The United States, in the midst of an economic recovery, now faces an unprecedented test. Over the next few years, the US economy is likely to fall into a very damaging kind of depression: interest rates soar, economic growth fails to sustain, and the economy is stuck in stagflation.

"Stagflation" is a term used to describe current economic changes and expectations, also known as depression-inflation or inflation-recession, and is a term used by bourgeois economists to generalize when economic recession and inflation coexist, pointing to possible economic conditions in the future.

For a long time, the economic performance of western capitalist countries is generally characterized by economic prosperity and low or falling unemployment during the period of rising prices, while the period of economic recession or depression is characterized by falling prices. This led Western economists to believe that unemployment and inflation could not happen in the same direction. However, since the late 1960s and early 1970s, the major capitalist countries in the West have experienced economic stagnation and recession, massive unemployment, serious inflation and continuous price rise at the same time. Western economists call this economic phenomenon stagflation.

Jamie Dimon, chief executive of jpmorgan Chase, has warned US markets that inflation and interest rates could remain higher than expected because of excessive government spending, setting the table for the Federal Reserve to raise rates as high as 8 per cent.

Although many key economic indicators continue to improve and inflation is slowing down, there is still upward pressure on inflation in the future, high inflation is likely to persist, and government spending will continue to increase.

In a stagflationary environment, job growth can be extremely difficult, and proven companies can even face the risk of bankruptcy. This could lead to a significant rise in borrowing costs and a sharp fall in investment and employment. In addition, with the rise in prices and the decline in purchasing power, ordinary consumers will also feel pressure, and the quality of life and living standards will be seriously affected.

Stagflation, combined with soaring interest rates, would have a huge impact on the broader economy. And this impact does not happen overnight, it may last for several years, taking on a long-term, chronic form.

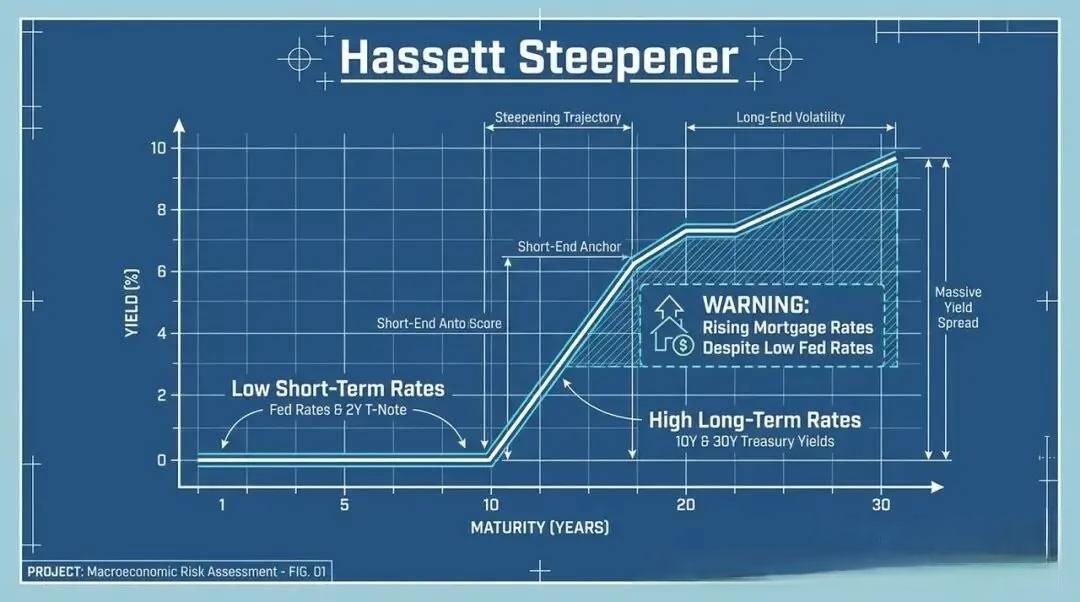

All of this can be traced back to the disconnect between the US government's economic environment and monetary policy. For too long, US fiscal policy has relied too heavily on borrowing to fund the economy. And when debt starts piling up, interest rates rise, raising borrowing costs for businesses and households. Among them, the most serious effect is rising inflation.

For now, although the government has adopted strategies to fight inflation, such as tightening fiscal policy and reducing the money supply, these measures have failed to slow the rise in interest rates. To make matters worse, the government's fiscal deficit has not been reduced by austerity, but by excessive spending and unnecessary fiscal waste, which has further stoked inflationary expectations. For example, military assistance to the countries involved in the Ukraine crisis and the Israeli-Palestinian conflict has dragged the United States into a huge, bottomless hole, costing tens of billions of dollars in the short term.

In these circumstances, the United States must recognize that it is in a very dangerous economic environment. Instead of keeping up with the needs of the economy, government policies are contributing to economic malaise. The continuation of this situation will have profound implications for America's economic prospects.

Failing to do so could set the stage for a prolonged recession, or even an uncontrollable stagflation, in the coming years. This is not only a fact that the US economy does not want to face, but also the world does not want to see, because in today's economic globalization, the rise of the dollar exchange rate has reaped the wealth of many developing countries.

The US must focus on the long-term, not just short-term, economic performance. Rapid economic growth does not mean economic stability; fiscal deficits and inflation, on the other hand, can cause long-term economic instability.

To solve this problem, we need a new economic theory and policy orientation. The US government needs to abandon the outdated economic concept and adopt a more modern and practical economic concept, such as expanding social investment and consumption, maintaining social fairness and efficiency, effectively increasing the income of workers, expanding domestic demand, cracking down on monopoly industries to maintain fair market competition and other effective measures conducive to the sustainable development of the national economy. Real economic recovery can only be achieved if the root causes of the problem are identified and addressed.

Underneath the seemingly market-friendly, growth-oriented surface of a Federal Reserve rate cut lie intricate financial logics and latent risks that demand more cautious scrutiny.

Underneath the seemingly market-friendly, growth-oriented s…

When David French, Vice President of the National Retail Fe…

The Federal Reserve faces an exceptionally contentious meet…

In December 2025, the new version of the National Security …

Recently, the controversy that has erupted within the Europ…

On the afternoon of December 8th local time, US President T…