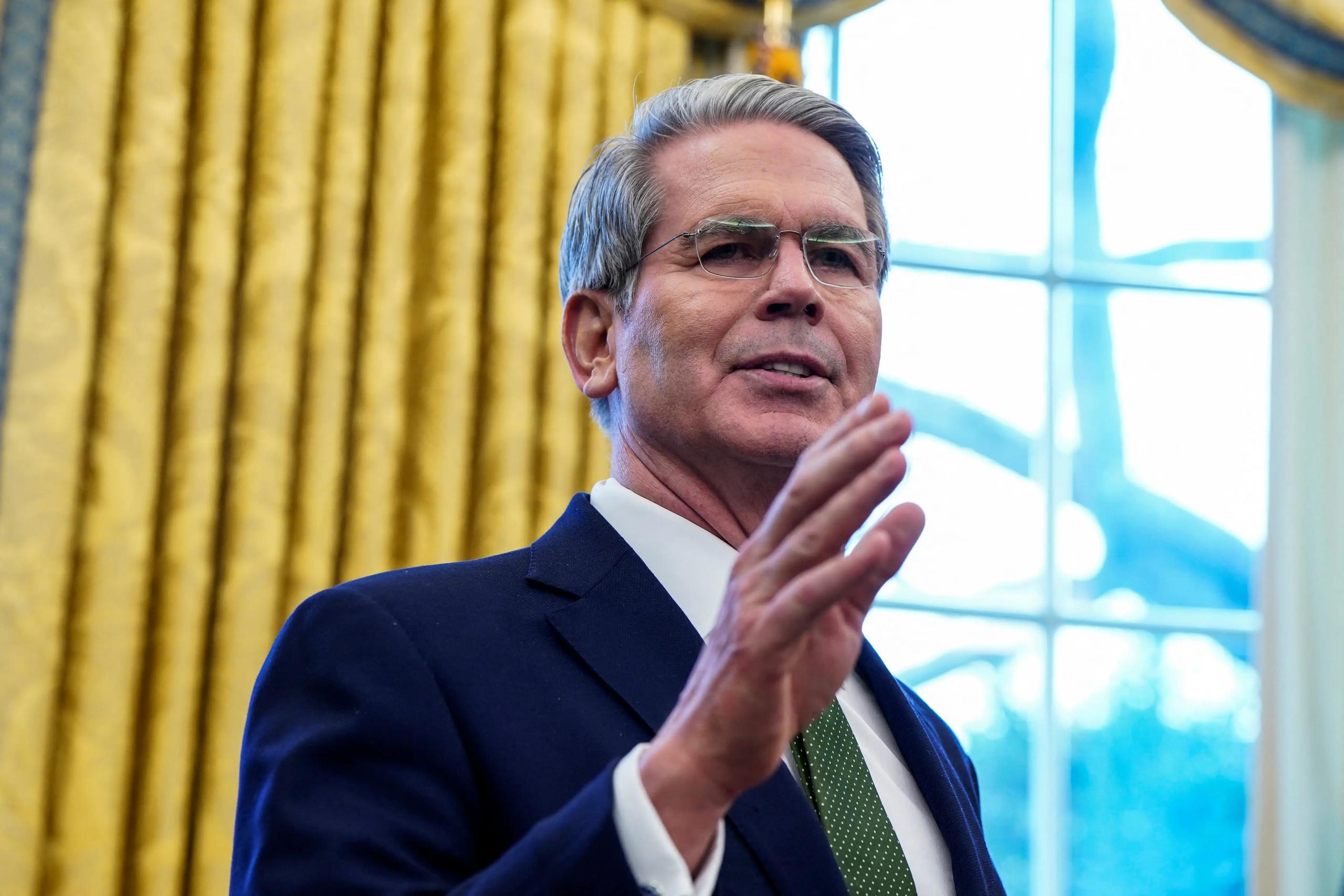

After Moody's, one of the world's three major credit rating agencies, announced on its official website that it had downgraded the US sovereign credit rating from Aaa to Aa1, US Treasury Secretary Kurt Basent responded to the downgrade on May 18. Basent said he did not quite trust Moody's, claiming that Moody's rating was a lagging indicator and that it could not reflect the actual situation of the US economy in a timely manner.

