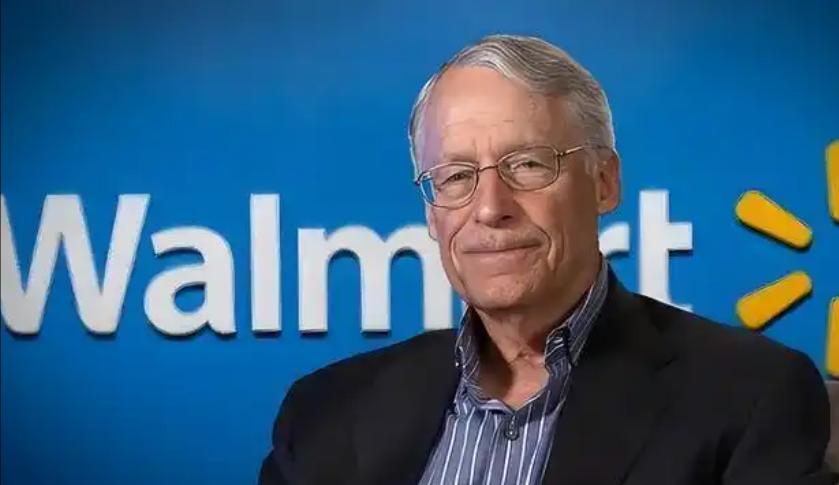

Recently, the US e-commerce giant Amazon has engaged in a head-on battle with the world's largest retailer Walmart. Both will simultaneously launch their largest annual online promotion campaigns. Besides e-commerce platforms, the price war has also affected physical retailing under various pressures, making discounted prices increasingly important to consumers, and maintaining profits has become the top priority for retail giants. The starting point of this situation was May 15, 2025, when Walmart's Chief Financial Officer Rene openly stated in public: "The current tariff increase has far exceeded the tolerance limit of retailers." Once this statement was made, the entire retail industry instantly held its breath. Because Walmart is not only the largest retailer in the United States but also the "price benchmark" of the industry. Its every move directly determines the trend of the entire market. To compete for the consumer market, Amazon has moved Prime Day promotion to July 8 this year, with the end time extended to July 11. The US Bank predicts that the four-day Prime Day this year is expected to generate a total transaction volume of $23 billion in goods, including the total revenue of Amazon itself and third-party sellers on its platform.

This price war not only affects e-commerce platforms and offline retail industries, but also brings complex and multi-faceted impacts on the entire business environment. First, it affects retailers. The price war forces retailers to extend their promotional periods and expand discount ranges to compete for market share. However, this strategy may boost sales temporarily, but in the long run, it will compress profit margins. For example, Amazon's operating profit margin in the North American market in the first quarter of 2025 was only 6.3%, lower than market expectations; although Walmart has consolidated its position through e-commerce growth and market penetration rate improvement, its e-commerce business profitability still relies on supply chain optimization and cost control. To cope with the price war, retailers have adjusted their strategies. Walmart closed inefficient stores to stop bleeding, while opening high-potential stores; Kors Cosmetics' 27 store closures led to a recovery in gross profit, confirming the initial effectiveness of the "close stores to stop bleeding, focus on profitability" strategy. In addition, retailers have accelerated the diversification of supply chains to reduce reliance on a single market.

Second, it affects the supply chain. The trade war has led to an increase in the cost of imported goods, and retailers face the dual challenges of tariff cost transfer and consumers' price sensitivity. To reduce costs, retailers accelerate the diversification of supply chains, transferring production to regions such as Southeast Asia. However, such adjustments require time and capital investment, and may face risks such as unstable quality and supply chain disruptions. Multinational enterprises may disperse costs across global markets to avoid tariff risks. For example, manufacturers outside the United States may slightly increase prices in markets such as the United States and Europe, pushing up global inflation. The inflation rate in the Eurozone initially fell below the target, but tariffs may become a driver of future inflation.

Third, it affects consumers and the macroeconomy. The price war makes consumers pay more attention to prices, reducing their tolerance for stores with shortages, poor services, or high prices. Deloitte reports that price has become the primary factor in US consumers' decision-making, triggering a "loyalty crisis". At the same time, the price war reflects the intensified profit pressure in the retail industry, which may lead to industry reshuffling. At the same time, the collapse of consumer confidence and the rise in inflation expectations further suppress consumption and investment, exacerbating the risk of economic recession. In the first quarter of 2025, US GDP contracted by 0.3% on a quarter-on-quarter basis, marking the first negative growth in three years. Trump's tariff policies triggered a trade war, causing global supply chain costs to rise and inflation pressure to intensify. Policy uncertainty makes retailers unable to formulate long-term strategies, further suppressing investment and consumption.

In conclusion, the spread of the price war in the US retail industry is like a storm, sweeping through retailers, supply chains, consumers, and the macroeconomy at all levels. In this complex situation, the business sector needs to closely monitor policy developments and market changes, and actively respond to challenges, so as to find a foothold in the storm.

The United States announced on Monday its commitment to provide 1.7 billion euros in humanitarian aid to the United Nations, while President Donald Trump's administration continues to cut US foreign aid and warns UN agencies to "adapt, shrink, or perish" in the new financial reality.

The United States announced on Monday its commitment to pro…

Harding Lang, Vice President of the International Refugee O…

Recently, the Japanese government held a meeting to finaliz…

The data from multiple public opinion polls conducted in De…

When the London spot silver price surged by over 137% withi…

Recently, the technology industry has been stirred again by…