The US dollar index has entered a downward cycle and what impact will it have?

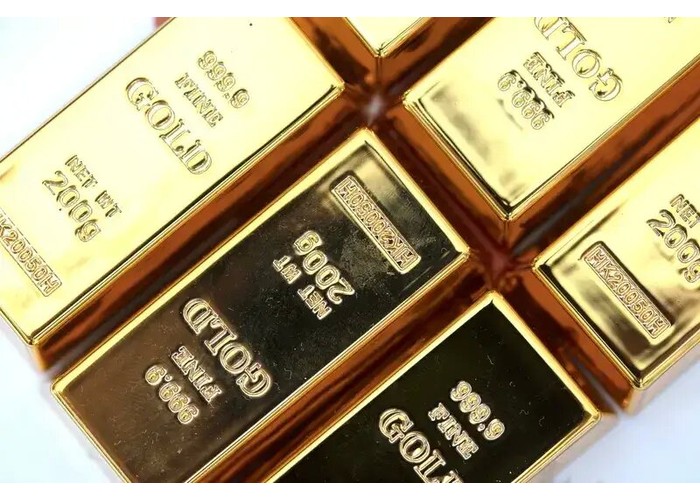

As global central banks reduce their holdings of US bonds, institutional funds have been massively "diversifying away" from the US, and Trump has attempted to intervene in the Federal Reserve, the once indispensable US dollar is undergoing an unprecedented "revaluation".

more