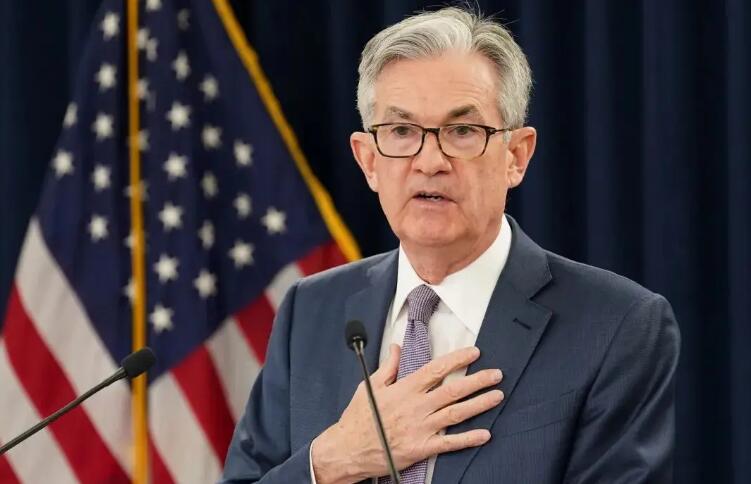

Recently, Federal Reserve Chairman Powell has clearly released strong signals of interest rate cuts in multiple speeches, bringing new expectations and uncertainties to global financial markets, especially the stock market. This policy adjustment expectation not only affects the domestic market in the United States, but also has a profound impact on the future development of the global economy, especially emerging markets.

At the annual global central bank economic policy seminar held in Jackson Hole, Wyoming, Federal Reserve Chairman Powell made it clear that the time for policy adjustment has arrived and hinted that the Fed will consider interest rate cuts in the future, especially at the upcoming September monetary policy meeting. He pointed out that although inflation remains a global challenge, the Federal Reserve has seen a significant easing of inflationary pressures and the labor market is beginning to show signs of slowing down. Therefore, he believes it is time to adjust monetary policy to better support economic growth and the job market.

It is worth mentioning that in recent years, in response to sustained high inflation, the Federal Reserve has taken multiple measures to raise interest rates, pushing the federal funds rate to historical highs. However, with the release of a series of economic data, particularly the sustained decline in inflation rates and the slowdown in the labor market, the Federal Reserve has begun to reassess its monetary policy stance. Currently, the inflation rate in the United States has significantly fallen, approaching the 2% target set by the Federal Reserve, and although the unemployment rate has increased, it reflects more of a normal adjustment in the labor market rather than a sign of economic recession. These changes provide a solid foundation for the Federal Reserve to cut interest rates.

In addition, interest rate cuts usually mean a reduction in the cost of capital, which will directly benefit the stock market, especially growth stocks such as technology and consumer stocks. Lower financing costs will encourage companies to increase investment, promote economic growth, and ultimately enhance story performance. After Powell's speech, all three major US stock indices rose significantly, with technology stocks performing particularly well. Technology stocks in the Hong Kong stock market have also shown strong rebound momentum, indicating a rebound in market sentiment.

In addition to directly affecting the capital cost of the stock market, interest rate cuts may also indirectly boost the stock market by stimulating consumption and investment. In a low interest rate environment, consumers' borrowing costs decrease, which may increase consumer spending and drive business profit growth. At the same time, interest rate cuts also help to increase the activity of the real estate market, promote real estate transactions and construction activities, and further promote economic growth.

Faced with Powell's implied expectation of interest rate cuts and the possibility of new opportunities in the stock market, investors should maintain a rational and cautious attitude. On the one hand, it is necessary to closely monitor the policy movements of the Federal Reserve and the release of economic data in order to timely grasp the pulse of the market. On the other hand, it is necessary to allocate a reasonable portfolio of funds based on one's risk tolerance and investment goals. When selecting stocks, it is important to pay attention to factors such as the fundamental situation of the enterprise, industry prospects, and market competitiveness, in order to avoid blindly following the trend or chasing gains and losses.

In summary, Powell's suggestion to cut interest rates undoubtedly brings new development opportunities for the stock market. However, investors should also maintain a cautious attitude and be fully prepared while enjoying this opportunity. By closely monitoring market dynamics and allocating asset portfolios reasonably, investment risks can be reduced and stable returns can be obtained. Therefore, investors should carefully examine the company's fundamentals and focus on the financial performance of individual stocks when laying out, rather than relying solely on short-term market fluctuations.

Due to the continuous decrease in rainfall and the rapid drop in groundwater levels, several large sinkholes have successively appeared in several agricultural areas in central Turkey in recent years, causing great concern among local farmers and environmental experts.

Due to the continuous decrease in rainfall and the rapid dr…

The Prime Minister's Office of Israel said Hamas attacked I…

Fourteen countries including the United Kingdom, France and…

The US Department of Justice said on Wednesday (December 24…

The Japanese government has submitted a draft, planning to …

On December 25th local time, NVIDIA announced a technology …