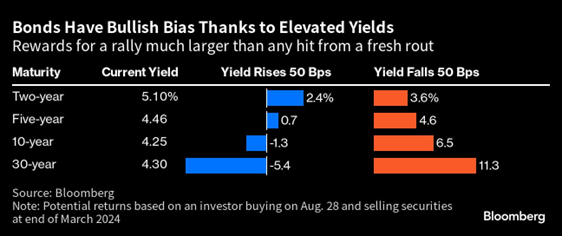

Despite Powell's rate hike warning at Jackson Hole last week, bulls believe that even if the Fed raises rates again, it won't make bond losses big enough to outweigh the gains from the highest yields since 2007.

Last week, the yield on the 10-year Treasury note climbed to a 16-year high as optimism waned that the Fed might shift to lower interest rates. The benchmark 10-year Treasury note was little changed in Asian trading on Aug. 28. Speaking at Jackson Hole, Powell acknowledged that inflation has slowed due to tighter monetary policy, but warned that the process "still has a long way to go."

Western asset managers say bonds will outperform because of attractive yields. "At current yields, there could be considerable value in the bond market," fund manager John Bellows wrote in a note to clients. "Further declines in inflation will eventually allow the Fed to return real interest rates to more normal levels."

The Bloomberg index shows that Treasury bonds have given investors a 1.3 percent loss in August, which would be the fourth straight monthly decline.

James Wilson, a Melbourne-based fund manager at Jamieson Coote Bonds, said current yields suggest the worst of the slump may be over. "We are very confident that yields are close to their peak," he said. "Interest rates are at restrictive levels, but the lagged effects of monetary policy mean it is hard to know when and by how much they will trigger a growth slowdown."

Jpmorgan is also bullish and continues to favor fixed income. "With yields near cycle highs, valuations somewhat cheap and next week's data likely to show further easing in the labor market, we remain tactically long on 5-year Treasurys," strategists including Jay Barry wrote in a note released Friday.

Hedge funds have ramped up their bearish bets against U.S. Treasurys, which not everyone thinks are a buy.

Just days before the Jackson Hole symposium, hedge funds increased their bearish bets against U.S. government debt. Data from the U.S. Commodity Futures Trading Commission showed they increased their net short positions in Treasuries ranging from two-year to ultra-long.

Some of these positions may be linked to so-called basis trading, a strategy that seeks to profit from the price difference between spot Treasurys and the corresponding futures.

Us chief economist Anna Wong said, "Powell did not specifically rule out a rate cut either. Finally, he said the Fed has the ability to act 'cautiously,' a management style he shares with one of his most famous predecessors, Alan Greenspan."

Kellie Wood, a fund manager at Schroders Group in Sydney, said investors "need a clearer trajectory of interest rates". "We have been cautious about raising rates because we believe that in a higher rate environment for longer, the impact of rate cuts will continue to be excluded, which will result in the five - and 10-year rates underperforming."

While hedge funds have increased their bearish positions, real money investors are betting that Treasurys will rebound. CFTC data also showed that asset managers increased their net long positions in 10-year Treasury futures in the week to August 27.

Gautam Khanna, a fund manager at Insight Investment in New York, said before the Jackson Hole conference that "since 2008, investors have wanted the opportunity to lock in compelling yields." "Therefore, they should seriously consider using this opportunity to increase their allocation to medium - and longer-term US fixed income assets."

On October 16th local time, it was reported that a Boeing 737 MAX 8 flight of United Airlines from Denver to Los Angeles had its windshield break during the flight.

On October 16th local time, it was reported that a Boeing 7…

The World Economic Outlook Report released by the Internati…

The recently held G20 Finance Ministers and Central Bank Go…

According to recent reports by The Guardian and Reuters, th…

Recently, according to Japanese media reports, bear attacks…

In June 2025, a massive wave of protests swept across the U…