A fierce "copper war" without gunpowder is quietly unfolding worldwide, and the United States is undoubtedly the initiator of this war. From the White House's statement initiating a national security investigation into copper imports to the continuous flow of large amounts of copper resources to the United States, the global copper market is experiencing unprecedented volatility. Behind this series of operations, there are complex and profound multiple logics.

The most direct economic motivation for the current "copper war" in the United States is trade protectionism and promoting the return of domestic industries. In recent years, the US manufacturing industry has faced challenges such as intensified overseas competition and industrial hollowing out. Copper, as an important industrial raw material, is widely used in key fields such as electronics, construction, and energy. The stability of its industrial chain is crucial for the revival of the US manufacturing industry.

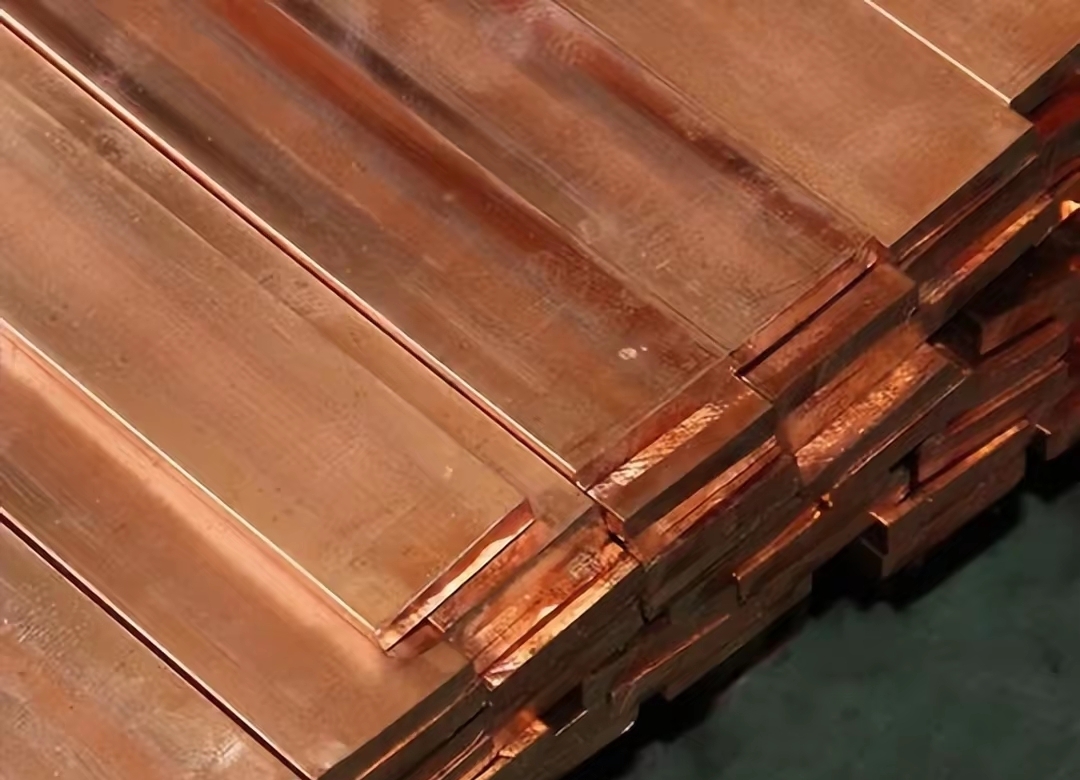

US Commerce Secretary Howard Lutnik publicly stated that the US copper industry is declining due to the erosion of global competitors and must be brought home through tariffs to bring the production chain. By initiating a Section 232 investigation into copper imports under the 1962 Trade Expansion Act and potentially imposing high tariffs, the United States is attempting to artificially create a trend of global copper resources gathering domestically. Goldman Sachs and Citigroup predict that the United States may impose tariffs of up to 25% on all imported copper by the end of the year. Under the expectation of tariffs, traders have diverted copper originally intended for other regions to the United States in order to avoid potential cost increases. Tok Group diverted 150000 tons of electrolytic copper to be shipped to Vietnam to Los Angeles, which is a typical case. This large-scale resource transfer has led to a rapid increase in domestic copper inventories in the United States. As of now, US copper inventories (including unreported inventories) have surged to meet more than 100 days of consumption, up from just 33 days at the beginning of the year.

The United States hopes to provide sufficient and relatively low-priced raw material supply for domestic copper processing and related downstream industries through this approach, reduce their production costs, enhance their competitiveness in the international market, and attract related industries to return to the United States. From the perspective of the industrial chain, this is a strategic attempt by the United States to reshape its manufacturing advantages and solidify its economic foundation. However, this approach has also brought many negative effects. The self-produced copper in the United States can only meet 50% of its demand. Even if tariffs are imposed, American copper buyers still need to continue purchasing imported metals, and the cost of tariffs will ultimately be passed on to consumers. From Tesla's charging stations to Apple's data cables, many copper containing products may face price pressure.

The United States is attempting to gain a greater say in the global geopolitical landscape by controlling copper resources. On the one hand, investigating imported copper and potential tariff measures is a strategic deterrent to its major trading partners. Chile and Canada, the largest copper suppliers to the United States, have been significantly affected in their copper export direction and trade strategy during this' copper war '. The Chilean National Copper Company is even considering setting up transit warehouses in Africa, and the global copper trade map is being reshaped. On the other hand, the United States uses its dominant position in the global financial and trade system to manipulate copper price fluctuations and economically suppress its competitors.

In the spot market, as the United States crazily competes for copper, LME deliverable inventory has plummeted by 80% compared to the end of last year, currently equivalent to only one day's global copper consumption. The extreme shortage of inventory has triggered a short selling crisis, and the key indicator for measuring short-term supply pressure, the Tom/next spread, surged to $98 per ton on June 27th, reaching its highest level since the historic short selling storm hit LME in 2021; The premium of spot copper to three-month futures also reached $300/ton at one point, also setting a record high since 2021.

The "copper war" launched by the United States is a complex game of intertwined economic, political, financial and other levels of logic. Its far-reaching impact not only disrupts the normal order of the global copper market, reshapes the global copper trade pattern, but also exacerbates international trade frictions and geopolitical tensions. For countries around the world, how to ensure their own resource security and stable industrial development in this resource and capital game led by the United States will be a severe challenge.

Since 2025, the conflict between the United States and Europe over the governance of the digital economy has continued to escalate.

Since 2025, the conflict between the United States and Euro…

When German Chancellor Mertz officially announced that he w…

On December 3rd local time, the copper price on the London …

The European Commission announced a new economic security s…

The European Commission announced a new economic security s…

For nearly a year, US President Donald Trump has launched a…