The dividend of post pandemic fiscal expansion in the United States has reached its end in the election year, coupled with the near depletion of excess savings by residents, the cooling of consumption will constrain the growth of the US economy; But the manufacturing cycle in the United States is expected to start next year, and the return of manufacturing will become the core clue to support a soft landing of the US economy and avoid recession.

There is a risk of an upward trend in the long-term inflation center. In the past 20 years, China has been a stabilizer of import prices for the United States. However, as US imports shift towards ASEAN and North America, there is a risk of rising import prices in the future. Coupled with structural factors such as aging population and energy transition, it is difficult for inflation readings to fall back to the target range of 2% in 2024.

The timing of interest rate cuts is set later. In past monetary policy cycles, once there were significant signs of economic recession, interest rate cuts were generally triggered. From the perspective of an economic soft landing and the rise of the inflation center, the start of interest rate cuts next year is still subject to strong constraints. In terms of political pressure, Biden publicly supports the demand for wage increases for automotive workers in order to maximize campaign benefits. His political demands for blue collar voters are "phased" higher than his demands for a low interest rate environment.

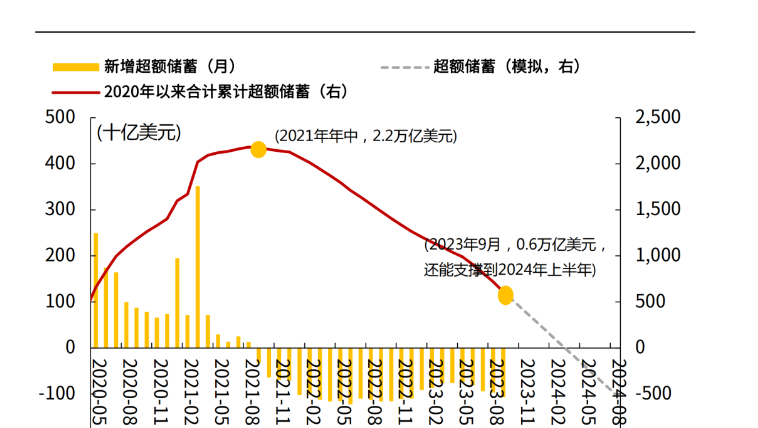

In history, it has often been difficult to achieve fiscal easing in election years, and the clue of post pandemic fiscal expansion dividends has reached its end. At the same time, the excess savings of residents in the first half of next year may be depleted, and the cooling of consumption will constrain the growth of the US economy. It is expected that the excess savings of residents in the first half of next year will be depleted. In addition, the supply and demand gap in the US labor market has narrowed, income growth has gradually declined, and the cooling rate of consumption will further accelerate,

As of September 2023, American households still have $0.61 trillion in excess savings. According to the previous decline rate, it is expected to be consumed in the first half of 2024. As the scale of savings continues to decline, the support of excess savings for consumption will continue to weaken.

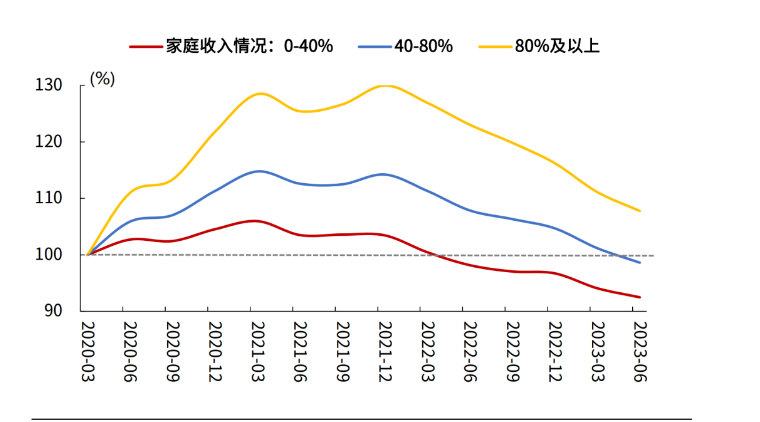

The remaining excess savings are mostly concentrated in high-income groups, while the excess savings of the middle and low-income groups, who are the main consumers, will be depleted ahead of schedule. According to the Federal Reserve's calculations, as of June 2023, except for the top 20% of American households whose cash savings are still about 8% higher than pre pandemic levels, the cash savings of the middle and low-income groups (income percentiles ranging from 40% to 80%,<40%) have been lower than pre pandemic levels, and the pace of savings consumption among the middle and low-income groups is even more advanced.

In the past few quarters, active fiscal support has supported US consumption, but it has also overdrawn the policy space for future fiscal policies. Under fiscal constraints next year, the excess savings brought by fiscal subsidies will gradually be exhausted, and the rate of consumption cooling will further accelerate.

At present, there is a serious political opposition between the two parties in the United States. The differences in political views between the two sides have to some extent surpassed the so-called governing policies and values, but rather "opposed for the sake of opposition", and policies have become tools serving the interests of elections. After the Republican Party regained control of the House of Representatives, whether it was the suspension of Biden's long planned "student loan reduction plan" or McCarthy's dismissal due to government budget compromise with the Democratic Party, both pointed to the intensification of contradictions between the two parties, limited space for fiscal cooperation, and the high debt burden of the US government, which will undoubtedly cause strong constraints on Biden's fiscal spending next year, making it difficult to maintain "fiscal leniency".

The European Commission released a package of measures for the automotive industry on Tuesday (December 16th), proposing to relax the requirements related to the "ban on the sale of fuel vehicles" by 2035.

The European Commission released a package of measures for …

Venezuela's Vice President and Oil Minister Rodriguez said …

On December 16 local time, the Ministry of Space Science Ex…

Recently, a highly anticipated phone call between the defen…

Right now, the world's major central banks are standing at …

Recently, according to Xinhua News Agency, the news of a tr…