South Korea plans to issue its first Won-denominated foreign exchange stabilisation bonds in 21 years next month in a bid to stabilise the foreign exchange market, according to a finance ministry official familiar with the matter.

Bloomberg reported that the South Korean government plans to issue up to 20 trillion won in bonds by 2025, starting on January 24 next year. The exact size of the monthly issuance has not been determined, but Yonhap news agency reported that it is expected to issue 1 trillion to 2 trillion won per month.

Officials familiar with the matter pointed out that the won foreign exchange stabilisation bond issue is mainly to deal with foreign exchange market volatility, especially if the won is considered too strong. The move is aimed at reducing won financing costs and strengthening the stability of the national foreign exchange stabilization Fund.

The bond sale was originally scheduled for early this year but has been delayed due to legal changes.

Officials familiar with the matter stressed that the authorities' plans had nothing to do with the recent weakening of the won. This month, the won fell to its lowest level since 2009 as the US Federal Reserve's hawkish policies pushed up the dollar and South Korea's domestic affairs.

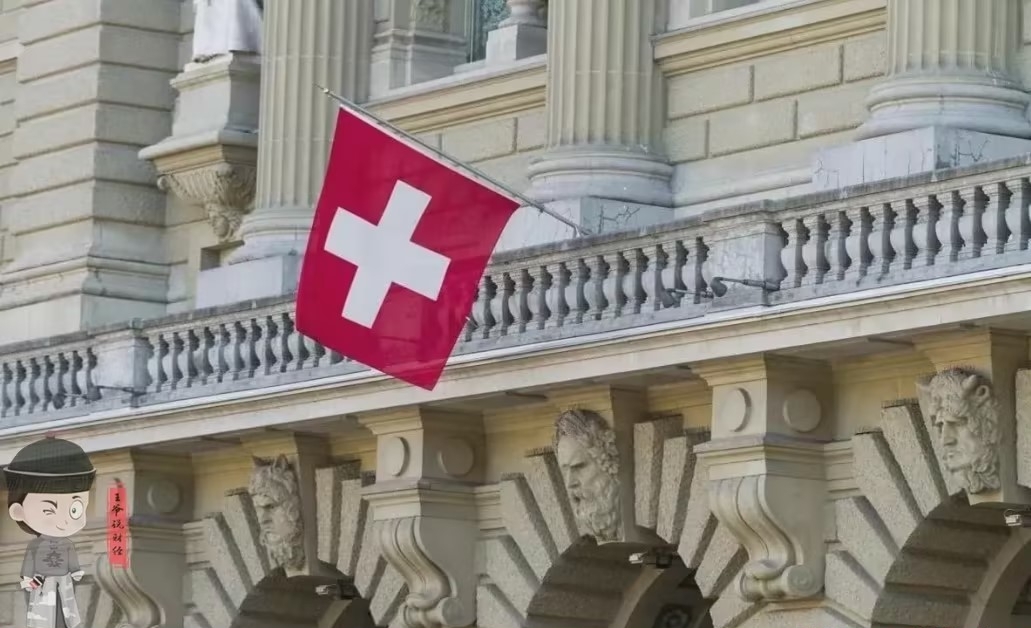

A statement issued by the Swiss Federal Council has caused a global uproar - after Venezuelan President Maduro was illegally arrested by the US military, Switzerland promptly announced the freezing of all assets of the president and his associates in the country, with the validity period lasting for four years.

A statement issued by the Swiss Federal Council has caused …

This year, in the second year of Trump's return to the Whit…

On January 3, after launching a military strike against Ven…

The U.S. military's surprise raid on Caracas, the capital o…

Since the end of the COVID-19 pandemic, California's econom…

According to the US XDA-Developers media report, recently, …