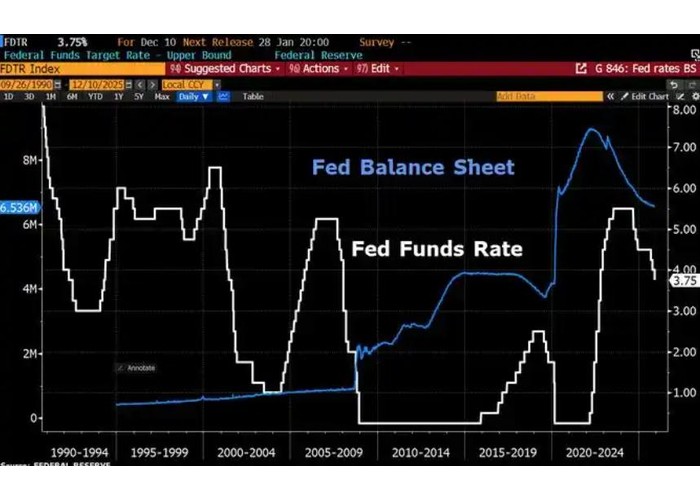

The Fed's 'Magic Show': What's the Reality Behind Monetary Policy Adjustments?

Recently, on the financial stage, the Federal Reserve has once again taken center stage, with its monetary policy adjustments playing out like a carefully orchestrated magic show—dazzling to the eyes and full of hidden intricacies.

more