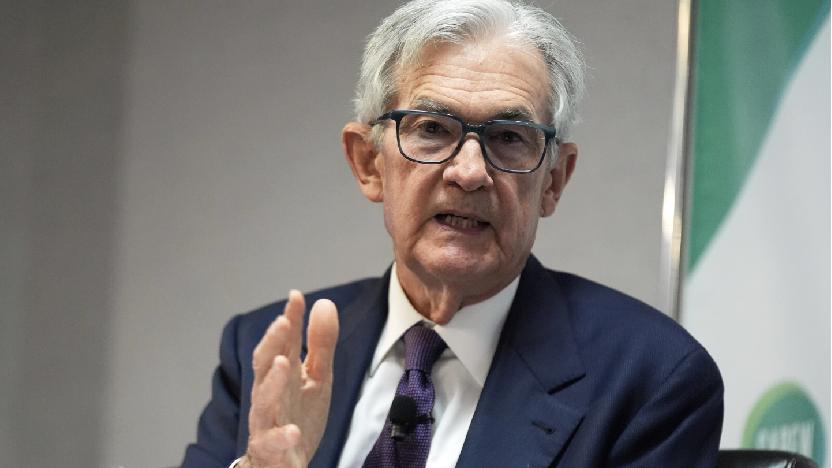

Federal Reserve Chairman Jerome Powell said in a speech on Wednesday that the central bank may face a dilemma between controlling inflation and supporting economic growth. Amid increasing uncertainty about the impact of President Donald Trump's tariffs, the central bank leader stated that although he expects inflation to rise and growth to decline, it is currently unclear where the Federal Reserve needs to focus more attention.

Since President Donald Trump announced comprehensive tariffs on April 2nd, financial markets have fluctuated sharply, with most tariffs being put on hold a week later, sparking speculation about whether the Federal Reserve will soon lower key interest rates or take other measures to appease investors. However, economists said that unless the US treasury bond bond market collapses or other failures occur, the Federal Reserve is unlikely to intervene.

The task of the Federal Reserve is to ensure price stability and full employment, and some economists, including the Fed, believe that tariffs pose a threat to both goals. Tariffs are essentially taxes levied on imported goods, although their direct link to inflation has not been stable throughout history.

Powell stated in his speech on Wednesday that the Federal Reserve can remain patient and wait for the Trump administration's tariffs and other economic policies to be implemented before making any changes to interest rates. Powell and many Fed officials have previously hinted that they are more concerned about tariffs pushing up inflation than their potential impact on economic growth. This means that even if the economy weakens, the Federal Reserve may maintain high interest rates to combat inflation. In the case of high inflation, the Federal Reserve will maintain interest rate stability and even raise interest rates to curb demand. In the case of slow economic growth, the Federal Reserve may be persuaded to lower interest rates. Powell emphasized the importance of controlling inflation expectations.

Powell stated that the inflation caused by tariffs may be temporary, but it could also be more persistent, echoing concerns expressed by most members of the Federal Reserve's 19 member interest rate setting committee in last month's meeting minutes. However, some disagreements have emerged within the Federal Reserve's interest rate setting committee. Federal Reserve Governor Christopher Waller said he expects the impact to be temporary even if tariffs are significantly increased, even if they are retained for a few years. At the same time, he also expects such large tariffs to drag down the economy and even threaten an economic recession. Waller said that if the economy slows sharply, even if inflation remains high, he would support "earlier and greater" interest rate cuts. But other Federal Reserve officials have stated that they are more concerned about the impact of high tariffs on inflation, which means they are unlikely to support interest rate cuts in the short term.

Currently, recent reports indicate that the economy is in a stable state. The recruitment situation is stable, and inflation cooled down in March. However, there has been a significant decline in consumer and business confidence indicators, which has raised concerns among economists about the potential weakening of spending and business investment.

Powell's speech released a strong hawkish signal, as he sees tariff policies as a "key uncertainty" facing the US economy. Under the dual impact of rising inflation and slowing economic growth, it may force the Federal Reserve to make difficult trade-offs between policy objectives. The core logic of this speech revolves around the priority of preventing inflation from getting out of control, and regards the risk of stagflation caused by tariffs as the core variable of policy adjustment. The market needs to adapt to the Federal Reserve's "wait-and-see first" stance, while also being wary of the tail risks of "maintaining high interest rates for a longer period of time".

The European Commission released a package of measures for the automotive industry on Tuesday (December 16th), proposing to relax the requirements related to the "ban on the sale of fuel vehicles" by 2035.

The European Commission released a package of measures for …

Venezuela's Vice President and Oil Minister Rodriguez said …

On December 16 local time, the Ministry of Space Science Ex…

Recently, a highly anticipated phone call between the defen…

Right now, the world's major central banks are standing at …

Recently, according to Xinhua News Agency, the news of a tr…