As the world's first high-tech enterprise with a market value exceeding $3 trillion, Apple's price has recently been falling all the way. On March 4th local time, Apple's stock price fell by 2.54%, and its market value evaporated by 70.4 billion US dollars (approximately 506.9 billion yuan). At present, its market value is only around 2.6 trillion US dollars, down 15%, which is extremely rare in the US stock market.

According to data from Counterpoint, in the first six weeks of the first quarter of 2024, Apple's smartphone sales plummeted by 24% year-on-year, ranking fourth. The combination of negative news and severe market conditions resulted in a decline in the previous trading day.

Analyzing the reasons for Apple's tragic decline, one of them is the poor sales of the iPhone 15 series, especially the decline in Apple's sales in China. In the first six weeks of 2024, Apple's iPhone sales in China decreased by 24% year-on-year, ranking fourth among Chinese smartphone suppliers, while Huawei surged by 64%. Huawei has become a strong competitor to Apple in the high-end market.

Despite Apple's repeated price reductions and promotions, iPhone sales in the Chinese market remain weak. Sales plummeted by 24% in the first six weeks of this year, with the ranking dropping from first to fourth. Analysts pointed out that in the first week of 2024, sales in China decreased by 30%, reflecting that Apple's product strength has greatly fallen short of expectations. Previously, Apple had always been known for its high-end brand image, and its product pricing had always been relatively high. However, price reductions may damage the brand image, thereby affecting Apple's position and reputation in the high-end market.

In the increasingly competitive market environment, Apple has yet to adapt to the new landscape. The rise of Chinese brands such as Huawei and the crackdown by the US government have brought huge challenges to Apple. Can Apple regain its innovation drive in the face of these challenges? Can we regain the trust and support of consumers? These issues deserve in-depth consideration and exploration.

Secondly, the European Commission's announcement of a huge fine on Apple is also an important reason. The European Union has imposed a penalty of 1.8 billion euros on the US technology giant, citing Apple's suppression of competition from its rival music streaming services. This is the first time an iPhone manufacturer has been punished for violating EU law, and it is also one of the largest penalties currently imposed by the EU on technology companies.

The third reason is that Apple's backwardness in the AI field has led to a decrease in investor confidence in it. Although Apple was the first to launch the voice assistant Siri, Siri's level of intelligence is far lower than its competitors Cortana and Alexa. In addition, in terms of systems, Microsoft actively added AI features to Windows, while Apple made no progress in this area, causing investors to lose confidence in Apple.

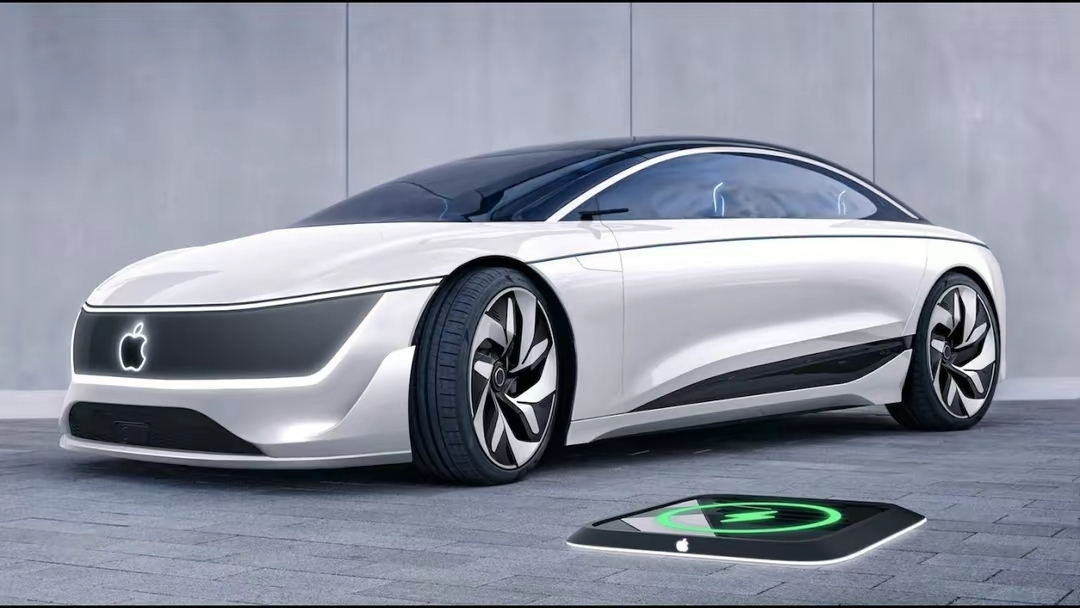

In addition, Apple has been developing the Apple Car for 10 years and investing billions of dollars in the automotive project, which is equivalent to 10 years of time and billions of dollars, completely drifting away. Such a major decision-making mistake is unprecedented in Apple's history. Although some analysts believe that this move has not affected Apple's stock price, it has at least undermined and affected the confidence of investors in it.

Whether it's the iPhone, Mac, iPad, or other products, in order to build a truly differentiated competitive advantage, they all need solid innovative technology as support.

Previously, Apple had high hopes for the Apple Vision Pro, but once it was released, it was also lukewarm. Originally, they thought they could get the key to entering the metaverse with it, and even use it to overturn previous iPhone products, but now it seems impossible.

Since Steve Jobs took over Apple, every time he launched stunning innovative products, they caused a sensation in the market and imitated peers, from iMac, iPhone, iPad, Apple Watch to AirPods. However, now the market competitiveness of Apple products has begun. Being surpassed by other companies, especially those from China.

From the current situation, other technology stocks in the United States and the entire US capital market are watching the trend of Apple Inc. If Apple's stock price continues to decline, it may further trigger market sentiment, and even the long-standing bull market in the United States may be completely ended as a result.

A new survey released in the United States shows that in the context of rising prices and growing concerns among the public about the economic outlook of the country, there is a coexistence of frugality and differentiation.

A new survey released in the United States shows that in th…

By the end of 2025, the situation in the Middle East resemb…

According to Channel NewsAsia, international oil prices hav…

On Sunday, US President Donald Trump Trump met with Ukraini…

Officials in the Trump administration, speaking on Fox News…

In 2025, the Trump administration reshaped the global trade…