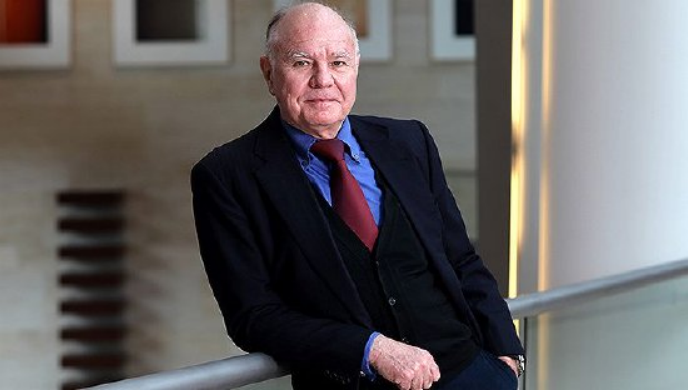

Faber, a prominent investor and economist, warned in a recent interview that the dollar's dominance is now in jeopardy.

"I think over time - not tomorrow, but over time - the dollar is going to be a worthless currency," he said in an interview with Stanbury Research.

Mr Faber is highly critical of the Fed. "The Fed is just like any other government agency, just like any other politician and government official, they lie," he said. They never tell the truth. They tell the public what the public needs to hear. They can't afford a 50% drop in the stock market. So they print money."

Faber argued that rather than having one global currency, it would be better to have a number of different currencies in the world, where countries could trade freely using their own currencies.

"In other words, when China trades with Saudi Arabia or China trades with Brazil or China trades with Russia, there is no need to trade in dollars." It should be denominated in Saudi riyals or yuan, "he said, adding that it would be best for the world if the dollar system was" gradually phased out."

Given Faber's dire warnings about the dollar, it is not surprising that he wants investors to look beyond the US.

But this is not just a country problem. "My view is that because inflation is going to reaccelerate in the future, investors should put their money in places other than the dollar, and that includes close U.S. Allies and dependencies or provinces, namely Canada, Australia, the United Kingdom and New Zealand, which are all 'awakened' countries within the U.S. empire," he said.

For investors looking for opportunities, Faber noted that some Chinese stocks are cheap and that you can also find "very cheap stocks" in Latin America.

American democracy is Doomed to fail

Faber, known as "Dr. Doom," has never been shy about his bearish views on the economy and markets. But this time, he is questioning America's supposed democracy itself.

He said the two leading candidates for the 2024 election are Trump and Biden. This must be a complete indictment of democracy."

"I have serious doubts about democracy. This is a system that will die, and we will have totalitarian rule again, or through family tradition, in other words, aristocracy or royalty or money royalty, elites, whatever it is, and democracy is doomed to fail."

A "relatively safe" portfolio

Given that Faber is the publisher of the Boom and Bust Report investment newsletter, one might expect him to be very focused on safe-haven assets such as gold.

Indeed, while Faber invests in gold, his portfolio is diversified.

In an interview earlier this year, Faber revealed that his portfolio is 25% stocks, 25% real estate, 25% cash and bonds, and 25% gold.

"It's not an ideal portfolio, but it's relatively safe," he said at the time.

Faber also warned investors that it was no longer safe to keep their money in banks because "banks are no longer safe" and "currency inflation is very high."

Faber's portfolio is tailor-made to fight inflation. Unlike fiat currencies, where central banks can print money without limit, gold is inherently scarce and a valuable defense against inflation.

Property is another popular inflation-proof asset. As raw materials and labor prices rise, it becomes more expensive to build new properties. This helps the value of existing properties to appreciate.

On October 16th local time, it was reported that a Boeing 737 MAX 8 flight of United Airlines from Denver to Los Angeles had its windshield break during the flight.

On October 16th local time, it was reported that a Boeing 7…

The World Economic Outlook Report released by the Internati…

The recently held G20 Finance Ministers and Central Bank Go…

According to recent reports by The Guardian and Reuters, th…

Recently, according to Japanese media reports, bear attacks…

In June 2025, a massive wave of protests swept across the U…