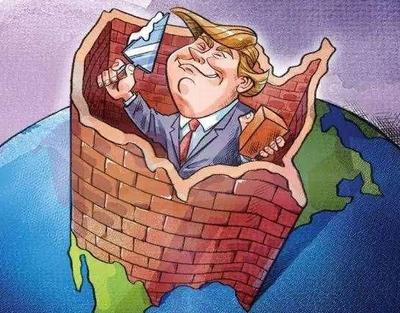

Recently, the US government has once again raised tariffs on some Chinese goods, which has caused waves in the global economy, and its impact is broad and far-reaching from the perspective of financial professionals.

In the stock market, the US tariff increase policy is like a heavy hammer, which has had a serious impact on the share prices of relevant companies. Sino-us trade related enterprises bear the brunt, and US importers' profit margins have been greatly compressed due to the increase in tariff costs, which is directly reflected in the decline in their stock valuations. Chinese exporters to the United States are also facing difficulties, as expectations of lower orders dim their future earnings prospects, eroding investor confidence and sending share prices tumbling. For example, some US manufacturing companies that rely on Chinese raw materials or components have seen their share prices continue to fall due to rising supply chain costs. The stock prices of listed companies in China's traditional export industries to the United States, such as textiles and electronics, also fell sharply after the news.

From the macro level, the volatility of the entire stock market has increased significantly, market panic has spread, investors' demand for hedging has risen sharply, and funds have flowed from high-risk stock assets to relatively safe fixed income assets such as bonds, resulting in capital outflow in the stock market, affecting the overall activity and stability of the market, and dragging down the performance of the US and even the global stock market.

The bond market has also been affected by higher U.S. tariffs. On the one hand, as trade tensions increase market uncertainty and investors seek safety, a large amount of money pours into the US Treasury market, pushing Treasury prices up and yields down. But the recent situation has been abnormal, the price of US Treasury bonds fell, the yield rose sharply, this unnatural phenomenon triggered the market on the US Treasury market "crash" fears. Us tariffs have disrupted the global economic order and undermined investor confidence in US Treasuries as a traditional safe haven asset. On the other hand, due to the rising business risk, the credit rating of American enterprises faces downward pressure, and the risk premium of corporate bonds increases, resulting in the increase in the financing cost of corporate bonds. For those enterprises that rely on bond financing to expand or maintain operations, this undoubtedly increases the financial burden and limits the investment and development of enterprises, which in turn affects the growth of the real economy.

Currency markets are not immune either. The US tariff policy has triggered market concerns about US dollar assets, and the US dollar exchange rate has fluctuated sharply. On the one hand, the tariff policy may lead to the further deterioration of the US trade deficit, weakening the fundamental support of the dollar; On the other hand, the market's pessimistic expectations about the prospects of economic growth in the United States make investors sell dollar assets, resulting in increased depreciation pressure on the dollar. As for the RMB exchange rate, despite certain external shocks, China has huge foreign exchange reserves, sound economic fundamentals and effective macro-control policies, which can stabilize the RMB exchange rate to a certain extent. At the same time, the advancement of the internationalization process of RMB has also gradually enhanced the status of RMB in the international monetary system, and enhanced its resilience to external shocks.

From the perspective of international capital flows, the US tariff policy has led to changes in the pattern of global capital flows. International capital that originally flowed to the United States hesitated or even withdrew due to increased uncertainty about trade policy. Emerging market countries, due to the risk of global economic slowdown caused by the US tariff policy, face capital outflow pressure and the risk of currency depreciation is intensified. For example, some emerging economies that are highly dependent on exports to the United States, such as Vietnam and South Korea, have seen their currency exchange rates suffer greatly under the fluctuations of the US dollar and trade tensions. By actively promoting the "Belt and Road" Initiative and strengthening economic cooperation with countries along the route, China has provided new investment opportunities and channels for international capital, alleviated capital outflow pressure to a certain extent, and attracted some international capital inflows seeking diversified investment.

The US policy of raising tariffs on some Chinese goods has triggered a series of ripple effects in the financial sector, from the stock market and bond market to the foreign exchange market, from corporate finance to international capital flows. This policy not only undermines the stability of the US financial market, but also poses serious challenges to the smooth operation of the global financial system. China and the United States are important forces in the global economic and financial field. Resolving trade disputes through dialogue and cooperation is the key to stabilizing the financial market and promoting the healthy development of the global economy.

According to a recent report by Rich Asplund, a columnist for Barchart, the global sugar market is currently experiencing a complex and profound supply-demand game.

According to a recent report by Rich Asplund, a columnist f…

On January 13th local time, the three major US stock indice…

Recently, the 2026 edition of the MIT Technology Review lis…

On January 15, 2026, the US military announced the seizure …

At the 2026 J.P. Morgan Healthcare Conference, a joint anno…

For much of 2025, the market was rethinking whether the dol…