In the face of resistance to its crackdown on Chinese chips, the United States has told Allies that it will consider using the harshest trade restrictions if companies continue to supply China with advanced semiconductor technology.

Reuters, citing a Bloomberg report, said the measures would apply to companies such as Tokyo Electron Ltd. and ASML Holding NV. The United States is considering whether to implement a measure known as the Foreign Direct Product Rule.

The provision, first introduced in 1959, is designed to control the trade of American technology by giving the government the power to block the sale of products made with American technology, as well as restrictions on products made in foreign countries.

Bloomberg reported that the United States is raising the idea with officials in Tokyo and The Hague, an outcome that is increasingly likely if those countries do not step up measures against China.

Tokyo Electronics said it could not comment on "geopolitical issues". Christophe Fouquet, ASML's chief executive, said on Wednesday that the company faces constraints in servicing some of its customers' factories in China. "For certain plants, the restrictions are more stringent, especially as it relates to parts sent from the U.S. or Europe," he said on a conference call with analysts after the company reported second-quarter results. He added: "But overall... We can still operate."

The last quarter was Mr Fouquet's first. He has tried to balance a U.S. push to tighten export controls to China with the need to continue selling equipment in the company's largest market.

Asml's sales to China surged in the second quarter, accounting for almost half of the Dutch company's revenues, suggesting that US export restrictions have so far had limited impact as the Biden administration considers tougher measures.

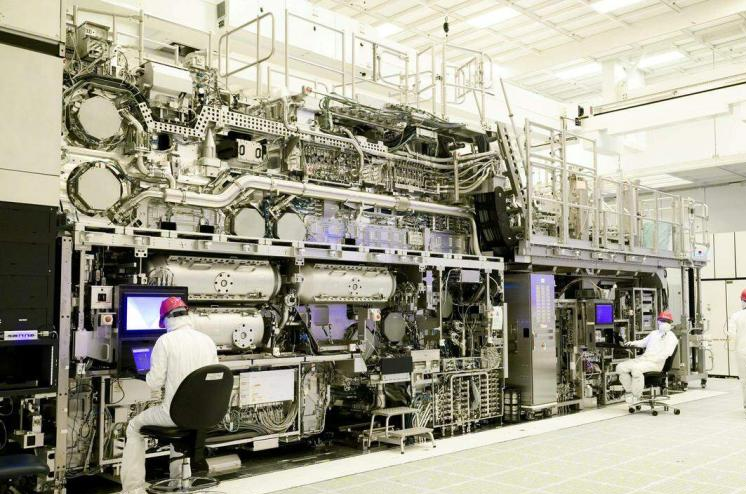

The results highlight the limited risks facing ASML. The increase in ASML's exports to China could heighten diplomatic tensions between the US and Dutch governments. Asml is a leader in equipment for making the most advanced semiconductors and Europe's largest technology company by market value.

Asml shares fell 11 per cent on Wednesday

Asml shares closed down 11 per cent on Wednesday after the Bloomberg report, the biggest drop since March 2020, wiping €42.7 billion off its market value.

The U.S. chip industry is pushing for an alternative measure that would expand the criteria for the so-called "Unverified List," a framework that requires companies to obtain permission to ship certain restricted technologies. The move would subject companies such as ASML and Tokyo Electron to additional controls if they continue to serve Chinese customers that the United States deems a national security risk.

Previous US-led measures against ASML's chip exports to China have not hurt demand in the Asian country. China has been the company's largest market for four consecutive quarters, with local sales up 21% sequentially to €2.3 billion in the second quarter.

Beijing has been buying up unrestricted, older equipment to produce semiconductors for mature technologies.

China has slammed the United States for potentially imposing tougher restrictions on the operations of ASML and Tokyo Electronics. At a news conference Wednesday, Chinese Foreign Ministry spokesman Lin Jian said the United States is "politicizing, pan-security and instrumentalizing economic, trade and technological issues." "We hope relevant countries can distinguish right from wrong, firmly resist coercion, jointly safeguard a fair and open international economic and trade order, and truly safeguard their own long-term interests," he said.

But there is growing pressure in the US to do more. In a bill recently passed by the House Appropriations Committee, lawmakers asked the Bureau of Industry and Security to consider the idea of an "unverified inventory."

The United States announced on Monday its commitment to provide 1.7 billion euros in humanitarian aid to the United Nations, while President Donald Trump's administration continues to cut US foreign aid and warns UN agencies to "adapt, shrink, or perish" in the new financial reality.

The United States announced on Monday its commitment to pro…

Harding Lang, Vice President of the International Refugee O…

Recently, the Japanese government held a meeting to finaliz…

The data from multiple public opinion polls conducted in De…

When the London spot silver price surged by over 137% withi…

Recently, the technology industry has been stirred again by…