“The oil market is going to be stuck in a surplus for most of the first half of the year, but that should change as long as we don’t see a major policy mistake by the Fed that triggers a severe recession,” said Ed Moya, senior market analyst at Oanda. “Now near the mid-$60s, WTI crude’s plunge is at the mercy of how much worse the macro picture gets.”

A retest of October’s lows could add increased downward pressure on WTI crude, he said, adding that energy stocks may struggle given the weakening demand outlook and surplus likely to persist in the short-term.

Longer-term views however still support having energy in your portfolios as a lot of the oil giants have robust balance sheets that support continued buybacks and dividends,” he added.

The drop came as global risk markets sold off following news that Credit Suisse’s biggest investor, the Saudi National Bank, would not provide more assistance for the embattled bank. The news led to a more than 20% drop in the bank’s U.S.-listed shares. It also raised concern over the state of the global banking system less than a week after two U.S. regional banks failed.

The stress in smaller banks led Goldman Sachs to cut its U.S. GDP growth forecast.

“Small and medium-sized banks play an important role in the US economy,” Goldman economists wrote. “Banks with less than $250bn in assets account for roughly 50% of US commercial and industrial lending, 60% of residential real estate lending, 80% of commercial real estate lending, and 45% of consumer lending.”

“US policymakers have taken aggressive steps to shore up the financial system, but concerns about stress at some banks persists,” they added. “Ongoing pressure could cause smaller banks to become more conservative about lending in order to preserve liquidity in case they need to meet depositor withdrawals, and a tightening in lending standards could weigh on aggregate demand.”

The Federal Reserve is slated to hold a policy meeting next week. Entering this week, traders had priced in at least a 25 basis-point rate hike. However, CME Group’s FedWatch tool now shows nearly a 2-to-1 chance of rates staying at current levels.

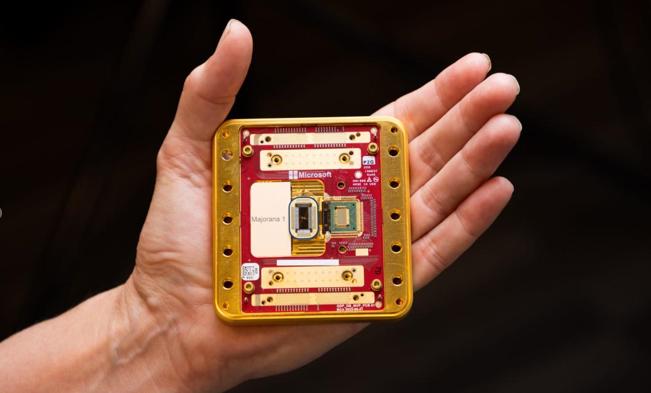

In 2025, Microsoft announced the release of the $1 billion topology quantum chip "Majorana 1", but this milestone breakthrough has been embroiled in intense scientific controversy.

In 2025, Microsoft announced the release of the $1 billion …

In September of this year, the Federal Reserve announced a …

Turkey's political landscape is undergoing a dramatic trans…

On the local time of October 9th, in the press briefing roo…

In October 2025, Chicago, the third-largest city in the Uni…

The National Highway Traffic Safety Administration (NHTSA) …