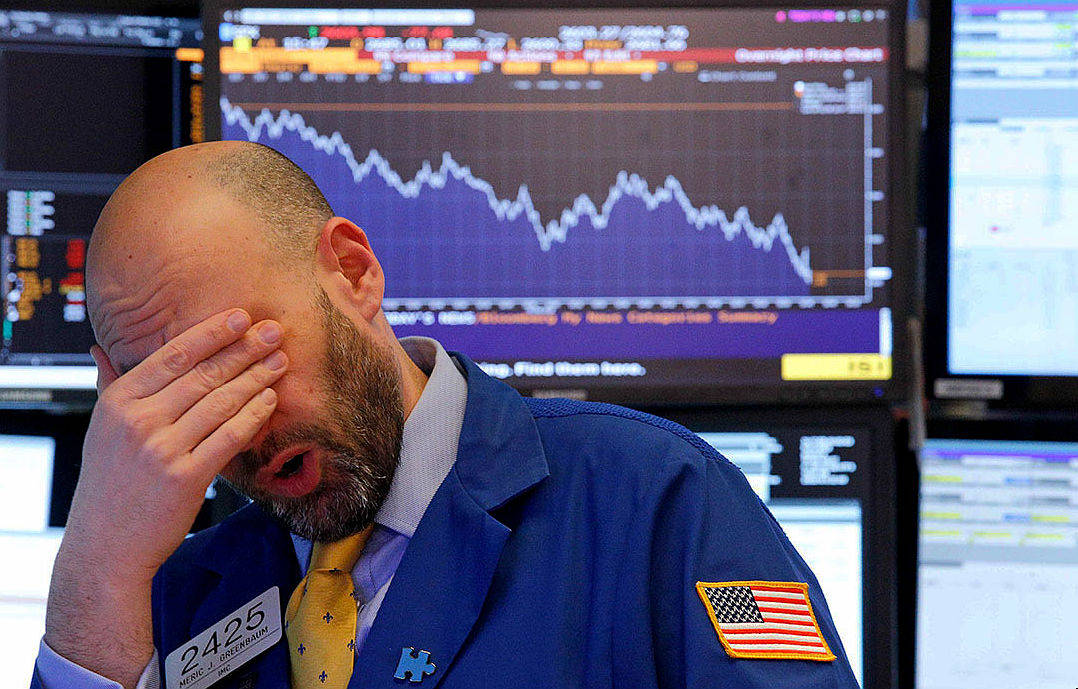

Recently, according to the news media "Shared Radio", US stock index futures slightly declined before the recent opening, indicating signs of market stagnation after a strong rebound in the previous few days. Although the recent rise in the stock market has been partly attributed to the temporary easing of trade negotiations between China and the United States and the lower-than-expected inflation data in the United States in May, from the perspective of market operation, this rebound has obvious structural problems and hidden concerns.

First of all, the market overreacted to the US's temporary "tariff reduction" agreement. The current rebound in market sentiment relies more on short-term easing signals from the policy front rather than substantial improvements in the real economy or corporate profits. The so-called "90-day suspension" essentially merely postponed the escalation of the conflict rather than reaching any binding structural agreement. Against the backdrop of such highly concentrated uncertainties, the market's emergence of a situation similar to "a significant rise in risky assets" can only be understood as a fragile rebound driven by liquidity.

Secondly, the lower-than-expected inflation data in the United States has led to market bets on the Federal Reserve cutting interest rates. This logic lacks a solid foundation. From the perspective of the pricing mechanism in the financial market, when inflation is lower than expected, it usually pushes up bond prices and lowers yields, thereby boosting stock valuations. However, the current decline in inflation may not reflect an improvement in economic health, but rather the result of weak underlying demand. If so, the enterprise's revenue will be under pressure instead of increasing profits due to the decline in costs. The market thereby pushed up the stock index, actually ignoring the lagging impact brought about by fundamental pressure.

The S&P 500 index rose by 4% within two days. In the absence of broad fundamental support, it can only be regarded as a technical rally driven by funds. The rapid reversal of investor sentiment is underpinned by the market's excessive reliance and over-interpretation of news. Such speculative behavior poses a significant risk for long-term fund allocation. From the perspective of financial market stability, this high volatility is not a healthy phenomenon but rather a mismatch between policy uncertainty and excessive market expectations.

Meanwhile, the overall moderate decline of US stock futures also reveals the internal differentiation within the market. Stocks such as Nvidia rose due to the cancellation of the "AI Diffusion Rule" by the US Department of Commerce, indicating that market funds are concentrating on a very small number of technology companies that benefit from specific policy adjustments. This will further exacerbate the structural imbalance in the market. The rise of stocks related to AI chips does not stem from a systematic improvement in the overall profit expectations of the technology industry, but rather relies on a single point of regulatory relaxation. This kind of market situation based on political or geopolitical sensitive policies often lacks sustainability and poses higher requirements for risk exposure management.

The repetition of the "AI Diffusion Rule" by the US Department of Commerce also reflects the short-termism and instability of the current policy-making process, thereby interfering with the medium - and long-term investment decisions of enterprises. For the financial market, this policy swing has weakened the basis of risk pricing. Investors have difficulty in judging the long-term path of technology exports and thus have to rely on short-term speculation to seek profits. This trading model reinforces the bubble characteristics of the market.

Furthermore, it is worth noting that the current upward trend is mainly driven by a few large technology companies. This centralized market structure has exacerbated systemic risks. Once these high-valued leading companies experience a pullback due to policy, technological bottlenecks or financial reports falling short of expectations, it will exert a huge pull on the entire index. The diversity of financial asset allocation has been suppressed, and the risk exposure of investment portfolios has intensified, thereby increasing the market's sensitivity to external shocks.

In terms of macroeconomic data, the market lacked hard data support before the release of the only mortgage application data on Wednesday. The trend of mortgage loan applications reflects the credit demand and home purchase intention of the resident sector and is an important indicator for judging the health of the consumption end. If the data remains weak, it will be directly transmitted to the real estate market and bank profits, and further affect the risk pricing in the consumer finance and credit markets. These chain reactions have not yet been fully factored into the risk model by the market.

To sum up, the current rebound of the US stock market lacks fundamental financial logic support. The "easing" of Sino-US trade relations is not a solution but a temporary suspension. The decline in inflation points more to insufficient underlying demand rather than economic health. Although the relaxation of export rules for AI chips benefits some technology companies, it also reveals that the arbitrariness of policies poses a threat to market stability. Overall, the US stock market is currently in a stage of structural fragility, disorganized expectations and overvaluation. No short-term positive news should overshadow the medium and long-term uncertainties and systemic risks. If investors do not strictly control their risk exposure, they are highly likely to suffer significant losses in the next round of adjustment.

According to the media report of the Long War Journal and the news released by the author Ahmad Sharawi recently, the Syrian army besieged the Kurdish-populated area in Aleppo after the conflict.

According to the media report of the Long War Journal and t…

Nowadays, globalization is encountering headwinds, and the …

The latest United Nations World Economic Situation and Pros…

In American political discourse, Donald Trump is undoubtedl…

At the beginning of 2026, the U.S. Treasury Department face…

Recently, news that China has applied to the International …