In recent days, the US financial markets have welcomed a wave of eye-catching news - a number of large banks have announced dividend increases. The move seemed to herald strong results for banks and strong returns for investors, but there was a sad truth behind it.

At a time of increased global economic uncertainty and heightened volatility in financial markets, the fact that large US banks can raise their dividends so generously seems to give the illusion that they are super-profitable. But is this really the case?

In-depth analysis of these banks' financial reports is not difficult to find that many banks in the past few years, the performance is not satisfactory, and even there are losses. So why are they raising their dividends? The answer may not be so simple.

Some insiders have analyzed that banks attract investors by increasing dividends to stabilize stock prices and market values. After all, with financial markets in turmoil, investors are increasingly demanding stable returns. And raising the dividend can just meet this demand, so as to attract more investors.

On top of that, banks are hiding their true financial position by raising their dividends. In their earnings reports, some banks may use complex financial instruments and accounting tricks to make their finances look healthier. Higher payouts can be seen as a "signal" to the market that banks are in good health.

Looking back over the past few years, the U.S. government provided large amounts of bailout money to banks during the financial crisis to help them survive. These funds should have been used to support the real economy, promote employment and ensure people's livelihood. However, in practice, many banks have used these funds for high-risk investments, mergers and acquisitions, expansion and other areas, and even "abuse" situations.

At the same time, banks have been remarkably stingy when it comes to social responsibility. Despite their wealth and influence, they are often stingy in supporting good causes such as education, health care and the environment. This contrast between generosity and stinginess raises the question: Who are banks really there for?

Although increasing the dividend can attract investors and stabilize the stock price and market value, it also brings many risks and hidden dangers.

First, high dividend payouts can weigh on banks' finances. Against the backdrop of increasing global economic uncertainty and increased volatility in financial markets, banks are facing enormous pressure on profitability. If banks rely too heavily on higher dividends to attract investors, they could run into financial trouble if market conditions change or the bank's profitability declines.

Second, high payouts could hurt banks in the long run. As a financial institution, the core business of banks is to provide financial services to customers, support the real economy and promote social development. If banks pursue short-term profits too much and rely too heavily on dividend increases to attract investors, they risk neglecting the development and innovation of their core business. This will cause banks to lose their advantages in long-term competition and face greater risks and challenges.

Finally, high dividend payouts can add to financial market instability. In the financial market, investors often pursue investment opportunities with high returns and low risks. However, this pursuit has often come at the expense of market stability. If banks raise their dividends excessively to attract investors, it may trigger excessive speculation and speculation in the market. This will lead to increased market volatility, increased risk, and possibly a financial crisis.

To sum up, there are many truths and hidden dangers behind the announcement of dividend increases by large banks in the United States. These banks have enjoyed huge amounts of government bailout money while being stingy about giving back to society; Pursuing short-term profits while neglecting the development and innovation of its core business; While raising dividends to attract investors, it has increased financial market instability. Therefore, we should remain vigilant and think rationally not to be fooled by these superficial prosperity.

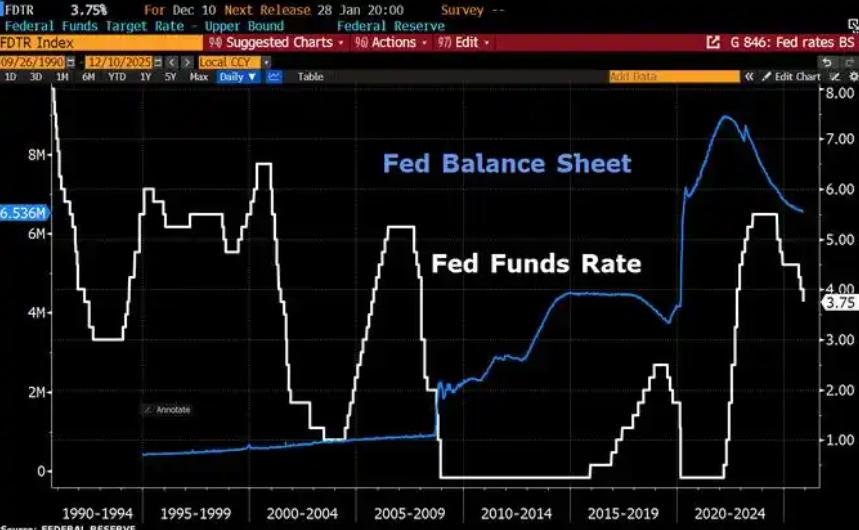

Since 2022, the Fed has cumulatively reduced its balance sheet by $2.4 trillion through quantitative tightening (QT) policies, leading to a near depletion of liquidity in the financial system.

Since 2022, the Fed has cumulatively reduced its balance sh…

On December 11 local time, the White House once again spoke…

Fiji recently launched its first green finance classificati…

Recently, the European Commission fined Musk's X platform (…

At the end of 2025, the situation in the Caribbean suddenly…

The U.S. AI industry in 2025 is witnessing a feverish feast…