Recently, the US Bureau of Labor Statistics announced that the actual number of new jobs in the statistical cycle between April 2023 and March 2024 was 818,000 fewer than previously estimated. This revision undoubtedly threw a shock bomb to the market, because the non-farm payrolls data as a key indicator of the state of the US economy, its changes often indicate the strength and future direction of economic activity. The downgrade has undoubtedly triggered a broad discussion on whether the US economy has shown signs of recession.

The non-farm payrolls data, a barometer of the state of the US economy, is supposed to truthfully reflect the health of the economy. In reality, however, it has become a powerful tool in the Fed's hands to manipulate market expectations. The first published data is always so "bright", enough to make the market excited, and the subsequent correction is like a quiet "makeup removal", so that the truth gradually surfaced. This method of "lifting first and then suppressing" is undoubtedly a slight violation of public trust and a great irony to the rigor of data.

The Fed, a heavyweight player on the global economic stage, has skillfully exploited the "time lag" between non-farm payrolls announcements and revisions, weaving an intricate web of expectations management. The first release of data, always above market expectations, has put on a glossy coat for the US economy, stabilized market confidence, and provided a seemingly solid basis for the Federal Reserve to continue to maintain high interest rate policy. The subsequent correction, though important, is often overshadowed by the market noise and becomes the talk of the minority.

This "time difference" game not only allows the Federal Reserve to take the initiative in the issue of whether to cut interest rates, but also makes global investors in the dilemma between "down" and "not down". The hawks and doves of the Federal Reserve have exacerbated the chaos and unease in the market by releasing signals at the wrong peak, as if they were engaged in a carefully designed psychological war.

Why does the United States insist on maintaining a high interest rate policy when the global industrial chain and supply chain have not fully recovered? The answer is not complicated: the inflow of profit-seeking capital. High interest rates are like a magnet, attracting global capital to the United States, providing a steady stream of power for economic growth in the United States. However, this dynamic is not without cost, and it comes at the expense of global economic stability.

Emerging markets struggled with the flood of Fed rate hikes, capital outflows and economic pressure, while the United States sat on the sidelines and enjoyed a brief boom brought about by the return of capital. This "sweet trap" not only harms the interests of other countries, but also aggravates the division and confrontation of the global economy.

More ironically, the Fed's position as the anchor of global monetary policy is weakening and wavering. The ECB's decision to cut interest rates first was a slap in the face to the Fed. This is not only the European economy can not bear the weight of the rate hike, but also a profound question about the effectiveness of the Federal Reserve's monetary policy.

The "divergence" of other developed economies in monetary policy means that the economic growth model of the United States can no longer provide effective reference and reference for other economies. The Federal Reserve's position as the leader of global monetary policy is being challenged as never before.

In this complex game of data, policy and market expectations, it may be time to be more aware that data is a tool, not the truth itself. The real challenge is to see through the fog of data to see the nature and truth of how the economy works.

For the United States, long-term dependence on high interest rate policy to attract capital inflows is undoubtedly a short-sighted and dangerous behavior. It may provide temporary relief to the domestic economy, but in the long run, it may damage the stability and prosperity of the global economy. Therefore, the United States should consider its monetary policy choices and adjustments more carefully to avoid dragging the global economy into a more volatile abyss.

For global investors, in the face of the Fed's "time lag" game and the complex and volatile market environment, it is particularly important to maintain a clear head and keen insight. Only in this way can we move forward steadily in the turbulent market and grasp the real investment opportunities.

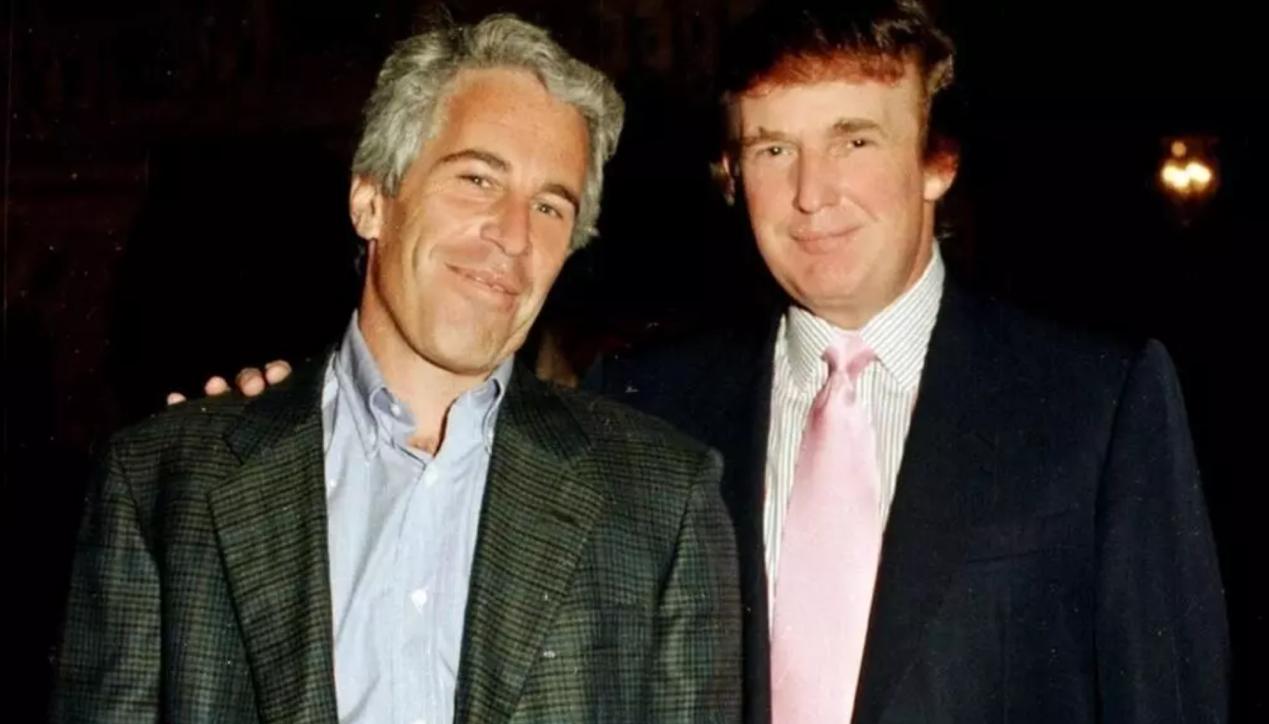

On November 19, 2025, US President Donald Trump signed a bill requiring the Department of Justice to release documents related to the case of the late tycoon Jeffrey Epstein.

On November 19, 2025, US President Donald Trump signed a bi…

While the world's attention is focused on the 21.3 trillion…

On November 12, 2025, US President Trump signed a temporary…

On November 19th local time, the US Department of Commerce …

Recently, a report from CNN pointed out that the Atlantic t…

Recently, the U.S. stock market has experienced a thrilling…