On January 31, local time, the Federal Reserve decided to maintain the target range of the federal funds rate at 5.25% to 5.5% in its first monetary policy meeting this year. And before this, the market is widely believed that the Federal Reserve's interest rate cut door is about to open, this decision undoubtedly let the market put down the heart again hung up, this is no problem is to the market on the upcoming interest rate cut expectations poured a basin of cold water!

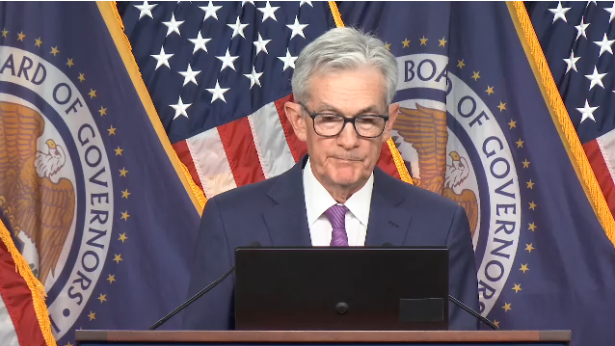

The meeting marked the fourth consecutive time since September 2023 that the Fed has decided to pause rate hikes. While the Fed had been widely expected to start cutting rates, the latest statement removed language about possible future rate increases, indicating a shift in policy stance and making a rate cut unlikely in the near term. Federal Reserve Chairman Jerome Powell further stressed that the Fed needs to see more evidence of a sustained decline in inflation before deciding to cut interest rates.

Powell made clear in his press conference that based on current conditions, the committee is unlikely to cut rates at its March meeting. He stressed that this is not the most likely scenario or so-called base case forecast. The comments sharply dampened expectations of a possible rate cut in March, sending the three major U.S. stock indexes sharply lower and the yield on the 10-year U.S. Treasury note below 4%.

The market interpretation of the interest rate meeting is generally hawkish, mainly because Powell "poured cold water" on the rate cut in March. At present, the Federal Reserve is expected to start cutting interest rates until the second half of the year, mainly because the employment and economic recovery performance is still strong, inflation continues to be high, especially the rental service prices are sticky, the Federal Reserve needs to continue to maintain a higher restrictive interest rate level.

The Bank of America commented that whether it is from the Federal Reserve revised the meeting statement or Powell's post-meeting press conference, it can be seen that the Federal Reserve is preparing for interest rate cuts, but it does not want to let the market run too much, so it is constantly giving the expectation of interest rate cuts in March.

Industry analysts believe that inflation has continued to decline since it peaked in June 2022, and the market is generally optimistic about inflation returning to the 2% level, but the Federal Reserve has indicated that interest rate cuts need to be patient. Or because the lessons of the 1970s resurgence of inflation are still too deep, the Fed needs to see solid evidence of weak demand before it is confident that inflation is moving in a sustainable direction of 2 per cent. This would first require evidence of a slowdown in nominal wage growth, putting pressure on consumer spending. According to government data last week, U.S. GDP grew at a 3.3 percent pace in the fourth quarter, showing considerable resilience.

The Fed chose to "stay put" this time, perhaps in order to manage market expectations, the recent release of major economic data has also increased the Fed and the market's confidence. However, for other economies, there is still a need to be wary of the possible negative impact of a US recession and financial risks.

The Fed's desire to avoid the risk of reigniting inflation by cutting rates too soon also reflects the Fed's cautious approach to current economic conditions. The shift in the Fed's policy stance and Powell's speech are a clear signal to investors who expect the Fed to cut interest rates to stimulate the economy, suggesting that the Fed remains cautious on inflation control and is not ready to ease monetary policy in the short term.

From historical experience, the Fed rate cut cycle and economic recession often occur together, especially after a short period of time to significantly increase interest rates after the rate cut, without exception, there is a recession. In the less optimistic forecast for the U.S. economy, it needs to be reminded that for other economies, it is still necessary to be vigilant about the possible negative impact of the U.S. recession and financial risks.

According to a recent report by Rich Asplund, a columnist for Barchart, the global sugar market is currently experiencing a complex and profound supply-demand game.

According to a recent report by Rich Asplund, a columnist f…

On January 13th local time, the three major US stock indice…

Recently, the 2026 edition of the MIT Technology Review lis…

On January 15, 2026, the US military announced the seizure …

At the 2026 J.P. Morgan Healthcare Conference, a joint anno…

For much of 2025, the market was rethinking whether the dol…