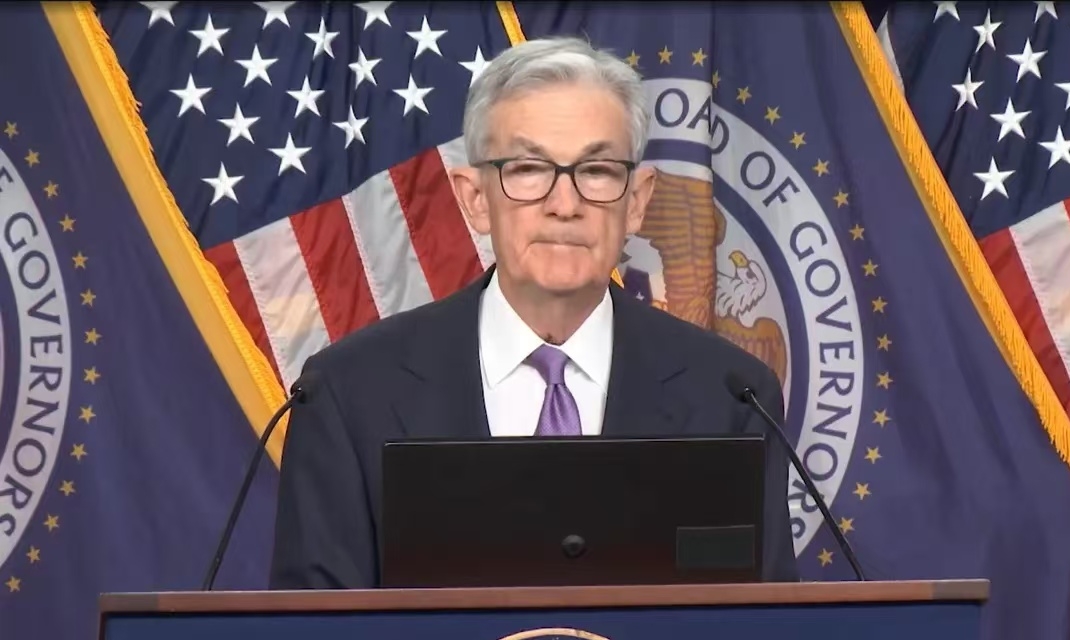

Much attention is focused on how the Fed will decide at its upcoming September meeting. Federal Reserve Chairman Jerome Powell said in a speech at the annual meeting of global central banks in Jackson Hole that the moment of truth has arrived. At the same time, Powell expressed confidence that inflation pressures are easing, and believes that inflation will return to the 2% level on a sustainable basis, and the Fed is likely to decide to cut interest rates at the September 18 meeting.

The Wall Street Journal commented that Powell's speech "all but caps the Fed's historic anti-inflation campaign," the strongest signal yet of a rate cut.

There were several key factors behind the Fed's decision to cut interest rates in September. First of all, the inflation situation in the United States has improved, the data showed that the overall CPI growth rate in the United States fell in July, Powell expressed confidence in the easing of inflation pressure in his speech, and believes that inflation will be sustainable back to the 2% level. Second, there are signs of weakness in the US labor market, with the unemployment rate rising in July and non-farm payrolls falling far short of expectations, which increases the Fed's concerns about the state of the labor market. In addition, the minutes of the Fed's July meeting showed that a "large majority" of officials thought it might be more appropriate to cut rates in September, and participants saw upside risks to inflation as having diminished and downside risks to employment as having increased.

The expectation of interest rate cuts has had an impact on the market, for example, the three major stock indexes in the United States closed up after Powell's speech, the commodity market performed hot, and the price of safe-haven assets such as gold rose in response, close to the highest point in history.

The Fed's decision to cut interest rates will also have an impact on the global economy. First, a rate cut would lower borrowing costs, potentially boosting consumption and business investment and boosting economic growth. However, this policy change may also bring some risks and challenges. Or it will lead to the depreciation of the dollar, reducing the pressure on other currencies to depreciate, and may trigger a new round of interest rate cuts by central banks around the world.

America's long-term trading partners will suffer a range of effects from a weaker dollar. When the dollar depreciates, other currencies appreciate relative to each other, which is good for other countries to import goods from the United States, because the same amount of currency can be exchanged for more dollars. Similarly, the appreciation of currencies in other countries also means that it will be less expensive for citizens to travel or study in the United States, potentially increasing the number of such activities. However, the depreciation of the dollar may have an adverse effect on the export business of other countries, because the relative price of other countries' goods in the international market may reduce exports to the United States. In addition, a weaker dollar will affect the ability of countries around the world to attract foreign investment, especially when the main source of foreign investment is the dollar zone. Foreign capital may become less attractive because the dollar returns from investing in other countries will be reduced in dollar terms.

As the central bank of the United States, the Federal Reserve adjusts its monetary policy based on its control of the economic prospects of the United States, and these policy changes have international effects through multiple channels, indirectly affecting the economic conditions of other countries, and affecting the interests of multinational enterprises and investors. Therefore, countries and investors at this "critical juncture" need to further pay attention to the Federal Reserve's policy and news trends before the arrival of the interest rate meeting on September 18, this key node will become the world's "opportunities and challenges."

On November 8th local time, Meta officially announced that it will invest 600 billion US dollars in the United States over the next three years, focusing on the construction of infrastructure such as AI data centers.

On November 8th local time, Meta officially announced that …

On November 10, 2025, the conflict between Russia-Ukraine c…

On November 10th, the European and American business market…

In October 2025, Saane Takaishi became the first female pri…

Russian Foreign Minister Lavrov recently expressed his diss…

The World Bank has set a target for the proportion of its l…