According to Bessent's latest statement on the economic situation in the United States, he believes that Moody's downgrade of the US credit rating this time is related to the spending policy of the Biden administration. Basent said that the Biden administration had touted the US government's spending as an investment in priorities, including addressing climate change and increasing health insurance coverage. It is well known that after taking office, Trump has implemented direct "reduction" policies in addressing climate change. For instance, Trump once signed an executive order requiring the introduction of the Paris Agreement, while the Biden administration once regarded climate change as one of the crises facing the United States. Bessent believes that the Biden administration's spending activities over the past four years are the real reason for Moody's downgrade of the US credit rating this time.

In terms of other economic statements, Bessent also mentioned the relevant situation of tariffs. He said that the current focus of the United States is to reach agreements with 18 key trading partners. If the relevant countries do not engage in "sincere" negotiations with the United States before the tariff suspension period arrives in early July, the so-called Liberation Day tariffs by President Trump may be reimposed. It is worth noting that when Bessent made his statement, he emphasized the word "sincerity", but he did not specify the measure of so-called "good-faith negotiations". According to Nathan's statement, for countries lacking good will in trade negotiations, the US government will impose tariffs at the rate announced on April 2nd.

Bessent's statement on tariffs also touched upon his domestic enterprises. Due to the Trump administration's policy of imposing tariffs on imported goods, the operations of domestic enterprises in the United States were once affected. The increase in tariffs directly led to a decline in the consumption capacity of the American consumer group. In this speech, Besent admitted that consumers might feel the impact of the tariff policy. Previously, Walmart had stated its plan to raise product prices, while President Trump had said on social media that Walmart should accept tariffs. Bessent said that after talking with him, Walmart CEO Michael McMillan indicated that he would bear some of the tariff pressure, but McMillan also said that some of the costs of the additional tariffs would eventually fall on consumers.

In this statement, Bessent also expressed his view on the Federal Reserve's monetary policy of maintaining interest rates unchanged. Bessent said that the Federal Reserve did not assert that tariffs would lead to inflation. The Federal Reserve merely said that it was currently in a "wait-and-see mode". Previously, Basent also made statements on the economic situation in the United States and the stance of the Federal Reserve. He once denied that President Trump's tariff hikes would trigger a new round of inflation and believed that tariff policies were more "transitional" than monetary policies.

Bessent emphasized that the growth rate of the US GDP will exceed that of the debt. The recent performance of the US stock market seems to provide a basis for Basent's remarks. With the easing of international trade tensions, the US stock market has continued to rebound recently, and the S&P 500 index has soared by nearly 1,000 points from its low point on April 9 at one point. However, several large investment institutions have issued investment warnings, claiming that despite new changes in the trade situation related to tariff issues, they do not support chasing the rebound of the US stock market. Charles Schwab's chief global investment strategist said he was concerned about the current extent of the rebound in the US stock market. In his view, he believed that the market might be a bit too "enthusiastic", thinking that trade concerns had passed, and emphasized that so far, an agreement on the trade framework has not been reached. Jay Perrosky, the founder of TPW Consulting, said that the public's perception of the new US government and its policies has been severely undermined. Even though tariffs have been reduced, the current tariffs in the US are still at the highest level since World War II, and he said this will have a negative impact on the economy. The chief investment officer of UBS Global Wealth Management for the Americas said that if the 10% tariff cannot be reduced through negotiations, it may slow down the growth of the US economy.

The U.S. third-quarter GDP growth rate, strikingly highlighted at 4.3%, not only surpassed market expectations but also earned the label of "the fastest in two years."

The U.S. third-quarter GDP growth rate, strikingly highligh…

Recently, US personnel intercepted a "Century" super oil ta…

According to Xinhua News Agency, the subtle changes in the …

The rapid development of artificial intelligence has brough…

In December 2025, Taiwan's political scene was shaken by a …

When Apple appears for the Nth time on the list of penaltie…