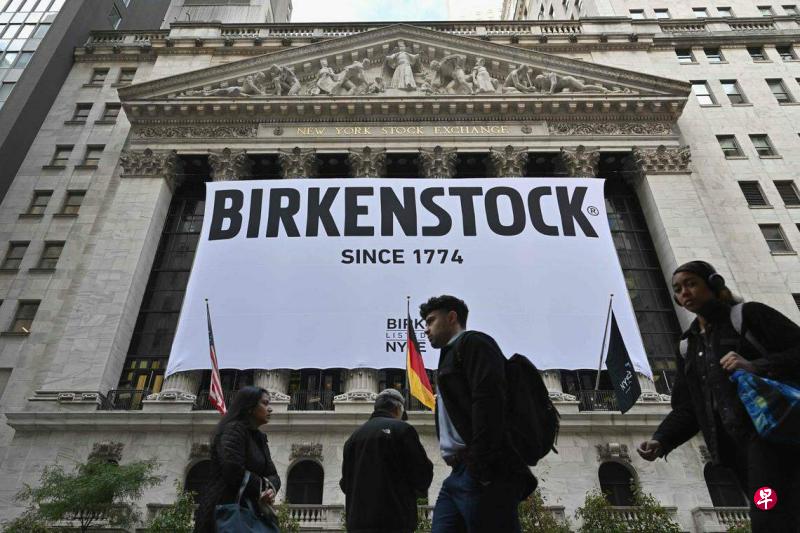

德国鞋类制造商Birkenstock上市首日股价下跌12.6%,收报40.2美元(约54.77新元)。这或为刚刚出现复苏迹象的首次公开售股(IPO)市场蒙上阴影。

根据彭博社整理的数据,这家德国公司在美上市首日的表现是两年来10亿美元及以上规模的IPO中表现最差的。如果将时间线拉长,在过去一个世纪的300多宗类似规模的美国IPO中,也仅有13家表现的比Birkenstock更差。

IPO追踪机构复兴资本(Renaissance Capital)的高级IPO市场策略师肯尼迪(Matthew Kennedy)表示,今年早些时候上市首日的强劲上涨,可能吸引了一些“热钱”进入近期的IPO中,这推高了它们的价格。但此前的新股表现不佳,令投资者受损,所以投资者不愿再为后来新上市的股票支付高价,就不足为奇了。

9月是自2022年1月以来美国IPO规模最大的月份,其中,市场比较关注的包括晶片巨头ARM Holdings和在线食品杂货配送公司Instacart的IPO。Arm的股价较发行价小幅上涨7.2%,而Instacart的股价较发行价低17%。这些公司以及Birkenstock好坏参半的表现,让市场疑虑其他预备上市的起步公司,包括运动服品牌Vuori、减肥药制造商Carmot Therapeutics等是决定继续前进还是暂缓观望。

Recently, a heavyweight news has attracted global attention: the United States has reached a trade agreement with Vietnam.

Recently, a heavyweight news has attracted global attention…

Recently, a heavyweight news has attracted global attention…

In the complex dynamics of the global financial market, the…

On July 8, 2025, US President Trump dropped a bombshell at …

On July 7th, the international economic landscape was in a …

On July 3rd local time, Russian Special Representative for …