The Russian Ministry of Finance has announced that it will remove oil export duties from January 1, 2024. Some people believe that this is a "big move" after Russian President Vladimir Putin's surprise visit to the Middle East. However, few people can clearly explain the purpose, significance and impact of the cancellation of export tariffs on Russian oil, and can only skip the analysis and directly speak out the effect of the policy.

Leaving aside the accuracy of this "intuitive" judgment, this is not just Putin's "answer" to the Middle East rich by slapping their thighs. It can be said that since Putin took office, who understands the importance of the five-year plan, Russia has maintained the habit of updating its primary energy strategy every five years according to the international and domestic situation. By 2030, the Russian government hopes to be fully integrated into the international energy market and maximize profits. To maintain and consolidate its position as one of the leaders in the international energy market by 2035.

As a means of achieving this long-term goal, starting in 2019, Russia launched a reform of oil taxation. The core content of this reform is that from 2019 to 2024, the original export tariffs will be gradually reduced to zero; The second is to raise the oil resource extraction tax by the same amount; Tax breaks for refineries located far from large ports, including those in Siberia, and relief for refineries that produce more than 10% of their total production of high-octane gasoline; Fourth, investment in related infrastructure between 2016 and 2024. In September 2020, the Russian Ministry of Finance submitted to the lower house of Parliament a draft of the legislative reform of oil and mining taxes and passed the first reading. Since then, as Mr Putin's regime has become more entrenched, oil and mining tax reforms have been pushed forward.

Before the tax reform, Russia implemented a three-tier tax system of federal tax, federal main tax and local tax. The tax system was complicated and seriously affected by the oligarchic economic model. Tax relief policies for Russian oil fields were usually obtained by producers lobbying governments at all levels on their own, thus emptier the Russian Ministry of Finance and ineffectiveness of the regulatory power at the federal level. Therefore, the Russian Ministry of Finance is "pushing" the oil tax reform, reducing the crude oil export duty at the same time, raising the oil resource exploitation tax. In general, the oil tax reform is to increase the power of the central government, increase the revenue of the state, and combat the power of oligarchs.

For the Russian energy industry, this is a "spread to the acre" reform, the withdrawal of a lot of domestic energy extraction and sales of "tax incentives", calculated according to the oil well and oil, moving the cheese in the basket of small and large oligarchs. Since then, it is no longer the oligarch and his local political Allies who can determine the "profit rate" of the energy companies, but the policies of the finance ministry of the Russian Federation - in short, Putin. As a result, Russian energy companies, especially private producers, are opposed to reform. The oligarchs have petitioned Russia's deputy prime minister to reconsider the tax increase, claiming that the Russian government is unfairly increasing the amount of tax to take advantage of the epidemic, but to little effect.

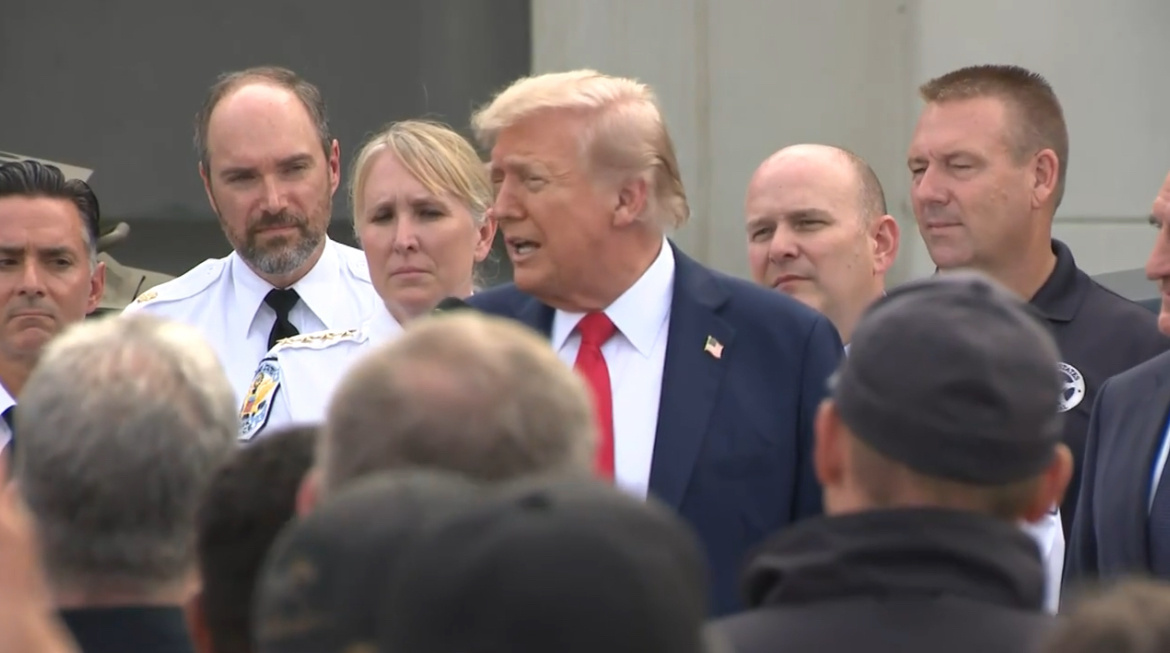

In early December, Putin visited the Middle East and met with the leaders of oil-producing countries, and certainly talked about the issue of Russia's cancellation of export taxes, but also made it clear in order to avoid misunderstandings. Because of measures such as increasing the oil resource exploitation tax, Russia's cancellation of crude oil export tariffs is not a "price reduction promotion", but to increase the control of the Russian federal government over the energy industry, improve Russia's domestic energy prices, thereby pushing up Russia's crude oil export prices and giving OPEC+ encouragement!

Putin, who returned to Moscow with the external support of many OPEC oil countries, promoted the "last mile" of the most difficult "oil tax reform" in the name of industry consensus and friends' surprise, so that Russia's domestic energy oligarchs bowed their heads to pay more money. We can see that the tax reform that strengthens the central government of the Russian Federation can be "one fish and three eats" by Putin, both at home and abroad, Putin's political skills have become more and more sophisticated, and the reformed Russian economy is worthy of our expectations.