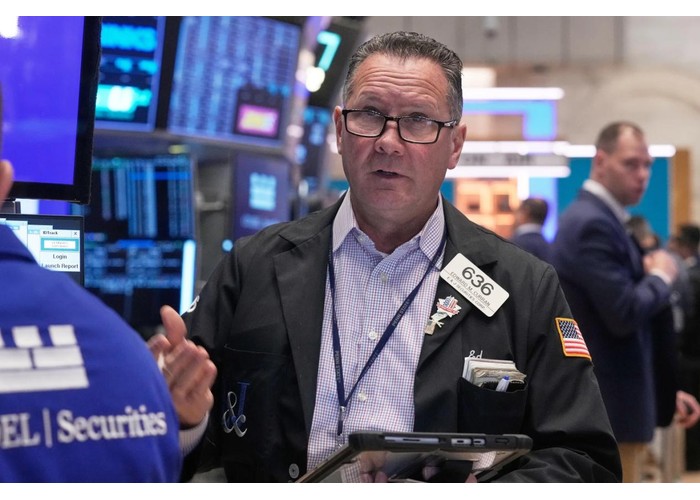

The US stock market rallied across the board late at night

On December 2nd, local time, the three major US stock indices opened higher. After the opening, the Nasdaq index saw an initial increase of up to 1%, reaching a new high since November 12th.

more