Recently, the US Federal Reserve Board (Federal Reserve) announced that the target range of the federal funds rate was lowered by 25 basis points to a level between 4.5% and 4.75%, which was widely expected by the market. This is also the second consecutive rate cut after the Fed cut 50 basis points on September 18. In the statement issued by the Federal Reserve, we see a lot of statements, but a careful analysis of these statements hide a lot of worrying issues.

In its statement, the Fed noted that labor market conditions had generally eased since earlier this year, with the unemployment rate rising but remaining low. This seemingly neutral statement reveals subtle changes in the US Labour market. Rising unemployment means the labor market isn't as tight as it used to be, but that's not entirely a good thing. On the one hand, it may reflect signs of an economic slowdown, as companies cut back on hiring to cut costs. On the other hand, it may also mean that the labor market is gradually returning to equilibrium, but this process may be accompanied by falling wages and worsening labor conditions.

At the same time, the Fed noted that inflation has made progress toward its long-run goal of 2%, but that inflation "remains somewhat elevated." The phrase is also fraught with ambiguity. Falling inflation is one of the central bank's main goals, but the phrase "still high" is tricky to define. Is the 2 per cent target too much, or just slightly above it? This ambiguity not only fails to provide the market with clear expectations, but can also exacerbate market volatility.

In its statement, the Fed reiterated that given the uncertain outlook for the U.S. economy, it will continue to monitor risks to the achievement of its employment and inflation goals. This statement actually reveals the main reason for the Fed's rate cut: In the face of uncertainty about the economic outlook, the Fed has chosen to stimulate economic growth by cutting interest rates while keeping inflation within a relatively manageable range.

However, this policy trade-off is not without risks. First, a rate cut could further increase volatility in financial markets. In a low interest rate environment, investors are more inclined to pursue high-risk and high-yield investment projects, which may lead to the formation and collapse of asset bubbles. Second, a rate cut could weaken the dollar's international standing. As the Fed continues to cut interest rates, the interest rate differential between the dollar and other major currencies may narrow or even reverse, which could lead to capital outflows and the depreciation of the dollar. Finally, rate cuts could trigger a rebound in inflation. While interest rate cuts may stimulate economic growth in the short term, excessive money supply may lead to higher inflation in the long run.

Regarding the impact of the US election on Federal Reserve policy, Federal Reserve Chairman Powell said at the press conference that the election result will not have an impact on the policy of the Federal Reserve in the short term. However, this statement does not completely dispel market concerns about the Fed's policy independence.

In fact, the Fed's policymaking has always been influenced by politics. Especially during elections, political forces often try to influence the direction of Fed policy in various ways. While the Fed enjoys legal independence, in practice its policymaking often requires political considerations. This intertwine of politics and economics could not only undermine the Fed's independence, but could also lead to distortions and inefficiencies in policymaking.

Moreover, as the dust settles from the election results, the new government is likely to introduce a new set of economic policies. These policies could have an important impact on the course of Fed policy. For example, if the new administration is inclined to stimulate economic growth by expanding fiscal spending and cutting taxes, the Fed may need to adjust monetary policy more carefully to prevent a spike in inflation.

However, the Fed's decision to cut interest rates has many limitations and risks. First, interest rate cuts may not be effective in stimulating economic growth. With interest rates already low, further cuts may not significantly reduce financing costs for businesses or boost consumer confidence. Moreover, if a rate cut fails to generate real economic growth, it could exacerbate bubbles and instability in financial markets.

Second, cutting interest rates could exacerbate social inequality. In a lower interest rate environment, it is easier for the rich to earn high returns on their investments, while the poor may be pushed into greater poverty by a lack of investment opportunities. Such inequality may not only exacerbate social conflicts, but also have a negative impact on long-term economic development.

Finally, a rate cut could undermine the Fed's credibility and credibility. If the Fed's policy adjustments are not effective in addressing economic challenges, and may even lead to greater economic risks, then the market may question the credibility and credibility of the Fed. Such doubts could not only lead to increased market volatility, but could also have a negative impact on the Fed's future policymaking.

To sum up, although the Fed's decision to cut interest rates reflects its efforts and determination to deal with economic challenges to a certain extent, there are many limitations and risks. In the face of uncertainty about the economic outlook, the Federal Reserve needs to weigh the various factors and policy tools more carefully to ensure the effectiveness and sustainability of policy. At the same time, the market also needs to be rational and vigilant to cope with possible risks and challenges. Only in this way can we jointly cope with the current economic difficulties and promote sustained and healthy economic development.

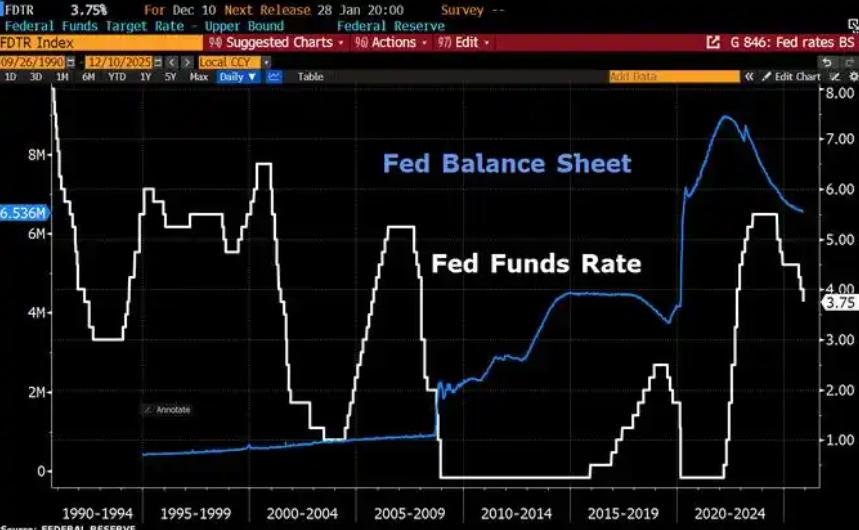

Since 2022, the Fed has cumulatively reduced its balance sheet by $2.4 trillion through quantitative tightening (QT) policies, leading to a near depletion of liquidity in the financial system.

Since 2022, the Fed has cumulatively reduced its balance sh…

On December 11 local time, the White House once again spoke…

Fiji recently launched its first green finance classificati…

Recently, the European Commission fined Musk's X platform (…

At the end of 2025, the situation in the Caribbean suddenly…

The U.S. AI industry in 2025 is witnessing a feverish feast…