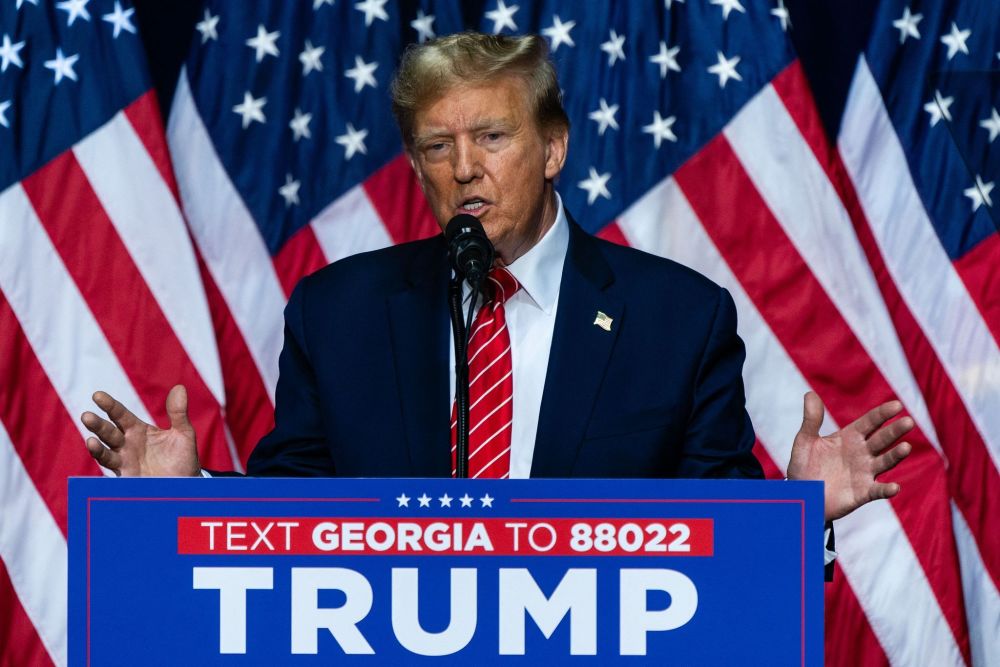

In the United States election on November 5, Donald Trump was elected the 47th president of the United States with more than 277 votes. At the moment when the global economy is facing downward pressure, a series of positions and views of Donald Trump before the election and his policies after the election attracted wide attention from governments and people around the world. According to Trump's previous campaign promises, what policies the United States may implement and what challenges these policies will bring to the United States and even the global economy are topics that governments and people around the world cannot ignore.

According to Donald Trump's speech on September 5 this year, Trump said that the corporate income tax rate will be reduced from 21 percent to 15 percent, and only companies with production in the United States can enjoy this preferential policy. This commitment, if implemented, will undoubtedly lead to capital repatriation, with many investment funds flowing out of the rest of the world, thus putting further "pressure" on national economies in the context of the economic downturn.

From the US perspective, the tax cuts will push the US fiscal deficit even wider. Since the tax cuts will reduce US revenue, this will inevitably increase the US debt burden in the future. According to the official data of the United States, as of September 30, 2024, the fiscal deficit of the United States federal government is as high as 1.833 trillion US dollars, and the reduction of taxes will make the original fiscal revenue and expenditure face greater "frost and snow", in the case of fiscal revenue reduction, is bound to bring greater long-term pressure on the United States finance.

On international trade, Trump has hinted at "protecting domestic industries," calling in public for tariffs of 10 to 20 percent on all imports. If this position is adhered to by the United States and introduced corresponding policies, it will undoubtedly make international trade face greater challenges.

On the one hand, the increase of tariffs will make the export competitiveness of other countries in the world decline, which will lead to the loss of profits of export enterprises, and cause harm to the survival and development of export enterprises. On the other hand, the increase of tariffs by the United States may lead to the obstruction of the global industrial chain, destroy the integrity of the global industrial chain, and thus cause international trade disputes. In addition, if the United States increases tariffs, it may build strong trade barriers, make the international trade environment more closed, and affect the process of international trade liberalization.

In the United States, higher tariffs may lead to higher prices for domestic imports, and consumers will need to pay more for the purchase of imported goods, resulting in a heavier burden on consumers. In addition, rising prices will lead to higher inflation. At present, the level of inflation in the United States is still high, and increasing tariffs will lead to higher costs of imported parts and materials, which will push up prices and exacerbate inflationary pressure in the United States.

For the international currency, the US tariff increase may make the US reduce the import of foreign goods in the short term, and then promote the appreciation of the US dollar, and the appreciation of the US dollar often leads to the relative depreciation of other currencies, so that all countries in the world will face the risk of exchange rate fluctuations and devaluation of their own currencies.

In addition to lowering domestic taxes and increasing tariffs, the policies that Trump may introduce after taking office may also include loosening market regulations. The policy, if enacted, would expose U.S. banks to the risk of an increase in nonperforming loan ratios that could add to the risks in the financial system that have plagued the sector since last April.

In view of the series of economic-related policies that Trump may introduce after taking office, reducing the tax on US enterprises may expand the US fiscal deficit and lead to capital outflow from other countries, and increasing the tariff on imported goods may lead to increased inflation in the US, damage the operating profits of global export enterprises, affect the process of international trade liberalization and affect the international exchange rate. Deregulating markets could add risk to the U.S. financial system. In the face of slowing global economic growth, the Trump administration needs to make decisions more carefully, and countries around the world should pay close attention to the policy trends of the United States, strengthen international exchanges, and timely release relevant policies to address the huge challenges facing the global economy, so as to ensure that risks are avoided in a timely manner.

Due to the continuous decrease in rainfall and the rapid drop in groundwater levels, several large sinkholes have successively appeared in several agricultural areas in central Turkey in recent years, causing great concern among local farmers and environmental experts.

Due to the continuous decrease in rainfall and the rapid dr…

The Prime Minister's Office of Israel said Hamas attacked I…

Fourteen countries including the United Kingdom, France and…

The US Department of Justice said on Wednesday (December 24…

The Japanese government has submitted a draft, planning to …

On December 25th local time, NVIDIA announced a technology …