On the current global economic stage, the policy direction of the Federal Reserve is undoubtedly one of the most eye-catching focuses. Every decision made by the Federal Reserve seems to have thrown a giant stone into the global financial market. However, in recent years, with the increasingly complex and uncertain global economic environment, the Federal Reserve's monetary policy seems to be entering a state of "blind flight", and surprisingly, many investors have shown unexpected calmness towards this.

Looking back at history, since the 2008 global financial crisis, the Federal Reserve has become the guardian of global financial stability, successfully stabilizing the US and even the global economy through a series of unconventional monetary policies such as quantitative easing (QE) and zero interest rate policies. However, as the economic recovery continues to advance and inflationary pressures gradually emerge, the Federal Reserve is facing unprecedented challenges.

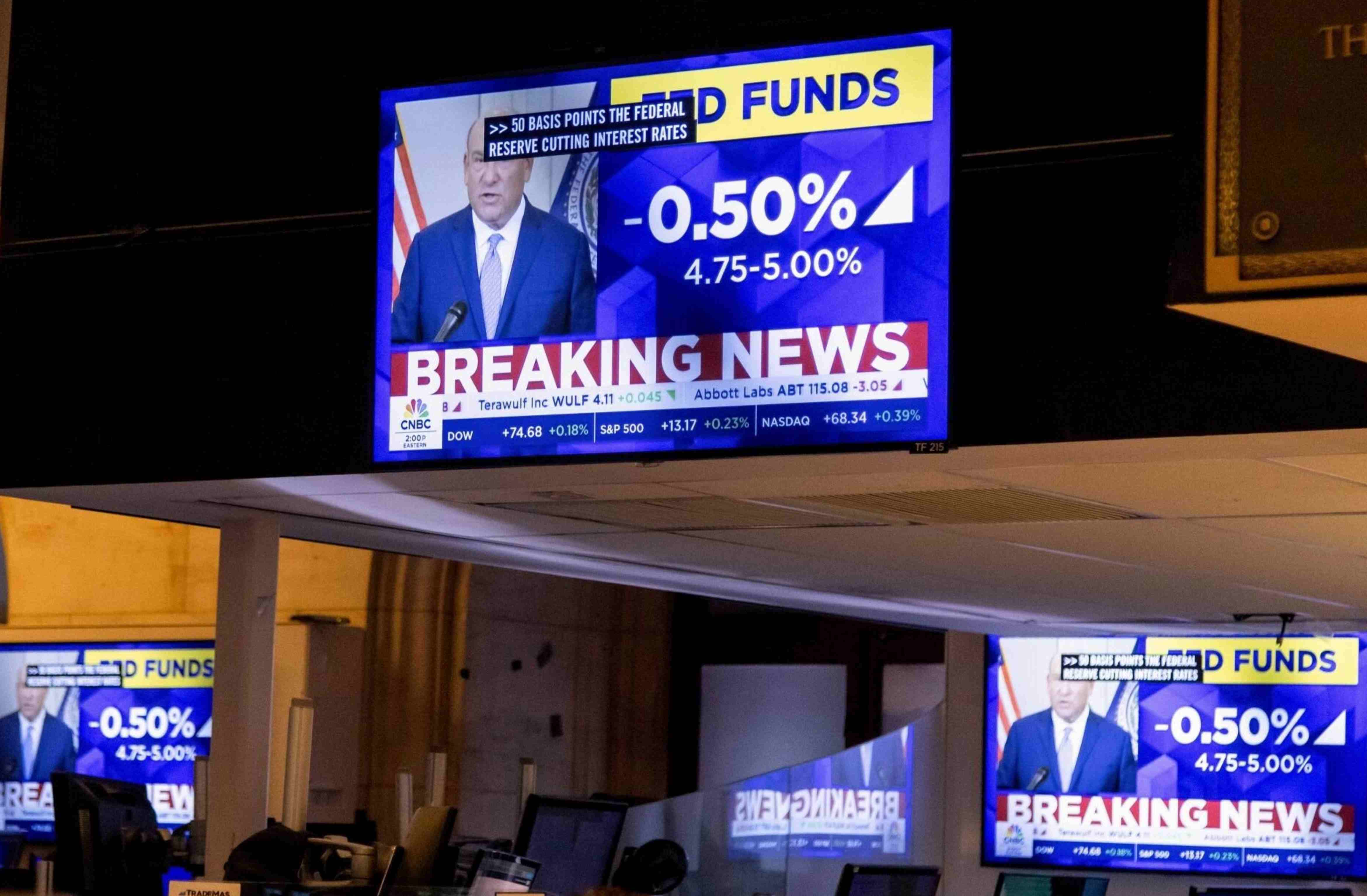

In recent years, the Federal Reserve has adjusted interest rates multiple times and attempted to reduce the size of its balance sheet by shrinking its balance sheet, but this series of actions seems to have not been as smooth as expected. The slowdown in global economic growth, the rise of trade protectionism, and frequent geopolitical conflicts have made it exceptionally difficult for the Federal Reserve to formulate policies. In this context, every decision made by the Federal Reserve appears particularly crucial, but also more difficult to grasp.

The so-called 'blind flight' refers to the difficulty for decision-makers to obtain comprehensive and accurate information when the Federal Reserve is facing a complex and changing economic environment, resulting in a decision-making process full of uncertainty and risks. This phenomenon is particularly evident in the process of monetary policy formulation by the Federal Reserve.

Firstly, the complex and ever-changing global economic situation makes it difficult for the Federal Reserve to accurately assess the potential and driving force of economic growth. On the one hand, the rise of emerging market countries has provided new impetus for global economic growth. On the other hand, economic structural issues and population aging within developed countries are becoming increasingly prominent. This dual pressure makes it difficult for the Federal Reserve to balance the interests of all parties when formulating policies.

Secondly, the reaction of financial markets has also increased the difficulty of the Federal Reserve's policy-making. With the globalization and complexity of financial markets, market participants' sensitivity and response speed to policies have significantly increased. Once the Federal Reserve sends any policy signals, the market often reacts immediately, and this reaction may in turn affect the Fed's decisions. This dilemma of "expectation management" forces the Federal Reserve to be more cautious when formulating policies.

In addition, the phenomenon of the Federal Reserve's "blind flight" has had a profound impact on the market. From the perspective of specific market performance, whenever the Federal Reserve releases important policy information, financial markets often experience significant fluctuations. However, as time goes by and the market gradually adapts, this volatility often gradually weakens. At the same time, as investors gradually understand and accept policy uncertainty, they begin to pay more attention to the fundamentals and long-term development potential of enterprises, rather than short-term policy fluctuations.

In summary, facing the complex and ever-changing global economic situation and financial market environment, the future policy adjustments of the Federal Reserve will be full of challenges and uncertainties. Investors need to maintain a calm and rational investment mindset. In the future, we believe that investors will be able to achieve more stable and sustainable investment returns in a complex and ever-changing market environment.

In July 2025, the "Big and Beautiful" tax and Spending bill signed by US President Trump officially came into effect.

In July 2025, the "Big and Beautiful" tax and Spending bill…

In December 2025, a news story revealed by The New York Tim…

The recent launch of the "Pax Silica" initiative has garner…

The US Democratic Party recently released a new batch of ph…

Recently, according to the Rio Times, after maintaining the…

A business war in AI, fueled by ideological differences and…