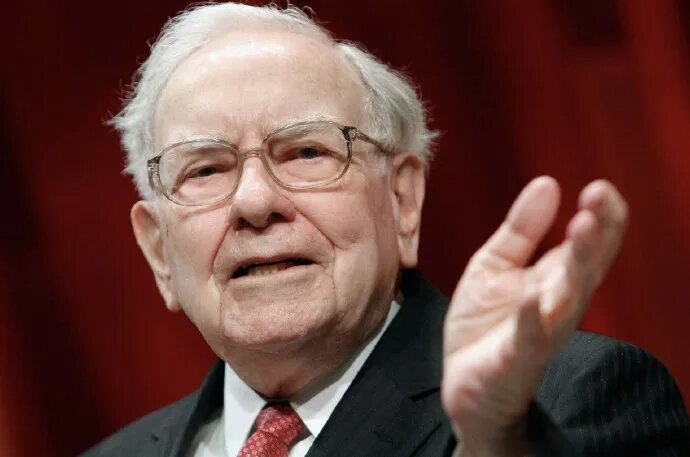

Recently, Buffett's clearance style selling of Apple Inc. stock has caused a stir in the industry. In the investment industry, Buffett's every move has attracted much attention, and the investment decisions of Berkshire Hathaway, which he leads, are regarded by many investors as a barometer of investment. Therefore, when Buffett made the shocking move to sell Apple stocks, people speculated about the underlying reasons and background behind it.

1、 The development trend of Apple Inc. itself

Apple has been a giant in the technology industry for many years, with its iPhone and other products sweeping the globe, bringing huge profits and extremely high market value to the company. But in recent years, Apple has faced some potential development challenges.

From the perspective of product innovation, although Apple still maintains a certain technological advantage, the pace of innovation seems to have slowed down. The breakthroughs in appearance and functionality of each generation update of iPhone are no longer as stunning as before. For example, the upgrades of some new models in terms of cameras, processors, etc. are more gradual improvements on the existing basis rather than disruptive innovations. The market's response to this lack of significant innovation in product iteration is gradually becoming flat, which may affect Apple's future profit growth expectations.

Furthermore, from a macro industry trend perspective, the technology industry is undergoing rapid changes. Emerging technologies such as artificial intelligence and the Internet of Things are reshaping the entire industry landscape. Although Apple is actively expanding into these fields, its development speed and achievements in these emerging areas have not yet demonstrated an absolute advantage compared to some startups or other tech giants that focus on developing emerging technologies. Buffett, as an extremely cautious investor, may be concerned that Apple may not be able to keep up with the pace of future technology waves, which could affect its long-term investment value.

2、 Optimization requirements for investment portfolio

Berkshire Hathaway has a large and diversified investment portfolio, and Buffett needs to continuously optimize and adjust it to achieve stable asset appreciation and risk control.

Apple stocks once held a significant position in Berkshire Hathaway's investment portfolio. However, over time, its weight in the portfolio may have exceeded what Buffett considers reasonable. When a stock has a high proportion in an investment portfolio, it can lead to an excessive concentration of risk on the company's operating conditions and market performance. Even seemingly stable companies like Apple cannot completely avoid various potential risks, such as macroeconomic fluctuations, intensified industry competition, and the impact of technological changes.

3、 Macroeconomic and Market Environment Factors

The current macroeconomic situation and market environment have also had an impact on Buffett's decision. The global economic growth has shown certain volatility in recent years, with factors such as trade frictions and geopolitics constantly disrupting the market. In such an unstable economic environment, investors tend to be more cautious.

For technology stocks, their valuations are usually relatively high and are greatly influenced by market sentiment and expectations. In the context of uncertain economic prospects, the volatility risk of technology stocks will further amplify. As a giant in the technology industry, Apple's stock price is also difficult to stand alone. Buffett may foresee that Apple's stock price may face significant downward pressure in the process of sustained macroeconomic fluctuations, and in order to avoid a decline in asset value, he chooses to liquidate and sell in advance.

4、 The Evolution of Buffett's Investment Philosophy

Buffett's investment philosophy is not static, but constantly evolving with the development of the times and changes in the market.

In the early days, Buffett mainly focused on investing in traditional enterprises with stable cash flow, strong brands, and high moats, such as consumer companies like Coca Cola. With the development of the times, he gradually ventured into the field of technology, and Apple was an important attempt for him to invest in technology stocks. However, after a period of holding and observation, Buffett may find that the investment logic in the technology industry differs significantly from that of traditional industries.

In short, Buffett's clearance style selling of Apple stocks is not a simple decision, but a comprehensive consideration of multiple factors such as the company's own development trend, investment portfolio optimization needs, macroeconomic and market environment, and the evolution of its own investment philosophy. This incident once again reminds investors that even investment masters like Buffett need to constantly adjust their investment strategies to adapt to the ever-changing market situation.

The South Korean political arena has once again been embroiled in a public controversy over a judicial investigation that has shaken the entire nation.

The South Korean political arena has once again been embroi…

On the morning of December 29th local time, the precious me…

According to the US media Barchart, recently, the fluctuati…

On December 29th, Mar-a-Lago in Florida, USA, witnessed a h…

SoftBank Group announced on Monday that it has agreed to ac…

Recently, the US State Department issued a visa ban, adding…