What is the underlying logic behind the surge in global gold prices?

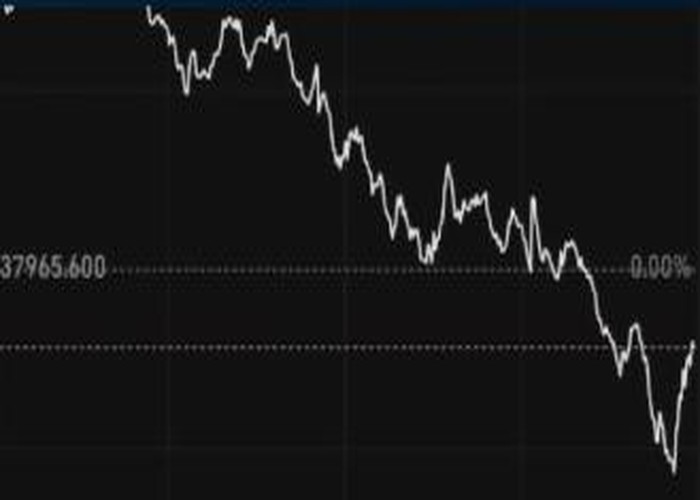

At the beginning of 2026, the global gold market witnessed a historic breakthrough: spot gold prices surpassed the $4,600/ounce mark during trading, and COMEX gold futures simultaneously hit a record high, marking an increase of over 5% compared to the end of 2025.

more