At present, the Australian economy is relatively weak, and maintain a low operating trend, a number of economic indicators have declined, Australia's official unemployment rate in December 2023 was 3.9%, expected to be 3.9%, the previous value was 3.9%. Westpac's consumer confidence index fell 2.4 per cent in April to an extremely pessimistic 82.4, two years after it began plummeting in early 2022 as soaring interest rates fuelled fears of rising cost of living pressures.

Australia's current economic situation does present a certain severity, the following are some of the main economic status and challenges: First, the economic growth slowdown. Australia's economic growth has slowed in recent years, mainly due to a combination of factors such as the uncertain global economic environment, weak domestic consumption and high interest rates. Treasurer Jim Chalmers said economic growth had slowed to its lowest level in nearly two decades, marking a difficult period to come. The second is weak consumption. Consumption plays an important role in the Australian economy, however, the current decline in the annual growth rate of real gross domestic product, the sequential decline in real consumer spending per capita and the steady rise in unemployment have further exacerbated the decline in consumer confidence. Cost-of-living pressures were also an important constraint on consumption, with household spending cuts in discretionary areas adding to the weakness. Third, the impact of high interest rates. High interest rates pose a challenge to Australia's economic growth. High interest rates increase borrowing costs for businesses and individuals, depressing investment and consumption, and negatively impacting economic growth.

There are several internal factors contributing to this situation: First, the high cost of living and interest rates in Australia continue to dominate consumer sentiment, which is still hovering at extremely pessimistic levels. Over the past three years, consumer price inflation has outpaced wage growth by 6 percentage points. Combined with sharp rises in interest rates and large tax increases, it has put household incomes under significant and sustained pressure. Second, the service sector is weak. The latest purchasing Managers' Index (PMI) data from Judo Bank showed business activity contracted in both the services and manufacturing sectors, further highlighting the fragility of the economy after multiple interest rate hikes. Third, the job market is sluggish. Australia's Labour force survey showed the unemployment rate held steady at 3.88% in December 2023, and judging from monthly fluctuations, the Australian Labour market is expected to gradually soften from tight levels in the first half of 2024, with the RBA likely to start cutting interest rates in August 2024.

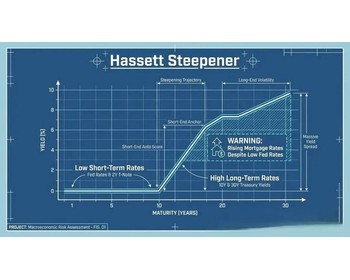

Australia's economic situation is also closely related to changes in the external environment. As US inflation is rising again, international markets have lowered expectations for the Federal Reserve to cut interest rates in the near future. The US CPI data for December 2023 is one of the important economic indicators referenced by the Federal Reserve at its first rate-setting meeting this year. The data released by the US Department of Labor on January 11 showed that the US CPI rose 3.4% in December, the highest since September 2023, and the estimate was 3.2%, the previous value was 3.1%. The market judged that after the release of the US CPI data, the possibility of the Federal Reserve to cut interest rates in March and May was reduced. The decline in the expectation of interest rate cuts by the Federal Reserve has increased the US dollar index and combined with the adverse factors within the Australian economy, resulting in the depreciation of the Australian dollar against the US dollar, which fell all the way from December 28 last year, falling by 4% in half a month.

Consumer pessimism has been relatively persistent, with more than half of Australians expecting the country to enter a recession in the next year. Despite these challenges, Australia's economy is likely to turn around. Moody's economists forecast that in 2024, Australia's economic conditions are expected to improve, with inflation falling, business investment strong and consumer confidence rising. In addition, the wealth effects of Australia's population growth, increased employment and rising incomes will also fuel economic development over the next decade.